Idaho Health Insurance Exchange Options

Introduction to Idaho Health Insurance Exchange Options

Idaho, like many other states in the U.S., offers its residents a variety of health insurance options through the state’s health insurance exchange, also known as the Idaho Health Insurance Exchange. This marketplace allows individuals and families to compare and purchase health insurance plans from different providers, often with the benefit of subsidies to help make coverage more affordable. The goal of the exchange is to provide accessible and comprehensive health insurance to as many Idahoans as possible.

Understanding the Idaho Health Insurance Exchange

The Idaho Health Insurance Exchange is essentially a platform where individuals, families, and small businesses can shop for health insurance. It’s a key component of the Affordable Care Act (ACA), also known as Obamacare, which aims to increase the quality and affordability of health insurance, lower the uninsured rate by expanding insurance coverage, and reduce the costs of healthcare for individuals and the government. In Idaho, the exchange operates under the state’s guidance but follows federal regulations and guidelines set by the ACA.

Eligibility for the Idaho Health Insurance Exchange

To be eligible for health insurance through the Idaho Health Insurance Exchange, individuals and families must meet certain criteria. These include: - Being a U.S. citizen, national, or qualifying lawful presence - Being an Idaho resident - Not being incarcerated - Not having access to affordable job-based coverage - Meeting specific income requirements to qualify for subsidies or cost-sharing reductions

It’s worth noting that small businesses can also use the exchange to find health insurance options for their employees, although the rules and eligibility may differ.

Types of Plans Available

The Idaho Health Insurance Exchange offers various types of health insurance plans from several providers. These plans are categorized into different metal levels based on how much of your medical expenses they cover versus how much you pay out-of-pocket. The categories include: - Bronze Plans: These plans have lower premiums but higher deductibles and out-of-pocket costs. They cover about 60% of medical expenses. - Silver Plans: These are moderate plans that cover about 70% of medical expenses. They have moderate premiums and deductibles. Silver plans are the only ones eligible for cost-sharing reductions for those who qualify. - Gold Plans: Gold plans cover about 80% of medical expenses and have higher premiums but lower deductibles compared to Bronze and Silver plans. - Platinum Plans: These plans offer the highest level of coverage, paying about 90% of medical expenses, but they have the highest premiums. - Catastrophic Plans: These are available to individuals under the age of 30 or those who qualify for a hardship exemption. They have very low premiums but very high deductibles and primarily cover emergency and preventive care.

Enrollment Periods

There are specific times when you can enroll in a health insurance plan through the Idaho Health Insurance Exchange. The main enrollment period, also known as the Open Enrollment Period, typically runs from November to December each year, though the exact dates can vary. Outside of this period, you may still be able to enroll if you experience a qualifying life event, such as: - Losing job-based coverage - Getting married or divorced - Having a baby or adopting a child - Moving to a new area that offers different health plan options - Becoming a U.S. citizen - Being released from incarceration

Subsidies and Cost Savings

One of the significant benefits of purchasing health insurance through the Idaho Health Insurance Exchange is the potential for subsidies. There are two main types of subsidies: - Premium Tax Credits: These help lower the monthly premium costs of health insurance. They are available to individuals and families with incomes between 100% and 400% of the federal poverty level. - Cost-Sharing Reductions (CSRs): These reduce the out-of-pocket costs (like deductibles and copays) associated with Silver plans. They are available to those with incomes between 100% and 250% of the federal poverty level.

Steps to Enroll

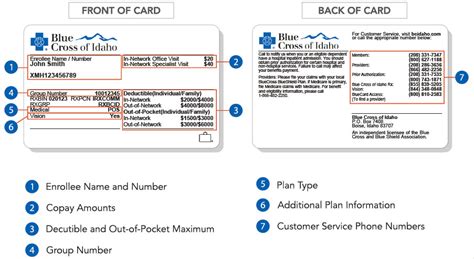

Enrolling in a health insurance plan through the Idaho Health Insurance Exchange involves several steps: 1. Determine Eligibility: Make sure you meet the eligibility criteria. 2. Gather Information: Collect necessary documents, such as proof of income, citizenship, and Idaho residency. 3. Apply: You can apply online, by phone, or in person with the help of a navigator or certified application counselor. 4. Compare Plans: Once your application is processed, compare the health insurance plans available to you, considering factors like premium cost, deductible, copays, and the network of providers. 5. Choose a Plan: Select the plan that best fits your health needs and budget. 6. Pay Your Premium: After selecting a plan, you’ll need to pay your first premium to activate your coverage.

📝 Note: It's essential to carefully review the details of any plan before making a selection, as the specifics can significantly impact your health care costs and access to care.

Conclusion and Key Points

In summary, the Idaho Health Insurance Exchange offers a range of options for individuals, families, and small businesses to find affordable health insurance. By understanding the types of plans available, eligibility criteria, and the process for enrolling, Idahoans can make informed decisions about their health insurance. Key points to remember include the importance of subsidies for making health insurance more affordable, the variety of plan options available, and the specific enrollment periods.

What is the Idaho Health Insurance Exchange?

+

The Idaho Health Insurance Exchange is a marketplace where individuals, families, and small businesses can compare and purchase health insurance plans from various providers, often with subsidies to make coverage more affordable.

How do I qualify for subsidies on the Idaho Health Insurance Exchange?

+

To qualify for subsidies, you must meet income requirements (between 100% and 400% of the federal poverty level for premium tax credits and between 100% and 250% for cost-sharing reductions) and not have access to affordable job-based coverage or certain other types of coverage.

Can I enroll in a health insurance plan through the Idaho Health Insurance Exchange at any time?

+

Generally, enrollment in health insurance plans through the exchange is limited to the annual Open Enrollment Period, unless you experience a qualifying life event that allows for a Special Enrollment Period.

Related Terms:

- Your Health Idaho

- Your Health Idaho login

- Idaho Health exchange Open Enrollment

- Idaho Health and Welfare

- Best health insurance in Idaho

- low cost health insurance idaho