5 Health Insurance Tips

Introduction to Health Insurance

When it comes to protecting one’s health and financial well-being, having the right health insurance plan is crucial. With so many options available, navigating the world of health insurance can be overwhelming. However, by understanding the basics and following some simple tips, individuals can make informed decisions and choose a plan that meets their needs. In this article, we will explore five essential health insurance tips that can help guide the selection process.

Tip 1: Assess Your Needs

The first step in choosing a health insurance plan is to assess your needs. Consider your age, health status, lifestyle, and financial situation. Think about any pre-existing conditions you may have and whether you need coverage for specific services such as maternity care or prescription medications. Make a list of your priorities and use it to evaluate different plans. Some key factors to consider include: * Coverage for doctor visits and hospital stays * Prescription medication coverage * Mental health and substance abuse treatment * Out-of-pocket costs, including deductibles and copays * Network of providers and hospitals

Tip 2: Understand the Types of Plans

There are several types of health insurance plans available, each with its own advantages and disadvantages. Familiarize yourself with the different options, including: * HMO (Health Maintenance Organization) plans, which require you to receive care from a specific network of providers * PPO (Preferred Provider Organization) plans, which offer more flexibility in choosing providers * EPO (Exclusive Provider Organization) plans, which combine elements of HMO and PPO plans * POS (Point of Service) plans, which allow you to choose between different networks of providers * Catastrophic plans, which offer limited coverage at a lower cost

Tip 3: Evaluate the Network

The network of providers and hospitals is a critical factor in choosing a health insurance plan. Consider the following: * Are your primary care physician and specialists part of the network? * Are the hospitals and medical facilities you prefer part of the network? * What are the out-of-network benefits, and how will they affect your costs? * Are there any restrictions on accessing specialty care or referrals?

Tip 4: Review the Costs

Health insurance plans can vary significantly in terms of cost. Carefully review the following expenses: * Premiums: the monthly cost of the plan * Deductibles: the amount you must pay out-of-pocket before the plan kicks in * Copays: the amount you pay for each doctor visit or prescription * Coinsurance: the percentage of costs you pay after meeting the deductible * Out-of-pocket maximum: the maximum amount you will pay for the year

Tip 5: Read the Fine Print

Finally, it is essential to read the fine print and understand the details of the plan. Pay attention to: * Pre-existing condition exclusions * Waiting periods for certain benefits * Limitations on coverage for specific services or treatments * Requirements for pre-authorization or referrals * Appeals process for denied claims

💡 Note: Always review the plan's summary of benefits and coverage, as well as the policy documents, to ensure you understand the terms and conditions.

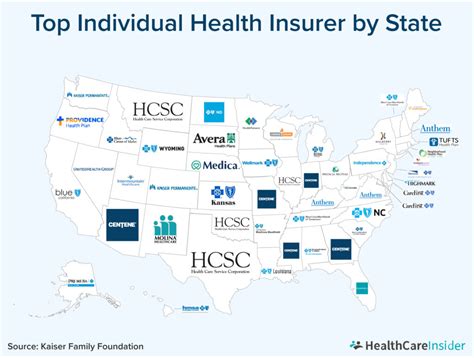

To help illustrate the differences between plans, consider the following table:

| Plan Type | Premium | Deductible | Copay |

|---|---|---|---|

| HMO | 300</td> <td>1,000 | 20</td> </tr> <tr> <td>PPO</td> <td>400 | 1,500</td> <td>30 |

| EPO | 350</td> <td>1,200 | $25 |

In summary, choosing the right health insurance plan requires careful consideration of your needs, the types of plans available, the network of providers, the costs, and the fine print. By following these five tips, you can make an informed decision and select a plan that provides the coverage you need at a price you can afford.

What is the difference between an HMO and a PPO plan?

+

An HMO plan requires you to receive care from a specific network of providers, while a PPO plan offers more flexibility in choosing providers. HMO plans typically have lower premiums, but may have more restrictions on accessing care.

How do I know which plan is right for me?

+

Consider your age, health status, lifestyle, and financial situation. Think about any pre-existing conditions you may have and whether you need coverage for specific services. Make a list of your priorities and use it to evaluate different plans.

Can I change my health insurance plan at any time?

+

Typically, you can only change your health insurance plan during the annual open enrollment period or if you experience a qualifying life event, such as a change in employment or marriage. Check with your insurance provider for specific details.

Related Terms:

- Hillsborough County health insurance login

- Hillsborough County insurance provider list

- Hillsborough County health insurance pharmacy

- hillsborough county health insurance portal

- hillsborough county health insurance programs

- aces hillsborough county login