Louisiana Health Insurance Exchange Options

Introduction to Louisiana Health Insurance Exchange

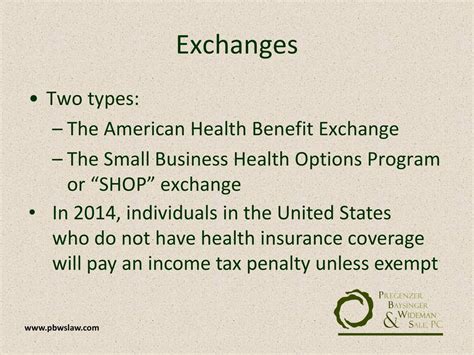

The Louisiana Health Insurance Exchange, also known as the Health Insurance Marketplace, is a platform where individuals and families can purchase health insurance plans that meet their needs and budget. The exchange is operated by the federal government and offers a range of plans from various insurance companies. In this article, we will explore the options available on the Louisiana Health Insurance Exchange and provide guidance on how to choose the right plan.

Types of Plans Offered on the Exchange

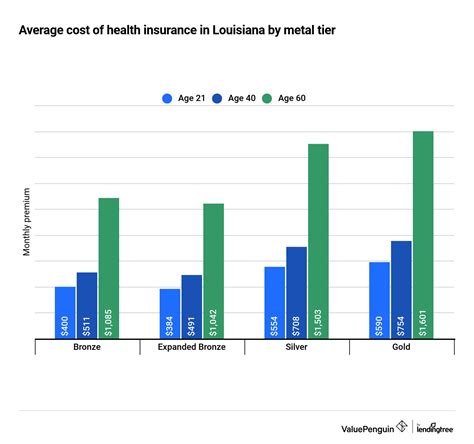

The Louisiana Health Insurance Exchange offers a variety of plans from several insurance companies, including Blue Cross Blue Shield of Louisiana, Humana, and UnitedHealthcare. The plans are categorized into four metal tiers: Bronze, Silver, Gold, and Platinum. Each tier offers a different level of coverage and cost-sharing. The main differences between the tiers are: * Bronze: Lowest premium, highest deductible and out-of-pocket costs * Silver: Moderate premium, moderate deductible and out-of-pocket costs * Gold: Higher premium, lower deductible and out-of-pocket costs * Platinum: Highest premium, lowest deductible and out-of-pocket costs

Eligibility and Enrollment

To be eligible for a plan on the Louisiana Health Insurance Exchange, individuals and families must meet certain requirements. These include: * Being a U.S. citizen or lawfully present in the United States * Being a resident of Louisiana * Not being incarcerated * Not having access to affordable health insurance through an employer or other sources The open enrollment period for the exchange typically runs from November to December each year, but individuals may be eligible for special enrollment periods if they experience certain life events, such as losing job-based coverage or having a child.

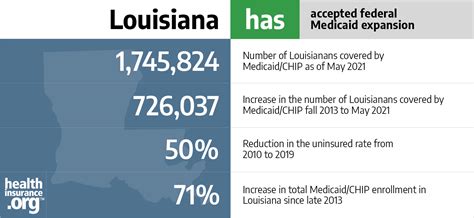

Cost and Financial Assistance

The cost of plans on the Louisiana Health Insurance Exchange varies depending on the tier, insurance company, and individual or family circumstances. However, many individuals and families are eligible for financial assistance to help lower their costs. This includes: * Premium tax credits: Reduce the monthly premium * Cost-sharing reductions: Lower the deductible, copayment, and coinsurance * Medicaid and Children’s Health Insurance Program (CHIP): Provide free or low-cost coverage to eligible individuals and families

Choosing the Right Plan

With so many options available on the Louisiana Health Insurance Exchange, choosing the right plan can be overwhelming. Here are some factors to consider: * Premium cost: Calculate the monthly premium and ensure it fits within your budget * Network of providers: Check if your primary care physician and specialists are part of the plan’s network * Prescription drug coverage: Ensure the plan covers your necessary medications * Maximum out-of-pocket costs: Consider the deductible, copayment, and coinsurance to determine the maximum amount you may need to pay out-of-pocket

📝 Note: It's essential to carefully review the plan's details, including the summary of benefits and coverage, to ensure it meets your needs and budget.

Additional Resources

For more information on the Louisiana Health Insurance Exchange and to enroll in a plan, individuals and families can: * Visit the official website of the exchange * Contact a licensed insurance agent or broker * Call the customer service hotline * Attend a community event or enrollment fair

| Insurance Company | Plan Name | Premium |

|---|---|---|

| Blue Cross Blue Shield of Louisiana | Bronze Plan | $300 |

| Humana | Silver Plan | $400 |

| UnitedHealthcare | Gold Plan | $500 |

In the final analysis, selecting a health insurance plan on the Louisiana Health Insurance Exchange requires careful consideration of various factors, including premium cost, network of providers, and prescription drug coverage. By understanding the options available and seeking guidance from licensed insurance agents or brokers, individuals and families can make informed decisions and choose a plan that meets their needs and budget.

What is the open enrollment period for the Louisiana Health Insurance Exchange?

+

The open enrollment period for the Louisiana Health Insurance Exchange typically runs from November to December each year.

How do I know if I’m eligible for financial assistance on the exchange?

+

To determine if you’re eligible for financial assistance, you can visit the official website of the exchange or contact a licensed insurance agent or broker.

Can I enroll in a plan on the exchange if I have a pre-existing condition?

+

Yes, individuals with pre-existing conditions can enroll in a plan on the exchange. The Affordable Care Act prohibits insurance companies from denying coverage based on pre-existing conditions.

Related Terms:

- louisiana health insurance companies

- louisiana health insurance marketplace

- louisiana health insurance guide

- louisiana health insurance plan

- louisiana health insurance consumer guide

- louisiana health insurance providers