ISI Health Insurance Options

Introduction to Health Insurance

When it comes to protecting one’s health and financial well-being, having the right health insurance is crucial. With numerous options available, selecting the most suitable health insurance plan can be overwhelming. In this article, we will delve into the world of health insurance, exploring the various options, benefits, and factors to consider when choosing a plan. Understanding the basics of health insurance is essential to making informed decisions about one’s health care.

Types of Health Insurance Plans

There are several types of health insurance plans, each with its unique characteristics, advantages, and disadvantages. Some of the most common types of plans include:

- Individual and Family Plans: These plans are designed for individuals and families who are not covered by an employer-sponsored plan.

- Group Plans: These plans are offered by employers to their employees and are often more affordable than individual plans.

- Medicare and Medicaid Plans: These plans are government-sponsored and provide coverage to individuals who are 65 or older, disabled, or have low incomes.

- Short-Term Plans: These plans provide temporary coverage for a limited period, usually up to 12 months.

Benefits of Health Insurance

Having health insurance provides numerous benefits, including:

- Financial Protection: Health insurance helps protect against high medical bills and financial ruin in the event of an unexpected illness or injury.

- Access to Quality Care: Health insurance provides access to quality medical care, including preventive services, diagnostic tests, and treatments.

- Peace of Mind: Having health insurance provides peace of mind, knowing that one is protected against unexpected medical expenses.

Factors to Consider When Choosing a Health Insurance Plan

When selecting a health insurance plan, there are several factors to consider, including:

- Premiums: The cost of the plan, including monthly premiums and out-of-pocket expenses.

- Network: The network of healthcare providers and hospitals that participate in the plan.

- Coverage: The types of services and treatments covered by the plan, including preventive care, hospital stays, and prescription medications.

- Deductibles and Copays: The amount of money that must be paid out-of-pocket before the plan begins to pay, as well as any copays or coinsurance.

ISI Health Insurance Options

ISI health insurance options provide a range of plans to suit different needs and budgets. Some of the features of ISI health insurance plans include:

- Affordable Premiums: ISI health insurance plans offer competitive premiums to help individuals and families save money.

- Comprehensive Coverage: ISI plans provide comprehensive coverage, including preventive care, hospital stays, and prescription medications.

- Extensive Network: ISI plans have an extensive network of healthcare providers and hospitals, ensuring that individuals have access to quality care.

💡 Note: It is essential to carefully review and compare the different ISI health insurance options to determine the most suitable plan for one's unique needs and budget.

Conclusion and Final Thoughts

In conclusion, having the right health insurance is crucial to protecting one’s health and financial well-being. With numerous options available, it is essential to carefully evaluate the different types of plans, benefits, and factors to consider when choosing a plan. ISI health insurance options provide a range of plans to suit different needs and budgets, offering affordable premiums, comprehensive coverage, and an extensive network of healthcare providers. By understanding the basics of health insurance and carefully evaluating the different options, individuals can make informed decisions about their health care and ensure that they are protected against unexpected medical expenses.

What is the difference between individual and group health insurance plans?

+

Individual health insurance plans are designed for individuals and families who are not covered by an employer-sponsored plan, while group plans are offered by employers to their employees and are often more affordable than individual plans.

What are the benefits of having health insurance?

+

Having health insurance provides financial protection, access to quality care, and peace of mind, knowing that one is protected against unexpected medical expenses.

How do I choose the right health insurance plan for my needs?

+

To choose the right health insurance plan, it is essential to evaluate factors such as premiums, network, coverage, deductibles, and copays, and to carefully review and compare the different options available.

Related Terms:

- iso health insurance usa

- foreign exchange student health insurance

- iso international student health insurance

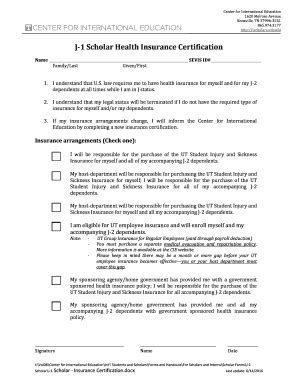

- j 1 scholar health insurance

- health insurance for foreign students

- health insurance for overseas students