5 Tips Kaiser Insurance

Introduction to Kaiser Insurance

Kaiser Insurance is a well-known health insurance provider in the United States, offering a range of plans and services to its members. With a strong focus on preventive care and a commitment to improving the health and well-being of its members, Kaiser Insurance has become a popular choice for individuals and families seeking comprehensive health coverage. In this article, we will explore five tips for getting the most out of your Kaiser Insurance plan, including how to choose the right plan, navigate the claims process, and take advantage of additional benefits and services.

Tip 1: Choose the Right Plan

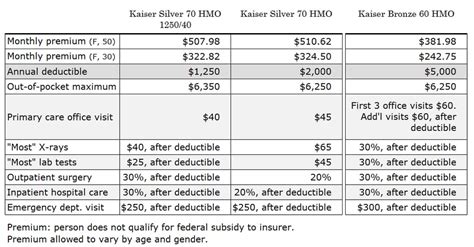

When selecting a Kaiser Insurance plan, it’s essential to consider your individual needs and circumstances. Kaiser Permanente offers a variety of plans, including HMO, PPO, and Medicare Advantage plans, each with its own set of benefits and limitations. To choose the right plan, consider the following factors: * Your budget: What can you afford to pay in premiums, deductibles, and copays? * Your health needs: Do you have any pre-existing conditions or ongoing health concerns that require specialized care? * Your lifestyle: Do you travel frequently or have a large family that may require additional coverage? By carefully evaluating these factors, you can select a plan that meets your needs and provides the best possible value.

Tip 2: Understand Your Coverage

Once you’ve selected a Kaiser Insurance plan, it’s crucial to understand what’s covered and what’s not. Review your policy documents carefully to familiarize yourself with the following: * Covered services: What medical services are included in your plan, such as doctor visits, hospital stays, and prescription medications? * Exclusions and limitations: What services are not covered or have limitations, such as cosmetic procedures or alternative therapies? * Copays and coinsurance: How much will you pay out-of-pocket for medical services, and what percentage of costs will you be responsible for? By understanding your coverage, you can avoid unexpected expenses and make informed decisions about your care.

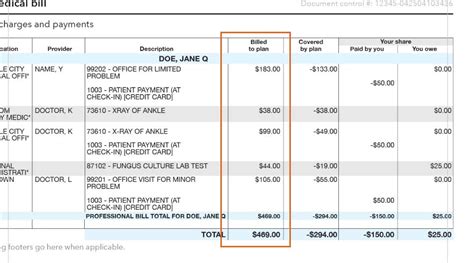

Tip 3: Navigate the Claims Process

If you need to file a claim with Kaiser Insurance, it’s essential to follow the correct procedures to ensure prompt and accurate processing. Here are the steps to follow: * Gather required documents: Collect any necessary medical records, receipts, or other documentation to support your claim. * Submit your claim: File your claim online, by phone, or by mail, depending on your plan’s requirements. * Track your claim: Monitor the status of your claim to ensure it’s being processed correctly and to address any issues that may arise. By following these steps, you can help ensure a smooth and efficient claims process.

Tip 4: Take Advantage of Additional Benefits

Kaiser Insurance offers a range of additional benefits and services to its members, including: * Preventive care services: Routine check-ups, screenings, and vaccinations to help prevent illness and detect health problems early. * Health and wellness programs: Fitness classes, nutrition counseling, and stress management programs to help you maintain a healthy lifestyle. * Online resources: Access to online tools and resources, such as health trackers and educational materials, to help you manage your care. By taking advantage of these benefits, you can improve your overall health and well-being, while also reducing your healthcare costs.

Tip 5: Stay Connected with Kaiser Insurance

Finally, it’s essential to stay connected with Kaiser Insurance to get the most out of your plan. Here are a few ways to do so: * Register for online account access: Create an online account to access your policy documents, claims information, and other resources. * Download the Kaiser Permanente app: Use the app to manage your care, track your health, and communicate with your healthcare team. * Attend health education events: Participate in workshops, seminars, and other events to learn more about healthy living and managing your care. By staying connected with Kaiser Insurance, you can stay informed, get support, and make the most of your health insurance plan.

💡 Note: Always review your policy documents and consult with a licensed insurance professional if you have any questions or concerns about your Kaiser Insurance plan.

In the end, getting the most out of your Kaiser Insurance plan requires a combination of careful planning, informed decision-making, and active engagement. By following these five tips, you can make the most of your health insurance coverage, improve your overall health and well-being, and reduce your healthcare costs.

What types of plans does Kaiser Insurance offer?

+

Kaiser Insurance offers a range of plans, including HMO, PPO, and Medicare Advantage plans, each with its own set of benefits and limitations.

How do I file a claim with Kaiser Insurance?

+

To file a claim, gather required documents, submit your claim online, by phone, or by mail, and track the status of your claim to ensure prompt and accurate processing.

What additional benefits and services does Kaiser Insurance offer?

+

Kaiser Insurance offers a range of additional benefits and services, including preventive care services, health and wellness programs, and online resources to help you manage your care.

Related Terms:

- Kaiser college student coverage

- Kaiser health insurance cost Calculator

- Kaiser Permanente plans

- Kaiser visitor insurance

- Kaiser out of area coverage

- Kaiser plan coverage