Texas Health Select Plans

Introduction to Texas Health Select Plans

Texas Health Select Plans are a type of health insurance plan designed for individuals and families in Texas. These plans are part of the Affordable Care Act (ACA) and are offered by various health insurance companies in the state. The plans are categorized into different metal tiers, including Bronze, Silver, Gold, and Platinum, each with varying levels of coverage and premiums.

Key Features of Texas Health Select Plans

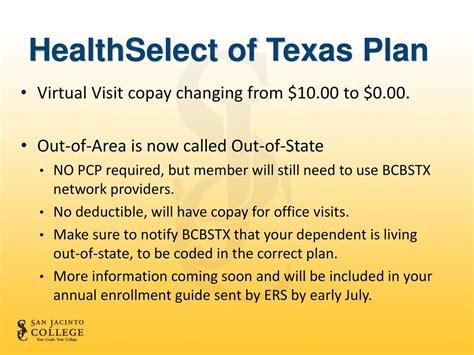

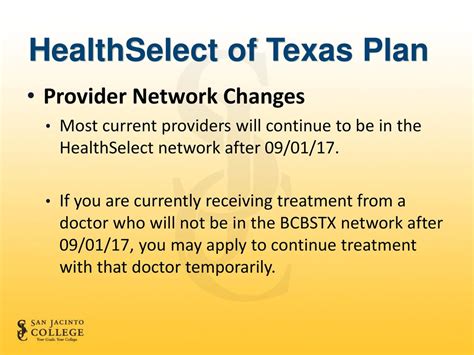

Some of the key features of Texas Health Select Plans include: * Essential Health Benefits (EHBs): These plans cover a range of essential health benefits, including doctor visits, hospital stays, prescription medications, and more. * No Pre-Existing Condition Limitations: Individuals with pre-existing conditions are eligible for coverage under these plans. * Free Preventive Care: Many preventive care services, such as annual physicals and screenings, are covered at no additional cost. * Dental and Vision Coverage: Some plans offer dental and vision coverage for adults and children. * Network Providers: Plans have a network of participating providers, including doctors, hospitals, and specialists.

Types of Texas Health Select Plans

There are several types of Texas Health Select Plans available, including: * Individual and Family Plans: These plans are designed for individuals and families who are not eligible for group coverage through an employer. * Group Plans: These plans are designed for small businesses and large groups. * Medicaid and CHIP Plans: These plans are designed for low-income individuals and families who are eligible for Medicaid or the Children’s Health Insurance Program (CHIP). * Catastrophic Plans: These plans are designed for young adults and individuals who are exempt from the ACA’s individual mandate.

Benefits of Texas Health Select Plans

Some of the benefits of Texas Health Select Plans include: * Affordability: These plans offer competitive premiums and out-of-pocket costs. * Comprehensive Coverage: Plans cover a range of essential health benefits, including doctor visits, hospital stays, and prescription medications. * Network Providers: Plans have a network of participating providers, including doctors, hospitals, and specialists. * Preventive Care: Many preventive care services are covered at no additional cost. * No Lifetime Limits: Plans do not have lifetime limits on coverage.

Eligibility and Enrollment

To be eligible for a Texas Health Select Plan, individuals must: * Reside in Texas * Be a U.S. citizen or lawful resident * Not be incarcerated * Not be eligible for Medicare or Medicaid Enrollment in Texas Health Select Plans typically occurs during the annual open enrollment period, which usually takes place from November to December. However, individuals may be eligible for special enrollment periods if they experience a qualifying life event, such as losing job-based coverage or getting married.

Cost and Financial Assistance

The cost of Texas Health Select Plans varies depending on the individual’s or family’s income, age, and location. However, many individuals and families are eligible for financial assistance, including: * Premium Tax Credits: These credits help lower the monthly premium costs. * Cost-Sharing Reductions: These reductions help lower the out-of-pocket costs, such as copays and deductibles. * Medicaid and CHIP: These programs provide free or low-cost coverage for low-income individuals and families.

| Plan Type | Premium | Deductible | Out-of-Pocket Maximum |

|---|---|---|---|

| Bronze | $300-$500 | $3,000-$6,000 | $7,000-$10,000 |

| Silver | $400-$700 | $2,000-$4,000 | $5,000-$8,000 |

| Gold | $500-$1,000 | $1,000-$2,000 | $3,000-$6,000 |

| Platinum | $1,000-$2,000 | $0-$1,000 | $1,000-$3,000 |

📝 Note: The premium, deductible, and out-of-pocket maximum costs listed in the table are approximate and may vary depending on the individual's or family's income, age, and location.

In summary, Texas Health Select Plans offer a range of health insurance options for individuals and families in Texas. These plans provide comprehensive coverage, including essential health benefits, preventive care, and network providers. Eligibility and enrollment in these plans typically occur during the annual open enrollment period, and individuals may be eligible for financial assistance, including premium tax credits and cost-sharing reductions. By understanding the different types of plans, benefits, and costs, individuals and families can make informed decisions about their health insurance needs. As the healthcare landscape continues to evolve, it is essential to stay informed about the latest developments and updates in Texas Health Select Plans. Ultimately, having the right health insurance coverage can provide peace of mind and financial protection for individuals and families in Texas.

What is the annual open enrollment period for Texas Health Select Plans?

+

The annual open enrollment period for Texas Health Select Plans usually takes place from November to December.

What are the different types of Texas Health Select Plans available?

+

There are several types of Texas Health Select Plans available, including Individual and Family Plans, Group Plans, Medicaid and CHIP Plans, and Catastrophic Plans.

How do I determine which Texas Health Select Plan is right for me?

+

To determine which Texas Health Select Plan is right for you, consider your income, age, location, and health needs. You can also consult with a licensed health insurance agent or broker for guidance.

Related Terms:

- Health select of Texas ERS

- Health select of Texas Benefits

- Health select of Texas providers

- Health select of Texas login

- Health select Rx

- healthselect of texas provider list