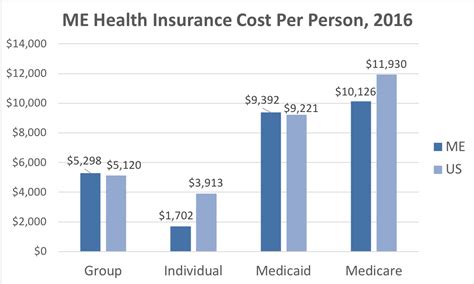

5 Ways Maine Health Insurance

Introduction to Maine Health Insurance

Maine health insurance is a vital aspect of healthcare for residents of the state. With the ever-changing landscape of healthcare, it’s essential to stay informed about the various options available. In this post, we’ll delve into the world of Maine health insurance, exploring the different ways to obtain coverage, the benefits of each option, and what to consider when choosing a plan.

Understanding Maine Health Insurance Options

When it comes to health insurance in Maine, there are several options to consider. Here are five ways to obtain health insurance in the state: * Employer-Sponsored Plans: Many employers in Maine offer health insurance as a benefit to their employees. These plans are often more affordable than individual plans and may offer additional benefits such as dental and vision coverage. * Individual and Family Plans: For those who are self-employed or don’t have access to employer-sponsored plans, individual and family plans are available. These plans can be purchased through the health insurance marketplace or directly from an insurance company. * Medicaid: Maine’s Medicaid program provides health coverage to low-income individuals and families. Eligibility is based on income and family size. * Medicare: Medicare is a federal health insurance program for people 65 or older, certain younger people with disabilities, and people with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant). * Short-Term Limited-Duration Insurance: Short-term limited-duration insurance (STLDI) plans provide temporary health coverage for a limited period, usually up to 12 months.

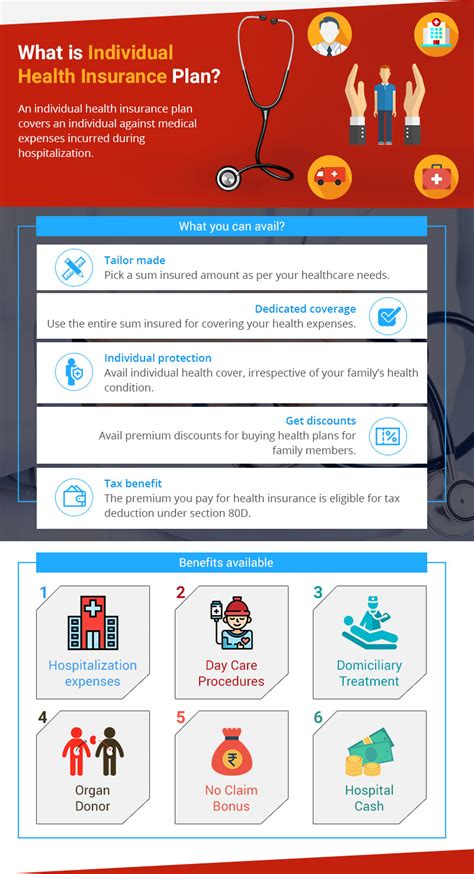

Benefits of Maine Health Insurance

Having health insurance in Maine provides numerous benefits, including: * Access to Preventive Care: Health insurance plans in Maine often cover preventive care services such as routine check-ups, screenings, and vaccinations. * Protection from Financial Burden: Health insurance helps protect individuals and families from the financial burden of unexpected medical expenses. * Improved Health Outcomes: Studies have shown that people with health insurance tend to have better health outcomes and are more likely to receive necessary medical care. * Peace of Mind: Having health insurance provides peace of mind, knowing that you and your loved ones are protected in case of a medical emergency.

What to Consider When Choosing a Maine Health Insurance Plan

When selecting a health insurance plan in Maine, there are several factors to consider: * Premium Costs: The monthly premium cost is a significant factor to consider. Plans with lower premiums may have higher deductibles or copays. * Deductible and Copays: The deductible is the amount you must pay out-of-pocket before your insurance plan kicks in. Copays are the fixed amounts you pay for doctor visits or prescriptions. * Network of Providers: Consider the network of healthcare providers included in the plan. Make sure your primary care physician and any specialists you see are part of the network. * Coverage and Benefits: Review the plan’s coverage and benefits, including any exclusions or limitations.

Maine Health Insurance Marketplace

The Maine health insurance marketplace, also known as the exchange, is a platform where individuals and families can purchase health insurance plans. The marketplace offers a variety of plans from different insurance companies, making it easier to compare and choose a plan that meets your needs.

| Insurance Company | Plan Name | Premium Cost |

|---|---|---|

| Company A | Plan 1 | $300/month |

| Company B | Plan 2 | $400/month |

| Company C | Plan 3 | $500/month |

📝 Note: The table above is a sample and not reflective of actual insurance plans or prices in Maine.

In conclusion, navigating the world of Maine health insurance can be complex, but understanding the different options available and what to consider when choosing a plan can make the process less overwhelming. By taking the time to research and compare plans, individuals and families can find the right coverage to meet their unique needs and budget.

What is the difference between a deductible and a copay?

+

A deductible is the amount you must pay out-of-pocket before your insurance plan kicks in, while a copay is a fixed amount you pay for doctor visits or prescriptions.

Can I purchase health insurance outside of the marketplace?

+

Yes, you can purchase health insurance directly from an insurance company or through a broker.

What is the open enrollment period for health insurance in Maine?

+

The open enrollment period for health insurance in Maine typically runs from November to December, but may vary depending on the year and any special enrollment periods.

Related Terms:

- Maine health insurance Marketplace

- Maine health insurance providers

- maine health insurance pre approval

- health insurance maine self employed

- maine health insurance providers

- health insurance for maine residents