Humana Health Insurance Alabama Plans

Introduction to Humana Health Insurance Alabama Plans

Humana is one of the largest health insurance providers in the United States, offering a wide range of plans to individuals, families, and groups. In Alabama, Humana provides various health insurance plans that cater to different needs and budgets. These plans are designed to provide comprehensive coverage, including doctor visits, hospital stays, prescriptions, and other medical services. In this article, we will explore the different types of Humana health insurance plans available in Alabama, their features, and benefits.

Types of Humana Health Insurance Plans in Alabama

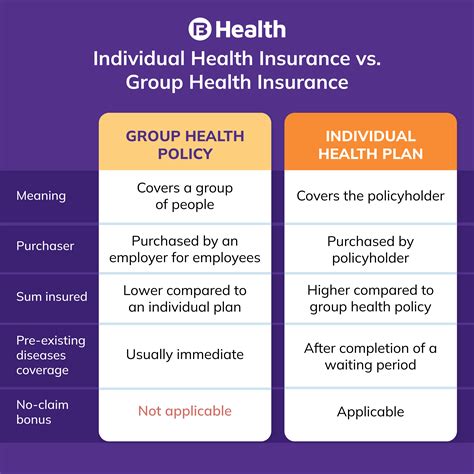

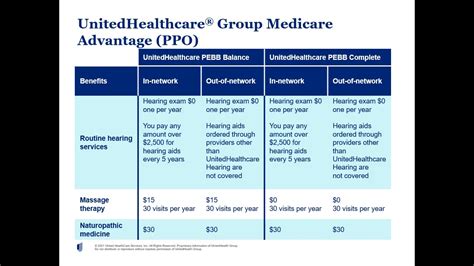

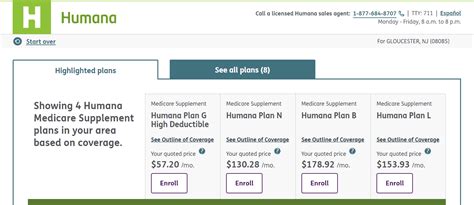

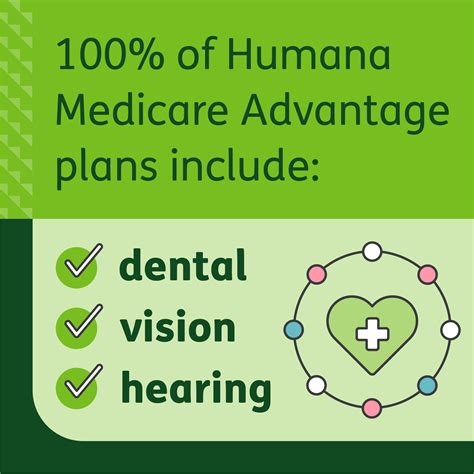

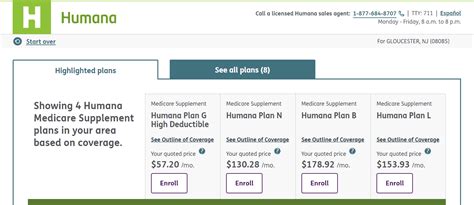

Humana offers several types of health insurance plans in Alabama, including: * Individual and Family Plans: These plans are designed for individuals and families who are not covered by their employer. They offer a range of deductibles, copays, and coinsurance options to suit different budgets and needs. * Group Plans: These plans are designed for businesses and organizations that want to provide health insurance to their employees. They offer a range of plan options, including HMO, PPO, and POS plans. * Medicare Plans: Humana offers a range of Medicare plans in Alabama, including Medicare Advantage, Medicare Supplement, and Medicare Prescription Drug Plans. These plans are designed for individuals who are eligible for Medicare. * Dental and Vision Plans: Humana also offers dental and vision plans in Alabama, which can be purchased separately or as an add-on to a medical plan.

Features and Benefits of Humana Health Insurance Plans in Alabama

Humana health insurance plans in Alabama offer a range of features and benefits, including: * Comprehensive Coverage: Humana plans cover a wide range of medical services, including doctor visits, hospital stays, prescriptions, and more. * Network of Providers: Humana has a large network of providers in Alabama, including doctors, hospitals, and other medical professionals. * Preventive Care: Humana plans cover preventive care services, such as routine check-ups, screenings, and vaccinations. * Wellness Programs: Humana offers wellness programs and discounts on gym memberships, fitness classes, and other healthy activities. * 24⁄7 Customer Service: Humana provides 24⁄7 customer service, including online chat, phone, and email support.

Humana Health Insurance Plan Options in Alabama

Humana offers a range of plan options in Alabama, including: * HMO Plans: These plans require you to receive medical care from a specific network of providers, except in emergency situations. * PPO Plans: These plans allow you to receive medical care from any provider, both in-network and out-of-network. * POS Plans: These plans combine features of HMO and PPO plans, allowing you to receive medical care from a specific network of providers, but also giving you the option to see out-of-network providers at a higher cost. * Catastrophic Plans: These plans are designed for young adults and others who want low-cost coverage in case of a medical emergency.

📝 Note: It's essential to review the plan options and features carefully to choose the best plan for your needs and budget.

How to Choose the Right Humana Health Insurance Plan in Alabama

Choosing the right Humana health insurance plan in Alabama can be overwhelming, but here are some tips to help you make an informed decision: * Assess Your Needs: Consider your medical needs, including any pre-existing conditions, prescription medications, and frequent doctor visits. * Compare Plan Options: Compare the different plan options, including deductibles, copays, coinsurance, and out-of-pocket maximums. * Check the Network: Make sure the plan you choose includes your preferred providers and hospitals in its network. * Consider Additional Benefits: Look for plans that offer additional benefits, such as wellness programs, dental and vision coverage, and 24⁄7 customer service.

Enrolling in a Humana Health Insurance Plan in Alabama

To enroll in a Humana health insurance plan in Alabama, you can: * Visit the Humana Website: Go to the Humana website and browse the different plan options. * Contact a Licensed Agent: Contact a licensed agent who can help you choose the right plan and answer any questions you may have. * Call Humana Customer Service: Call Humana customer service to get more information and enroll in a plan.

Conclusion

Humana health insurance plans in Alabama offer a range of options for individuals, families, and groups. By understanding the different types of plans, features, and benefits, you can make an informed decision and choose the best plan for your needs and budget. Remember to assess your needs, compare plan options, check the network, and consider additional benefits when selecting a plan. With the right plan, you can enjoy comprehensive coverage, a large network of providers, and additional benefits that support your overall health and well-being.

What is the difference between an HMO and a PPO plan?

+

An HMO plan requires you to receive medical care from a specific network of providers, except in emergency situations. A PPO plan allows you to receive medical care from any provider, both in-network and out-of-network.

Can I purchase a Humana health insurance plan outside of the open enrollment period?

+

Yes, you can purchase a Humana health insurance plan outside of the open enrollment period if you experience a qualifying life event, such as losing your job or having a baby.

How do I know which Humana health insurance plan is right for me?

+

To choose the right Humana health insurance plan, assess your medical needs, compare plan options, check the network, and consider additional benefits. You can also contact a licensed agent or call Humana customer service for guidance.

Related Terms:

- Humana individual health insurance cost

- Humana insurance phone number

- Humana individual health insurance providers

- United HealthCare plans

- Humana non Medicare plans

- Humana family health insurance