5 Ways Healthcare Stays Non Cyclical

Introduction to Non-Cyclical Nature of Healthcare

The healthcare industry is often regarded as a non-cyclical sector, meaning its performance is not heavily influenced by economic fluctuations. This characteristic makes healthcare an attractive investment opportunity, especially during times of economic uncertainty. But what makes healthcare non-cyclical, and how does it manage to stay that way? In this article, we will explore the factors that contribute to the non-cyclical nature of the healthcare industry.

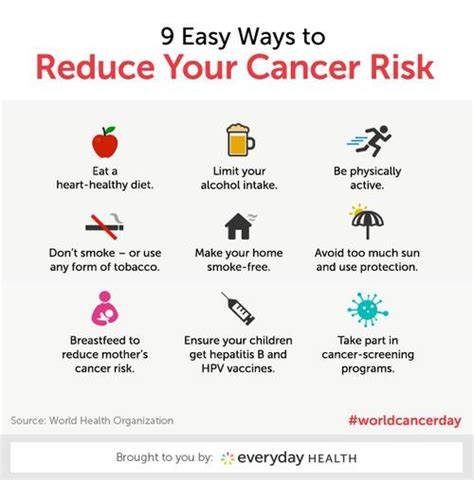

1. Constant Demand for Healthcare Services

One of the primary reasons healthcare remains non-cyclical is the constant demand for its services. People will always need medical care, regardless of the state of the economy. Whether it’s for routine check-ups, chronic condition management, or emergency treatments, healthcare services are essential and cannot be postponed or skipped. This consistent demand ensures that healthcare providers and related businesses continue to operate and generate revenue, even during economic downturns.

2. Government Support and Funding

Government support and funding play a significant role in maintaining the non-cyclical nature of healthcare. In many countries, healthcare is subsidized or fully covered by the government, which means that patients do not have to worry about the cost of treatment. This financial backing ensures that healthcare providers receive a steady stream of revenue, regardless of economic conditions. Additionally, government-funded research and development initiatives help drive innovation and growth in the healthcare sector.

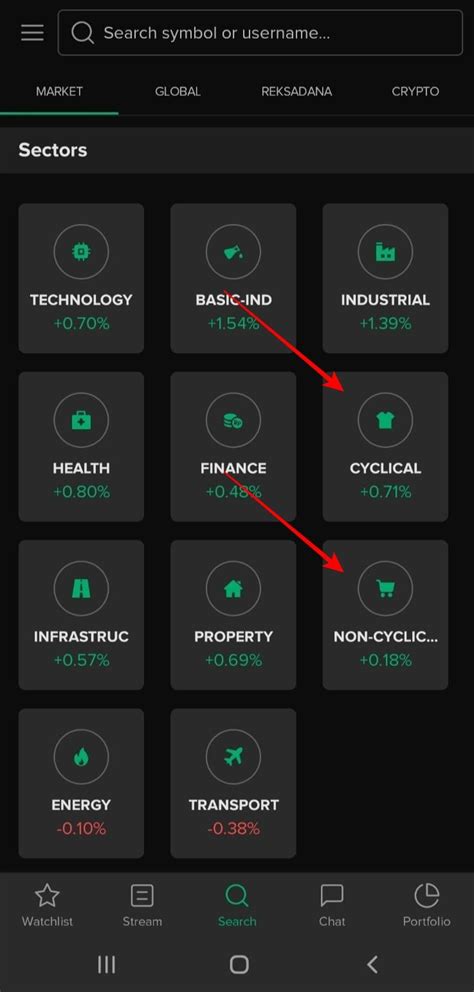

3. Diversified Revenue Streams

The healthcare industry has diversified revenue streams, which helps reduce its dependence on any one particular source of income. This diversification includes: * Private insurance premiums * Government funding * Out-of-pocket payments * Research grants * Pharmaceutical sales This variety of revenue streams ensures that the healthcare industry can withstand economic fluctuations and continue to generate revenue, even if one or more streams are affected.

4. Innovation and Technological Advancements

The healthcare industry is constantly evolving, with innovation and technological advancements driving growth and improvement. New treatments, medications, and medical devices are being developed and introduced to the market, creating new revenue streams and opportunities for investment. This innovation also helps to increase efficiency and reduce costs, making healthcare more accessible and affordable for patients.

5. Aging Population and Chronic Conditions

The world’s population is aging, and with this aging population comes an increase in chronic conditions and age-related diseases. This demographic shift ensures that the demand for healthcare services will continue to grow, regardless of economic conditions. Additionally, the prevalence of chronic conditions such as diabetes, heart disease, and obesity requires ongoing medical care and management, providing a steady stream of revenue for healthcare providers.

💡 Note: The non-cyclical nature of healthcare is not immune to economic fluctuations, but it is more resilient than other industries. Investors should still conduct thorough research and consider multiple factors before making investment decisions.

As we can see, the healthcare industry’s non-cyclical nature is a result of a combination of factors, including constant demand, government support, diversified revenue streams, innovation, and demographic changes. These factors contribute to the industry’s stability and make it an attractive investment opportunity, especially during times of economic uncertainty.

In terms of investment opportunities, the healthcare industry offers a range of options, including: * Pharmaceutical companies * Biotechnology firms * Medical device manufacturers * Healthcare providers and services * Health insurance companies * Healthcare technology and software providers

When considering investing in the healthcare industry, it’s essential to conduct thorough research and consider multiple factors, including the company’s financial performance, competitive landscape, and growth prospects.

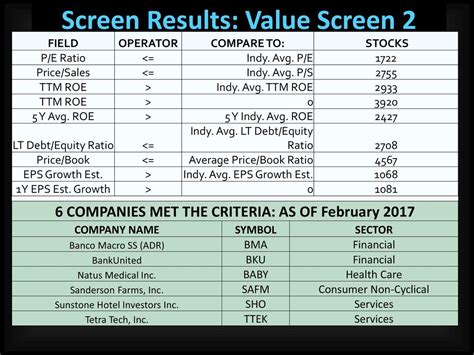

To illustrate the non-cyclical nature of healthcare, let’s consider a table showing the revenue growth of a healthcare company during different economic periods:

| Economic Period | Revenue Growth |

|---|---|

| Boom (2005-2007) | 10% |

| Recession (2008-2010) | 5% |

| Recovery (2011-2013) | 8% |

| Stable (2014-2016) | 7% |

As we can see, the healthcare company’s revenue growth is relatively stable, even during economic downturns. This stability is a result of the non-cyclical nature of the healthcare industry.

To summarize, the healthcare industry’s non-cyclical nature is a result of a combination of factors, including constant demand, government support, diversified revenue streams, innovation, and demographic changes. These factors contribute to the industry’s stability and make it an attractive investment opportunity, especially during times of economic uncertainty. As the world’s population continues to age and chronic conditions become more prevalent, the demand for healthcare services will continue to grow, ensuring the industry’s non-cyclical nature remains intact.

What makes the healthcare industry non-cyclical?

+

The healthcare industry is non-cyclical due to constant demand, government support, diversified revenue streams, innovation, and demographic changes.

How does government support contribute to the non-cyclical nature of healthcare?

+

Government support and funding ensure that healthcare providers receive a steady stream of revenue, regardless of economic conditions. This financial backing also drives innovation and growth in the healthcare sector.

What are some investment opportunities in the healthcare industry?

+

Investment opportunities in the healthcare industry include pharmaceutical companies, biotechnology firms, medical device manufacturers, healthcare providers and services, health insurance companies, and healthcare technology and software providers.

Related Terms:

- non cyclical stocks examples