Check KP Health Savings Account Balance

Introduction to KP Health Savings Account

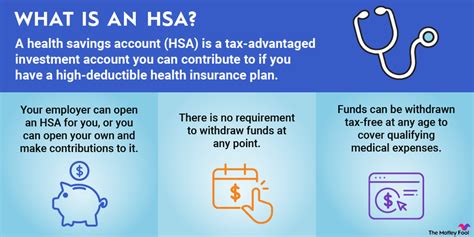

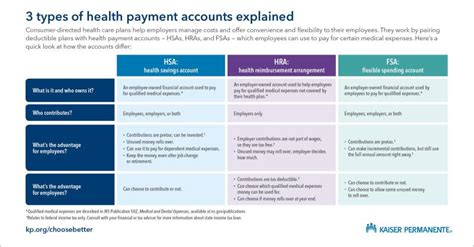

A Health Savings Account (HSA) is a valuable tool for individuals with high-deductible health plans, allowing them to save money on a tax-free basis for medical expenses. Kaiser Permanente (KP) offers its members the opportunity to open and manage a Health Savings Account. Understanding how to check the KP Health Savings Account balance is essential for effective management of your healthcare funds.

Benefits of a KP Health Savings Account

Before diving into the specifics of checking your account balance, it’s helpful to understand the benefits of having a KP Health Savings Account: - Tax Advantages: Contributions to an HSA are tax-deductible, and the funds grow tax-free. - Flexibility: You can use the funds for qualified medical expenses at any time, and unused funds roll over year after year. - Portability: The account is yours, so even if you change jobs or retire, you can keep the account. - Investment Opportunities: Many HSAs offer investment options, allowing your savings to potentially grow over time.

Ways to Check KP Health Savings Account Balance

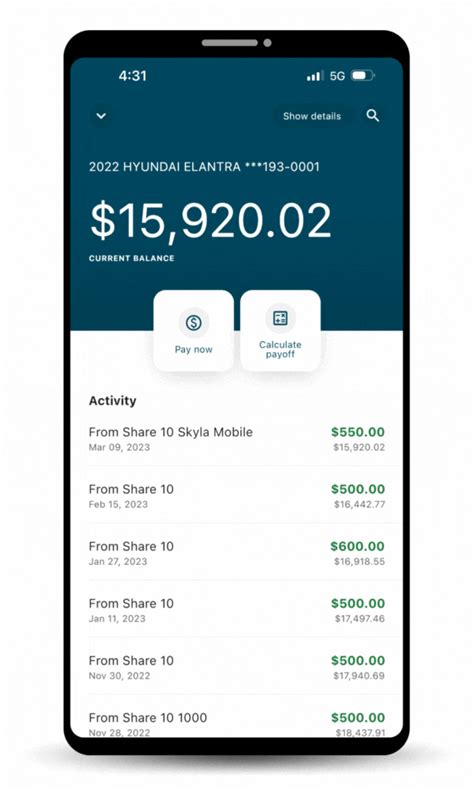

Kaiser Permanente provides its members with several convenient methods to check their Health Savings Account balance: - Online Portal: Members can log in to their account through the KP website or mobile app. This method allows for real-time balance checks, transaction history, and the ability to manage investments if applicable. - Mobile App: For those always on the go, KP’s mobile app offers a quick and secure way to check balances and perform other account management tasks. - Phone: Members can call the customer service number provided by KP to inquire about their account balance. This method is useful for those who prefer personal assistance or have questions about their account. - Mail: Although less common, members can request a statement to be mailed to them, which will include the current balance and recent transactions.

Steps to Check Balance Online

Checking your KP Health Savings Account balance online is straightforward: 1. Visit the KP Website: Navigate to the Kaiser Permanente website and click on the login section for members. 2. Login to Your Account: Enter your username and password. If you haven’t registered, you’ll need to create an account first. 3. Navigate to HSA Section: Once logged in, look for the section related to your Health Savings Account. This may be under a financial or benefits section. 4. View Account Balance: Your current balance should be displayed prominently. You can also view transaction history, manage investments, and perform other account tasks from this section.

Understanding Your Account Statement

When checking your balance, whether online, through the app, or via a mailed statement, it’s essential to understand what you’re looking at: - Current Balance: The total amount currently in your HSA. - Available Balance: The amount available for use, which may not include pending transactions. - Contributions: The amount you’ve added to your account, which can include employer contributions if applicable. - Distributions: The amount you’ve withdrawn for medical expenses.

📝 Note: Always review your account statements carefully to ensure all transactions are accurate and recognized. If you notice any discrepancies, contact KP customer service promptly.

Maintaining Your KP Health Savings Account

To get the most out of your KP Health Savings Account, consider the following tips: - Regularly Check Your Balance: Stay informed about your account to ensure you have sufficient funds for medical expenses and to monitor for any potential errors. - Contribute Consistently: Take advantage of the tax benefits by contributing to your HSA regularly, especially if your employer offers matching contributions. - Keep Receipts: For all medical expenses paid from your HSA, keep detailed records. This is crucial for tax purposes and in case of an audit.

Investing Your HSA Funds

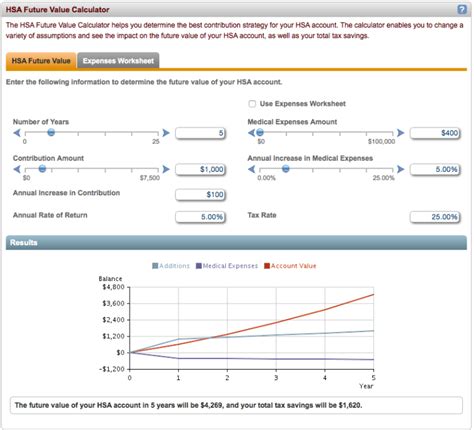

For those interested in growing their HSA funds over time, many accounts offer investment options: - Research Available Investments: Look into the types of investments offered through your KP HSA, such as stocks, bonds, or mutual funds. - Understand Fees: Be aware of any management fees associated with the investments. - Consider Your Risk Tolerance: Choose investments that align with your comfort level regarding risk and potential return.

How do I contribute to my KP Health Savings Account?

+

You can contribute to your KP HSA through payroll deductions if your employer offers this option, or you can make personal contributions online, by mail, or through the mobile app.

Can I use my KP Health Savings Account for expenses not related to medical care?

+

Using HSA funds for non-qualified medical expenses before the age of 65 will result in penalties and taxes on the withdrawn amount. After 65, you can use the funds for any purpose without penalty, though you'll pay income tax on non-medical expenses.

How do I manage my KP Health Savings Account investments?

+

You can manage your HSA investments through the online portal or mobile app, where you can choose from available investment options, monitor performance, and make changes as needed.

In summary, managing your KP Health Savings Account effectively involves regularly checking your balance, understanding your account statements, and making informed decisions about contributions and investments. By doing so, you can maximize the benefits of your HSA and ensure you’re well-prepared for future medical expenses.

Related Terms:

- kaiser hsa account online

- kaiser hsa account management

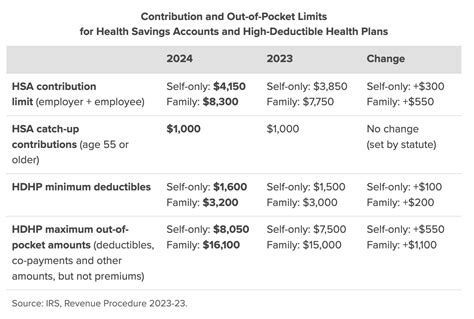

- kaiser permanente hsa contribution limit

- kaiser hsa payment plan

- kaiser hsa contribution calculator

- kaiser permanente hsa calculator