5 IHSS Insurance Tips

Introduction to IHSS Insurance

In-Home Supportive Services (IHSS) is a program designed to provide assistance to elderly, blind, or disabled individuals, allowing them to remain safely in their own homes. One of the critical aspects of this program is the insurance coverage for the caregivers and recipients. Understanding the nuances of IHSS insurance is essential for both parties to ensure they are protected and aware of their rights and responsibilities. This article aims to provide valuable insights and tips on navigating IHSS insurance, focusing on its importance, benefits, and how to make the most out of the program.

Understanding IHSS Insurance

IHSS insurance is not just about financial protection; it’s also about ensuring that caregivers are compensated fairly for their work and that recipients receive the care they need without worrying about the financial implications. The program is funded by Medicaid and the state, with the goal of supporting individuals who are at risk of being placed in out-of-home care. The insurance aspect of IHSS covers a range of services, including household chores, personal care, and protective supervision.

Benefits of IHSS Insurance

The benefits of IHSS insurance are multifaceted: - Financial Protection: For caregivers, having insurance means they are protected in case of work-related injuries or illnesses. - Peace of Mind: Recipients and their families can have peace of mind knowing that their caregivers are insured, reducing the risk of unforeseen financial burdens. - Compliance with Regulations: It ensures that both caregivers and recipients are in compliance with state and federal regulations, avoiding potential legal issues. - Improved Care Quality: By ensuring caregivers are adequately compensated and protected, the quality of care can improve as caregivers are more likely to be motivated and less stressed about their financial situation.

5 Essential IHSS Insurance Tips

Navigating the world of IHSS insurance can be complex, but with the right guidance, both caregivers and recipients can make informed decisions. Here are five tips to consider: 1. Understand Your Coverage: It’s crucial to know what is covered under your IHSS insurance. This includes understanding the types of services that are eligible, the payment structures, and any limitations or exclusions. 2. Keep Accurate Records: Maintaining detailed records of the care provided, including hours worked, services performed, and any incidents or accidents, is vital for insurance purposes. This can help in case of audits or when filing claims. 3. Report Changes Promptly: Any changes in the recipient’s condition, caregiver’s status, or other relevant factors should be reported promptly to the insurance provider and the IHSS program. This ensures that the insurance coverage remains relevant and effective. 4. Seek Professional Advice: Given the complexity of IHSS insurance, seeking advice from professionals, such as insurance specialists or social workers familiar with the program, can provide valuable insights and help in making informed decisions. 5. Review and Update Insurance Regularly: Insurance needs can change over time. Regularly reviewing and updating your IHSS insurance coverage can help ensure that it continues to meet the needs of both caregivers and recipients.

Common Challenges and Solutions

Despite the benefits, navigating IHSS insurance can come with challenges, such as understanding the eligibility criteria, dealing with denied claims, or managing the paperwork. Solutions include: - Education and Awareness: Being well-informed about the program, its benefits, and its limitations can help manage expectations and reduce frustration. - Professional Guidance: Utilizing resources such as legal aid, social services, or insurance consultants can provide the necessary support and guidance. - Advocacy: Both caregivers and recipients should be aware of their rights and not hesitate to advocate for themselves when faced with challenges or disputes.

📝 Note: It's essential to regularly check the official IHSS website or consult with a relevant authority for the most current information and guidelines regarding IHSS insurance, as policies and regulations can change.

Future of IHSS Insurance

As healthcare needs and societal demographics continue to evolve, the importance of programs like IHSS and their associated insurance coverage will only grow. Innovations in care delivery, advancements in insurance products, and shifts in policy will likely impact the future of IHSS insurance. Staying informed and adaptable will be key for those involved in the program.

What is the primary purpose of IHSS insurance?

+

The primary purpose of IHSS insurance is to provide financial protection and support to caregivers and recipients, ensuring that individuals can receive necessary care in the comfort of their own homes.

How do I apply for IHSS insurance?

+

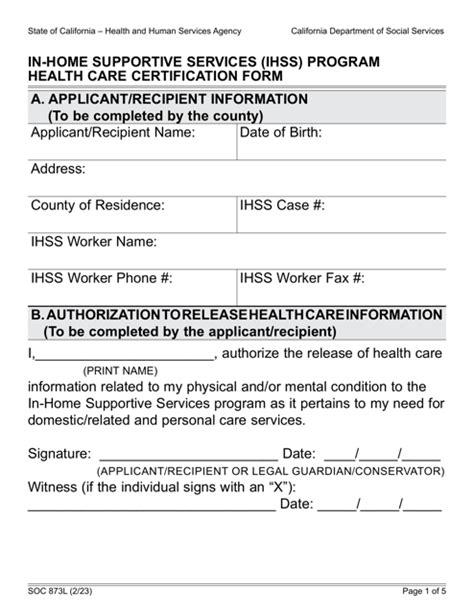

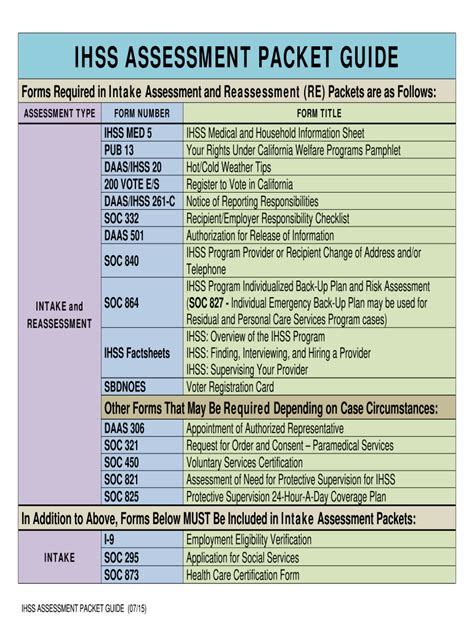

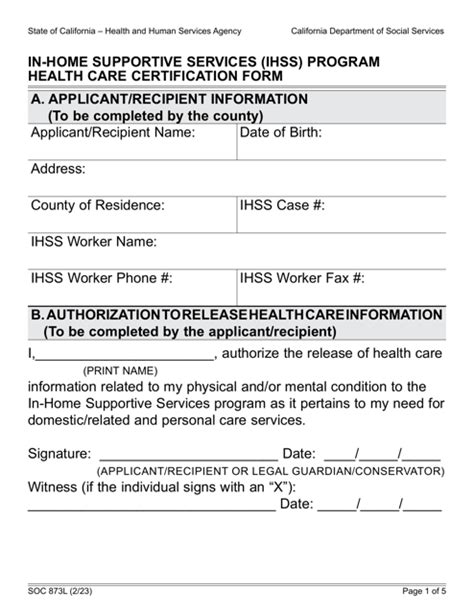

To apply for IHSS insurance, you typically need to contact your local social services department or the IHSS program directly. They will guide you through the application process, which may include assessments of the recipient's needs and eligibility.

Can IHSS insurance cover services provided by family members?

+

Yes, in many cases, IHSS insurance can cover services provided by family members who are acting as caregivers, provided they meet the program's criteria and are approved as caregivers through the IHSS program.

In summary, IHSS insurance plays a vital role in supporting both caregivers and recipients under the In-Home Supportive Services program. By understanding the benefits, navigating the complexities, and staying informed about the program and its insurance options, individuals can ensure they are making the most out of the available resources. Whether you are a caregiver, a recipient, or a family member involved in the care process, being well-informed and proactive can significantly impact the quality of care and the overall experience with the IHSS program.

Related Terms:

- IHSS benefits enrollment

- IHSS health insurance phone number

- IHSS benefits for Providers

- IHSS health insurance California

- IHSS health insurance application

- IHSS health insurance Santa Clara