Health

5 Kemper Insurance Tips

Introduction to Kemper Insurance

Kemper Insurance is a well-established insurance company that offers a wide range of insurance products to individuals and businesses. With a long history of providing excellent customer service and competitive rates, Kemper Insurance has become a trusted name in the insurance industry. In this article, we will provide you with 5 valuable tips to help you make the most of your Kemper Insurance policy.

Tip 1: Understand Your Policy

It is essential to thoroughly understand your Kemper Insurance policy to ensure that you are adequately covered in the event of an unexpected incident. Take the time to read through your policy documents carefully, and do not hesitate to contact your insurance agent if you have any questions or concerns. Make sure you understand the terms and conditions, coverage limits, and deductibles. This will help you avoid any potential disputes or issues when filing a claim.

Tip 2: Take Advantage of Discounts

Kemper Insurance offers various discounts to policyholders, which can help reduce your premiums. Some of the discounts available include: * Multi-policy discount: If you have multiple policies with Kemper Insurance, you may be eligible for a discount. * Good student discount: If you have a student on your policy who maintains good grades, you may be eligible for a discount. * Defensive driving course discount: If you complete a defensive driving course, you may be eligible for a discount. * Bundling discount: If you bundle your auto and home insurance policies with Kemper Insurance, you may be eligible for a discount.

Tip 3: Review and Update Your Policy Regularly

It is crucial to review and update your Kemper Insurance policy regularly to ensure that it continues to meet your changing needs. Life events such as marriage, divorce, or the birth of a child can impact your insurance requirements, and it is essential to update your policy accordingly. Additionally, if you have made any significant changes to your home or vehicle, you should notify your insurance agent to ensure that your policy reflects these changes.

Tip 4: File Claims Promptly

If you need to file a claim with Kemper Insurance, it is essential to do so promptly. Delays in filing a claim can result in denied or reduced claims, so it is crucial to act quickly. Make sure you have all the necessary documentation and information ready, including police reports, medical records, and witness statements. Your insurance agent can guide you through the claims process and help you navigate any issues that may arise.

Tip 5: Consider Additional Coverage Options

Kemper Insurance offers various additional coverage options that can provide extra protection and peace of mind. Some of these options include: * Umbrella insurance: This type of insurance provides additional liability coverage beyond the limits of your standard policy. * Rental car coverage: This type of insurance provides coverage for rental cars, which can be essential if you rent vehicles frequently. * Flood insurance: This type of insurance provides coverage for flood damage, which can be essential if you live in a flood-prone area. Consider your individual needs and circumstances when deciding whether to purchase additional coverage options.

📝 Note: Always read and understand the terms and conditions of any additional coverage options before purchasing.

Conclusion and Final Thoughts

In conclusion, Kemper Insurance is a reliable and trustworthy insurance company that offers a wide range of insurance products to individuals and businesses. By following these 5 valuable tips, you can make the most of your Kemper Insurance policy and ensure that you are adequately protected in the event of an unexpected incident. Remember to always review and update your policy regularly, take advantage of discounts, and consider additional coverage options to provide extra protection and peace of mind.

What types of insurance does Kemper Insurance offer?

+

Kemper Insurance offers a wide range of insurance products, including auto, home, life, and umbrella insurance.

How do I file a claim with Kemper Insurance?

+

To file a claim with Kemper Insurance, contact your insurance agent or call the company’s claims hotline. Have all necessary documentation and information ready, including police reports, medical records, and witness statements.

Can I purchase additional coverage options with Kemper Insurance?

+

Yes, Kemper Insurance offers various additional coverage options, including umbrella insurance, rental car coverage, and flood insurance. Consider your individual needs and circumstances when deciding whether to purchase additional coverage options.

Related Terms:

- kemper home healthcare insurance company

- Kemper Health insurance provider Portal

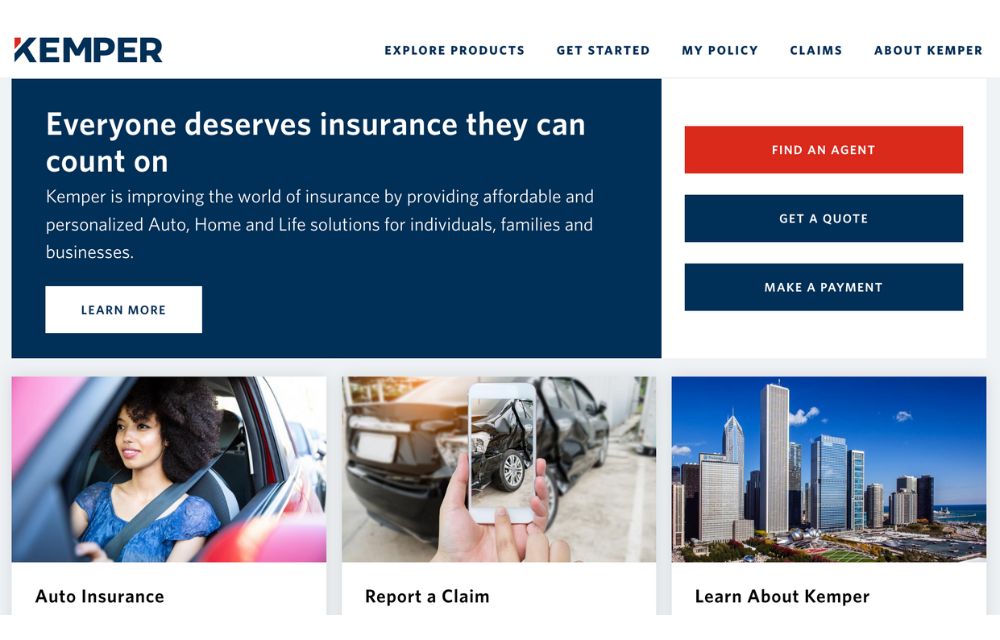

- Kemper Health Medicare Supplement

- Kemper Life insurance

- Kemper Health provider phone number

- Reserve National Insurance