Health

Living Well with High Deductible Health Plans

Introduction to High Deductible Health Plans

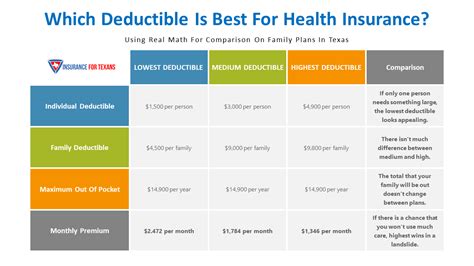

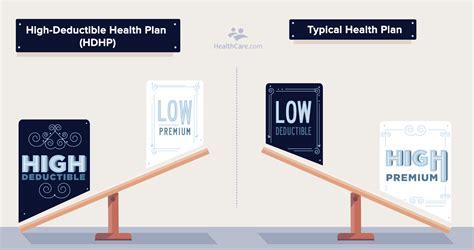

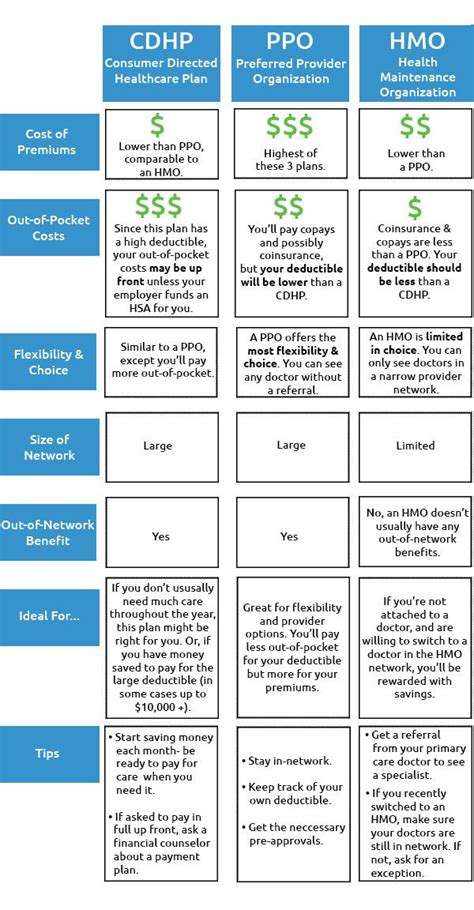

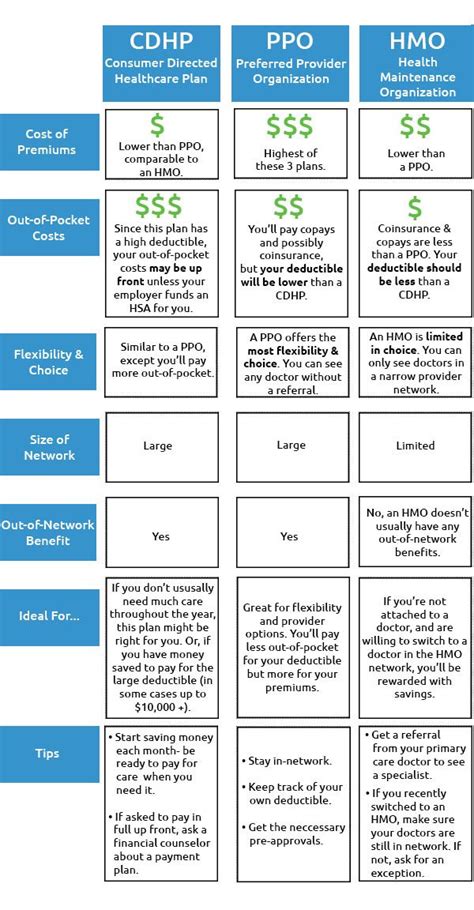

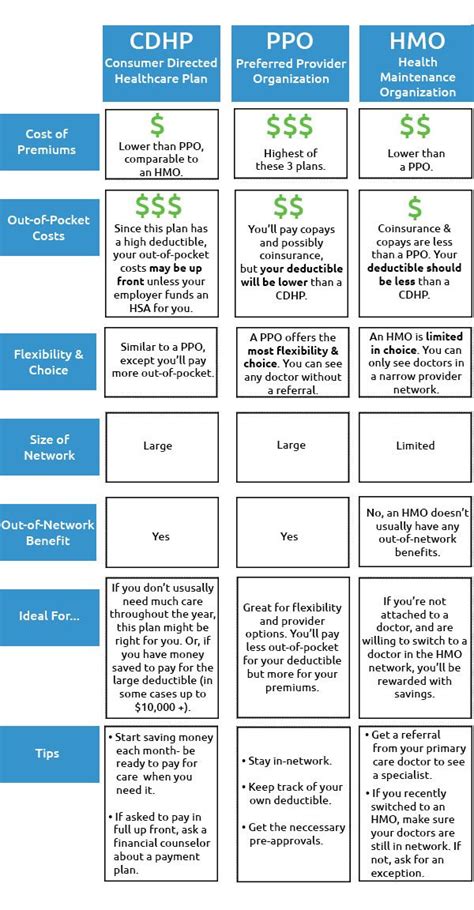

High deductible health plans (HDHPs) have become increasingly popular in recent years due to their lower premiums compared to traditional health insurance plans. These plans are designed to encourage individuals to take a more active role in their healthcare decisions, as they require policyholders to pay a higher deductible before the insurance coverage kicks in. Understanding how HDHPs work is crucial for individuals and families who want to make the most out of their health insurance.

How High Deductible Health Plans Work

HDHPs typically have a higher deductible, which is the amount that policyholders must pay out-of-pocket before the insurance company starts covering the costs. In exchange for the higher deductible, HDHPs usually offer lower premiums, making them more affordable for individuals and families. It’s essential to note that HDHPs often come with a health savings account (HSA) or a health reimbursement arrangement (HRA), which allows policyholders to set aside pre-tax dollars to pay for qualified medical expenses.

Benefits of High Deductible Health Plans

There are several benefits to having an HDHP: * Lower premiums: HDHPs typically have lower premiums compared to traditional health insurance plans. * Health savings account (HSA): HDHPs often come with an HSA, which allows policyholders to set aside pre-tax dollars to pay for qualified medical expenses. * Increased transparency: HDHPs encourage policyholders to take a more active role in their healthcare decisions, which can lead to increased transparency and awareness of medical costs. * Improved health outcomes: By taking a more active role in their healthcare decisions, policyholders may be more likely to prioritize preventive care and make healthier lifestyle choices.

Challenges of High Deductible Health Plans

While HDHPs can be a cost-effective option for some individuals and families, there are also some challenges to consider: * Higher out-of-pocket costs: HDHPs require policyholders to pay a higher deductible before the insurance coverage kicks in, which can be a significant burden for those with limited financial resources. * Limited provider networks: Some HDHPs may have limited provider networks, which can restrict policyholders’ access to certain healthcare providers and facilities. * Increased administrative burden: HDHPs often require policyholders to navigate complex billing and reimbursement processes, which can be time-consuming and frustrating.

Strategies for Living Well with High Deductible Health Plans

To make the most out of an HDHP, policyholders can use the following strategies: * Take advantage of preventive care: HDHPs often cover preventive care services, such as annual physicals and screenings, at no additional cost. * Shop around for healthcare services: Policyholders can compare prices and quality of care among different healthcare providers and facilities to make informed decisions. * Use health savings accounts (HSAs) wisely: Policyholders can use their HSA funds to pay for qualified medical expenses, such as prescription medications and medical equipment. * Stay organized and keep track of expenses: Policyholders can use tools, such as spreadsheets or mobile apps, to keep track of their out-of-pocket expenses and ensure that they are taking advantage of all the benefits available to them.

Managing Out-of-Pocket Expenses

To manage out-of-pocket expenses, policyholders can use the following tips: * Set aside funds for unexpected medical expenses: Policyholders can set aside a portion of their income each month to cover unexpected medical expenses. * Use generic or store-brand medications: Policyholders can save money on prescription medications by using generic or store-brand options. * Negotiate medical bills: Policyholders can negotiate with healthcare providers to reduce the cost of medical bills. * Take advantage of telemedicine services: Policyholders can use telemedicine services to access healthcare services remotely, which can be more convenient and cost-effective.

📝 Note: Policyholders should always review their HDHP policy documents carefully to understand the terms and conditions of their coverage, including any limitations or exclusions.

Conclusion and Final Thoughts

In conclusion, living well with high deductible health plans requires a combination of strategies, including taking advantage of preventive care, shopping around for healthcare services, using health savings accounts wisely, and managing out-of-pocket expenses. By understanding how HDHPs work and using these strategies, individuals and families can make the most out of their health insurance and achieve better health outcomes.

What is a high deductible health plan (HDHP)?

+

A high deductible health plan (HDHP) is a type of health insurance plan that requires policyholders to pay a higher deductible before the insurance coverage kicks in.

What are the benefits of having an HDHP?

+

The benefits of having an HDHP include lower premiums, a health savings account (HSA), increased transparency, and improved health outcomes.

How can I manage out-of-pocket expenses with an HDHP?

+

To manage out-of-pocket expenses with an HDHP, policyholders can set aside funds for unexpected medical expenses, use generic or store-brand medications, negotiate medical bills, and take advantage of telemedicine services.

Related Terms:

- livingwell high deductible health plan

- Living Well CDHP vs PPO

- Living well CDHP deductible

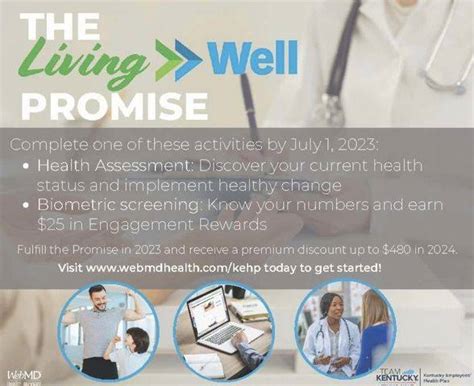

- www kehp livingwell com login

- Living well Basic CDHP

- KEHP living well rewards login