High Deductible vs PPO Health Plan

Understanding Health Insurance Plans

When it comes to choosing a health insurance plan, there are several options available, each with its own set of benefits and drawbacks. Two of the most popular types of health insurance plans are High Deductible Health Plans (HDHPs) and Preferred Provider Organization (PPO) plans. In this article, we will delve into the details of both plans, exploring their characteristics, advantages, and disadvantages, to help you make an informed decision about which plan is best for you.

High Deductible Health Plans (HDHPs)

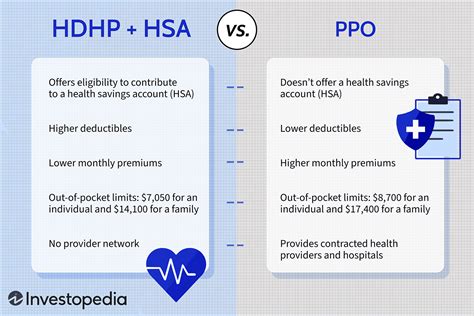

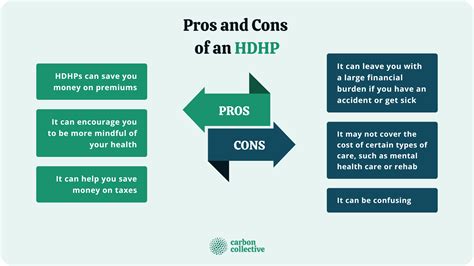

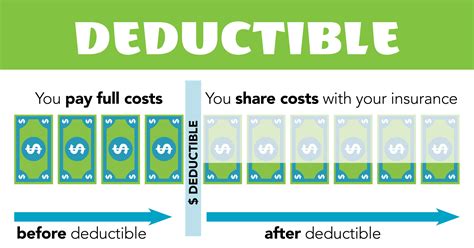

A High Deductible Health Plan is a type of health insurance plan that requires you to pay a higher deductible before the insurance company starts covering your medical expenses. The deductible is the amount you must pay out-of-pocket for healthcare expenses before your insurance plan kicks in. In exchange for the higher deductible, HDHPs typically have lower monthly premiums. HDHPs are often paired with Health Savings Accounts (HSAs), which allow you to set aside pre-tax dollars to pay for qualified medical expenses.

Some key features of HDHPs include: * Higher deductibles, which can range from 1,000 to 7,000 or more per year * Lower monthly premiums * Ability to pair with an HSA * Coverage for preventive care services, such as annual physicals and screenings, without requiring you to meet the deductible

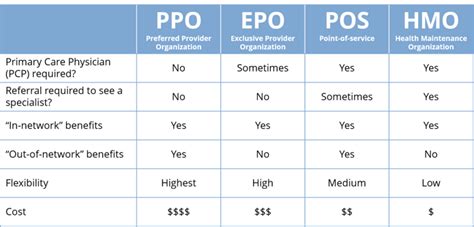

Preferred Provider Organization (PPO) Plans

A Preferred Provider Organization plan is a type of health insurance plan that offers a network of healthcare providers who have agreed to provide discounted services to plan members. With a PPO plan, you have the flexibility to see any healthcare provider, both in-network and out-of-network, although seeing an out-of-network provider will typically result in higher costs. PPO plans often have higher monthly premiums compared to HDHPs, but they also offer more comprehensive coverage and lower out-of-pocket costs for medical services.

Some key features of PPO plans include: * Network of preferred healthcare providers * Ability to see any healthcare provider, both in-network and out-of-network * Higher monthly premiums * Lower out-of-pocket costs for medical services, such as copays and coinsurance * Coverage for a wide range of medical services, including preventive care, hospital stays, and prescriptions

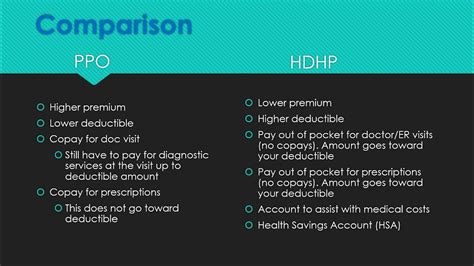

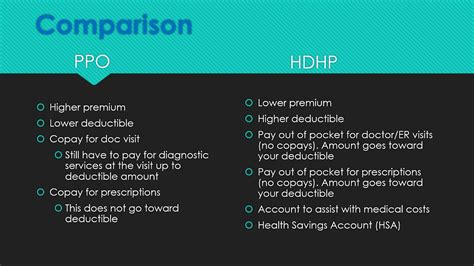

Comparing HDHPs and PPO Plans

When deciding between an HDHP and a PPO plan, there are several factors to consider. HDHPs are often a good choice for individuals who are relatively healthy and do not expect to incur high medical expenses. On the other hand, PPO plans may be a better option for those who require more comprehensive coverage and are willing to pay higher monthly premiums. The following table summarizes the key differences between HDHPs and PPO plans:

| Plan Type | Deductible | Monthly Premium | Network | Out-of-Pocket Costs |

|---|---|---|---|---|

| HDHP | Higher ($1,000 to $7,000 or more) | Lower | No network requirements | Higher |

| PPO | Lower ($500 to $2,000 or more) | Higher | Preferred provider network | Lower |

Choosing the Right Plan for You

Ultimately, the choice between an HDHP and a PPO plan depends on your individual healthcare needs and financial situation. It is essential to carefully consider your options and weigh the pros and cons of each plan. If you are relatively healthy and want to save money on monthly premiums, an HDHP may be the way to go. However, if you require more comprehensive coverage and are willing to pay higher premiums, a PPO plan may be a better fit.

💡 Note: It is crucial to review and understand the terms and conditions of each plan, including deductibles, copays, coinsurance, and out-of-pocket maximums, before making a decision.

In summary, both HDHPs and PPO plans have their advantages and disadvantages, and the right choice for you will depend on your individual circumstances. By carefully considering your options and weighing the pros and cons of each plan, you can make an informed decision and choose the plan that best meets your healthcare needs and budget.

To recap, the key points to consider when choosing between an HDHP and a PPO plan include the deductible, monthly premium, network, and out-of-pocket costs. By taking the time to understand these factors and how they apply to your situation, you can make a smart decision about your health insurance coverage.

What is the main difference between an HDHP and a PPO plan?

+

The main difference between an HDHP and a PPO plan is the deductible and the network requirements. HDHPs have higher deductibles and no network requirements, while PPO plans have lower deductibles and a preferred provider network.

Which plan is better for individuals who are relatively healthy?

+

HDHPs are often a good choice for individuals who are relatively healthy and do not expect to incur high medical expenses. They offer lower monthly premiums and the ability to pair with an HSA.

What is the benefit of having a PPO plan?

+

The benefit of having a PPO plan is that it offers more comprehensive coverage and lower out-of-pocket costs for medical services. It also provides a network of preferred healthcare providers, which can result in lower costs for plan members.

Related Terms:

- PPO vs EPO

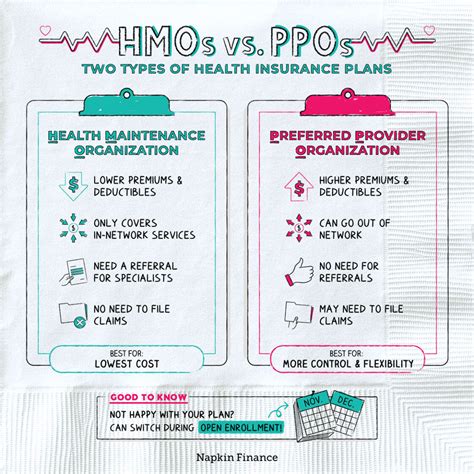

- HMO vs PPO

- HSA vs PPO

- HSA vs FSA

- Regence HDHP vs PPO reddit

- CDHP vs HDHP vs PPO