LBUSD Retiree Health Benefits Guide

Introduction to LBUSD Retiree Health Benefits

The Long Beach Unified School District (LBUSD) offers a comprehensive range of health benefits to its retirees, acknowledging the dedication and service of its employees. Understanding these benefits is crucial for retirees to make informed decisions about their health care. This guide is designed to navigate the complexities of LBUSD retiree health benefits, ensuring that retirees can maximize their coverage and maintain optimal health.

Eligibility for Retiree Health Benefits

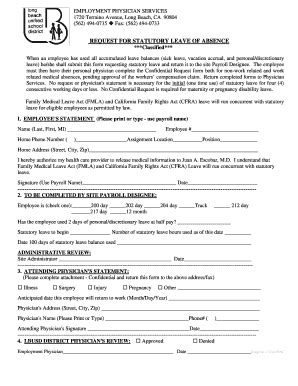

To be eligible for LBUSD retiree health benefits, individuals must meet specific criteria. Typically, this includes being a retired employee of the district, having reached a certain age (often 55 or older), and having completed a minimum number of years of service. The exact eligibility requirements can vary, so it’s essential for retirees to consult with the LBUSD Human Resources department or refer to their retirement packet for detailed information.

Types of Health Benefits Offered

The LBUSD offers a variety of health benefits to its retirees, which may include: - Medical Coverage: This can include access to medical, surgical, and hospital services. - Dental Coverage: Retirees may be eligible for dental insurance that covers routine check-ups, fillings, crowns, and other dental procedures. - Vision Coverage: Vision benefits can include eye exams, glasses, and contact lenses. - Prescription Drug Coverage: This benefit helps cover the cost of prescription medications. - Life Insurance: Some retirees may be eligible for life insurance benefits.

Enrollment and Premium Payments

To enroll in LBUSD retiree health benefits, eligible retirees typically need to complete an enrollment form during a specified open enrollment period or within a certain timeframe after retirement. Premium payments for these benefits can vary and may be deducted from the retiree’s monthly pension check. It’s crucial for retirees to understand their premium obligations and any changes to premiums or benefits over time.

Managing Your Benefits

Effective management of retiree health benefits involves understanding the coverage, knowing how to access care, and being aware of any necessary documentation or procedures. Key aspects include: - Network Providers: Using health care providers within the network can significantly reduce out-of-pocket costs. - Pre-Authorizations: Certain services or treatments may require pre-authorization from the insurance provider. - Claims and Billing: Retirees should understand how claims are processed and how to manage billing inquiries.

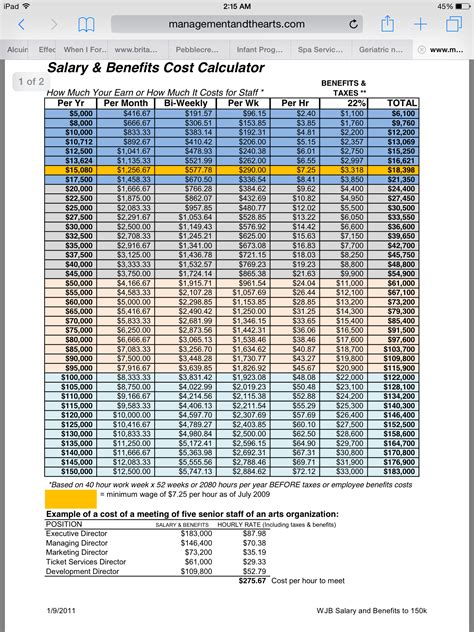

Financial Planning for Retiree Health Benefits

Financial planning is a critical component of maximizing retiree health benefits. This includes: - Budgeting for Premiums: Retirees should factor health benefit premiums into their retirement budget. - Understanding Deductibles and Co-Pays: Knowing the deductibles and co-pays associated with each benefit can help retirees plan for health care expenses. - Tax Implications: Some health benefit premiums or expenses may have tax implications, which retirees should consider in their financial planning.

Support and Resources

The LBUSD and external organizations offer various support and resources to help retirees navigate their health benefits. These can include: - LBUSD Human Resources: The district’s HR department is a primary source of information and assistance. - Insurance Providers: The health insurance companies themselves can provide detailed information about coverage and claims. - Retiree Associations: Many districts have retiree associations that offer support, advice, and advocacy.

💡 Note: Retirees should regularly review their health benefits and financial plans to ensure they are making the most of their coverage and preparing for any future changes or needs.

Conclusion and Future Planning

In conclusion, LBUSD retiree health benefits are a valuable resource for individuals who have dedicated their careers to the district. By understanding the eligibility criteria, types of benefits, enrollment process, and financial implications, retirees can better navigate their health care options. As health care needs and costs continue to evolve, it’s essential for retirees to stay informed and plan carefully to ensure they receive the care they need while managing their expenses effectively.

How do I enroll in LBUSD retiree health benefits?

+

To enroll, complete the enrollment form during the specified open enrollment period or within the timeframe provided after your retirement. Contact the LBUSD Human Resources department for specific details and deadlines.

Can I change my health benefits after enrollment?

+

Changes to your health benefits can usually only be made during open enrollment periods or due to a qualifying life event, such as marriage, divorce, or the birth of a child. Contact your insurance provider or the LBUSD Human Resources department for more information.

Are LBUSD retiree health benefits taxable?

+

The tax implications of LBUSD retiree health benefits can vary. Premiums paid for health insurance may be tax-deductible, but the benefits received are generally not taxable. However, specific tax rules can apply, so it’s recommended to consult with a tax professional for personalized advice.

Related Terms:

- LBUSD Benefits Phone number

- Lbusd risk Management

- LBUSD jobs

- LBUSD Portal Employee

- LBUSD Portal Login

- LBUSD School nurse