5 Ways Vulnerable Get Insurance

Introduction to Insurance for Vulnerable Groups

Getting insurance can be a daunting task for anyone, but it can be especially challenging for vulnerable groups such as the elderly, those with pre-existing medical conditions, and low-income individuals. These groups often face higher premiums, limited coverage options, and stringent eligibility requirements. However, there are ways for vulnerable individuals to obtain insurance that meets their needs and budget. In this article, we will explore five ways vulnerable groups can get insurance.

Understanding Vulnerable Groups

Before we dive into the ways vulnerable groups can get insurance, it’s essential to understand who these groups are and the challenges they face. Vulnerable groups include: * The elderly (65+ years) * Individuals with pre-existing medical conditions (e.g., diabetes, cancer, heart disease) * Low-income individuals and families * Those with disabilities or chronic illnesses * Unemployed or underemployed individuals These groups often struggle to access affordable insurance due to their increased risk profile or limited financial resources.

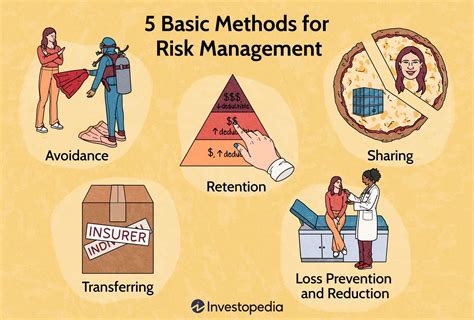

5 Ways Vulnerable Groups Can Get Insurance

Despite the challenges, there are ways for vulnerable groups to obtain insurance. Here are five options: * Government-Sponsored Programs: Many governments offer insurance programs specifically designed for vulnerable groups. For example, Medicaid in the United States provides health insurance to low-income individuals and families. Similarly, the Affordable Care Act (ACA) offers subsidized health insurance to eligible individuals. * Non-Profit Organizations: Non-profit organizations, such as the HealthWell Foundation or Patient Access Network Foundation, provide financial assistance to individuals with specific medical conditions. These organizations often offer grants, scholarships, or discounted insurance premiums to help vulnerable individuals access necessary care. * Community-Based Initiatives: Community-based initiatives, such as community health centers or faith-based organizations, offer affordable insurance options to vulnerable groups. These initiatives often partner with local insurance providers to offer discounted premiums or specialized coverage. * Private Insurance Companies: Some private insurance companies specialize in providing coverage to vulnerable groups. For example, Guaranteed Issue policies offer coverage to individuals with pre-existing medical conditions, regardless of their health status. * Online Insurance Marketplaces: Online insurance marketplaces, such as eHealth or GetInsured, allow individuals to compare insurance plans and prices from multiple providers. These marketplaces often cater to vulnerable groups by offering specialized plans or discounts.

Benefits and Drawbacks of Each Option

Each option has its benefits and drawbacks. Here’s a brief summary:

| Option | Benefits | Drawbacks |

|---|---|---|

| Government-Sponsored Programs | Affordable premiums, comprehensive coverage | Eligibility requirements, limited provider networks |

| Non-Profit Organizations | Financial assistance, specialized coverage | Limited funding, restrictive eligibility criteria |

| Community-Based Initiatives | Affordable premiums, community support | Limited coverage options, geographic restrictions |

| Private Insurance Companies | Flexible coverage options, nationwide networks | Higher premiums, stringent eligibility requirements |

| Online Insurance Marketplaces | Comparative shopping, specialized plans | Complex navigation, varying provider networks |

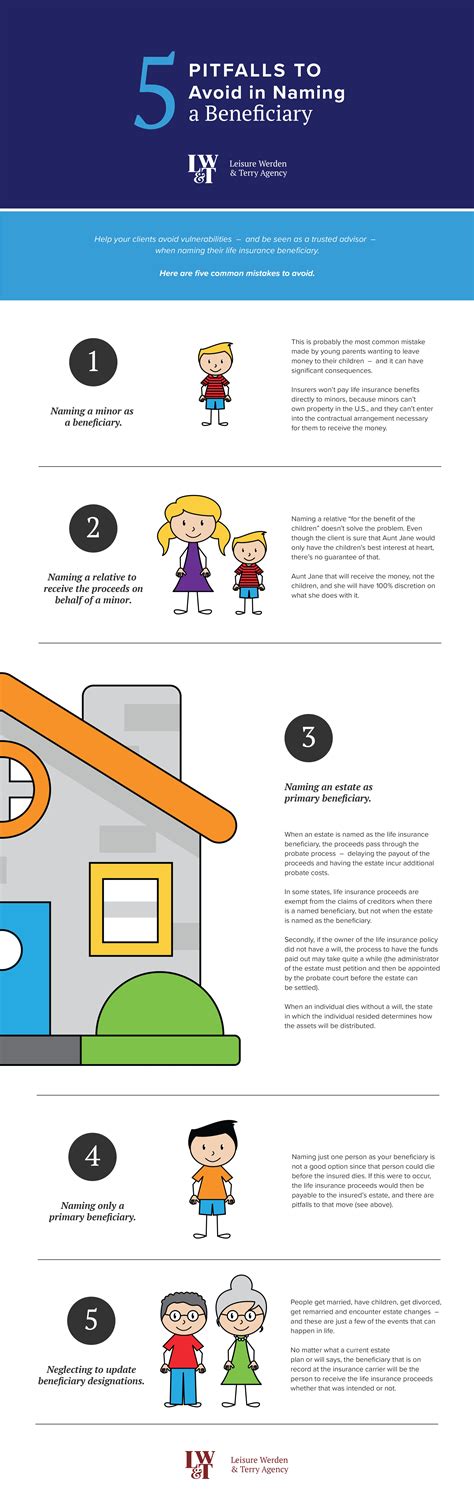

Key Considerations for Vulnerable Groups

When exploring insurance options, vulnerable groups should consider the following key factors: * Eligibility requirements: Understand the eligibility criteria for each option, including income limits, age restrictions, and medical conditions. * Coverage options: Review the coverage options, including deductibles, copays, and coinsurance. * Premium costs: Compare premium costs across options, considering factors like age, health status, and income level. * Provider networks: Evaluate the provider networks, including the number of participating providers and their locations. * Customer support: Assess the customer support offered by each option, including phone, email, and in-person support.

📝 Note: Vulnerable groups should carefully review and compare insurance options to ensure they find the best fit for their needs and budget.

In summary, vulnerable groups can access insurance through various channels, including government-sponsored programs, non-profit organizations, community-based initiatives, private insurance companies, and online insurance marketplaces. By understanding the benefits and drawbacks of each option and considering key factors like eligibility requirements, coverage options, and premium costs, vulnerable individuals can make informed decisions about their insurance needs.

What is the most affordable insurance option for vulnerable groups?

+

The most affordable insurance option for vulnerable groups often depends on their specific circumstances. However, government-sponsored programs like Medicaid or the Affordable Care Act (ACA) may offer the most affordable premiums and comprehensive coverage.

Can individuals with pre-existing medical conditions get insurance?

+

Yes, individuals with pre-existing medical conditions can get insurance. The Affordable Care Act (ACA) prohibits insurance companies from denying coverage based on pre-existing conditions. Additionally, some private insurance companies specialize in providing coverage to individuals with pre-existing conditions.

How do online insurance marketplaces cater to vulnerable groups?

+

Online insurance marketplaces cater to vulnerable groups by offering specialized plans, discounts, and comparative shopping tools. These marketplaces often partner with insurance providers to offer tailored coverage options and financial assistance to vulnerable individuals.