5 Ways Lively HSA

Introduction to Lively HSA

In today’s fast-paced world, managing healthcare expenses can be a daunting task. With the rising costs of medical bills and insurance premiums, it’s essential to have a reliable and efficient way to save for healthcare expenses. This is where a Health Savings Account (HSA) comes in. A Lively HSA is a type of savings account that allows individuals with high-deductible health plans to set aside pre-tax dollars for medical expenses. In this article, we’ll explore the benefits of a Lively HSA and how it can help you manage your healthcare expenses effectively.

Benefits of a Lively HSA

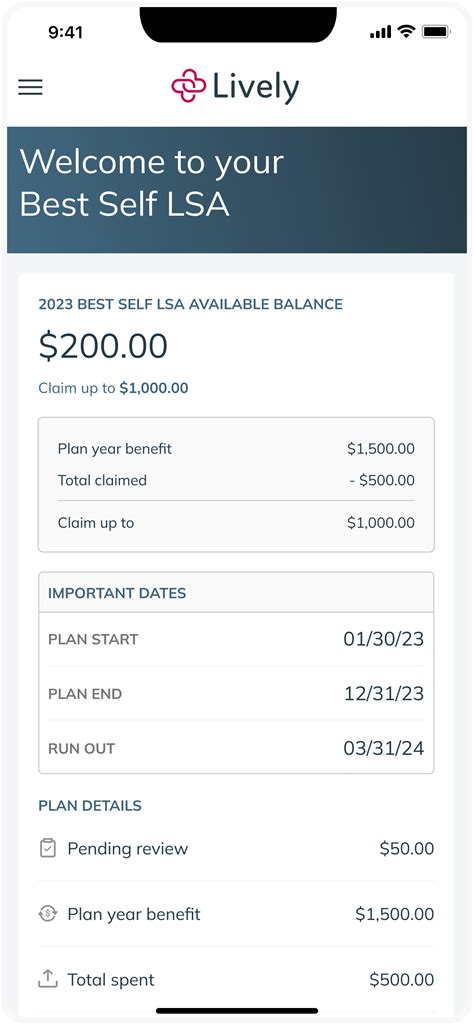

A Lively HSA offers numerous benefits that make it an attractive option for individuals and families. Some of the key benefits include: * Tax advantages: Contributions to a Lively HSA are tax-deductible, and the funds grow tax-free. * Flexibility: You can use your Lively HSA funds to pay for a wide range of medical expenses, including doctor visits, hospital stays, and prescriptions. * Portability: A Lively HSA is portable, meaning you can take it with you if you change jobs or retire. * Investment opportunities: You can invest your Lively HSA funds in a variety of assets, such as stocks, bonds, and mutual funds. * No “use it or lose it” rule: Unlike Flexible Spending Accounts (FSAs), a Lively HSA doesn’t have a “use it or lose it” rule, which means you can carry over unused funds from year to year.

How to Use a Lively HSA

Using a Lively HSA is relatively straightforward. Here are the basic steps: * Open an account: You can open a Lively HSA account online or through a financial institution. * Contribute funds: You can contribute funds to your Lively HSA account through payroll deductions or by making individual contributions. * Use funds for medical expenses: You can use your Lively HSA funds to pay for qualified medical expenses, such as doctor visits, hospital stays, and prescriptions. * Keep receipts: Be sure to keep receipts for your medical expenses, as you may need to provide documentation to support your HSA claims.

5 Ways a Lively HSA Can Benefit You

A Lively HSA can benefit you in numerous ways. Here are five ways a Lively HSA can help you manage your healthcare expenses: * Save for retirement: A Lively HSA can be a great way to save for retirement, as you can use your HSA funds to pay for medical expenses in retirement. * Pay for unexpected medical expenses: A Lively HSA can help you pay for unexpected medical expenses, such as emergency room visits or surgeries. * Cover deductible and copayment expenses: A Lively HSA can help you cover deductible and copayment expenses, which can add up quickly. * Invest in your health: A Lively HSA can help you invest in your health, by allowing you to use your HSA funds to pay for preventive care and wellness programs. * Reduce your taxable income: A Lively HSA can help reduce your taxable income, as contributions to a Lively HSA are tax-deductible.

Eligibility and Contribution Limits

To be eligible for a Lively HSA, you must have a high-deductible health plan (HDHP). The contribution limits for a Lively HSA vary from year to year, but for 2022, the contribution limits are:

| Contribution Type | Contribution Limit |

|---|---|

| Individual | 3,650</td> </tr> <tr> <td>Family</td> <td>7,300 |

| Catch-up contributions (age 55 or older) | $1,000 |

💡 Note: The contribution limits may change from year to year, so it's essential to check the current limits before contributing to your Lively HSA.

In summary, a Lively HSA is a valuable tool for managing healthcare expenses. With its tax advantages, flexibility, and investment opportunities, a Lively HSA can help you save for retirement, pay for unexpected medical expenses, and reduce your taxable income. By understanding the benefits and eligibility requirements of a Lively HSA, you can make informed decisions about your healthcare finances.

What is a Lively HSA?

+

A Lively HSA is a type of savings account that allows individuals with high-deductible health plans to set aside pre-tax dollars for medical expenses.

How do I contribute to a Lively HSA?

+

You can contribute funds to your Lively HSA account through payroll deductions or by making individual contributions.

Can I use my Lively HSA funds for non-medical expenses?

+

No, you can only use your Lively HSA funds for qualified medical expenses. If you use your HSA funds for non-medical expenses, you may be subject to penalties and taxes.

Related Terms:

- lively hsa sign in

- log into my lively account

- best health savings account lively

- lively health log in

- bmo lively login

- livelyme login