Michigan Health Insurance Exchange Options

Introduction to Michigan Health Insurance Exchange

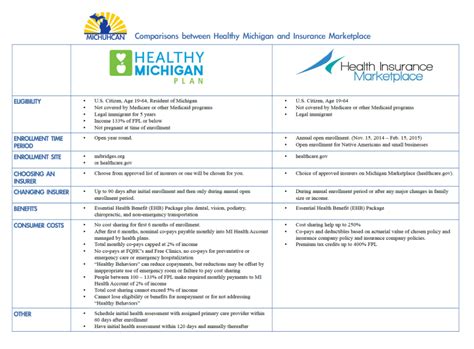

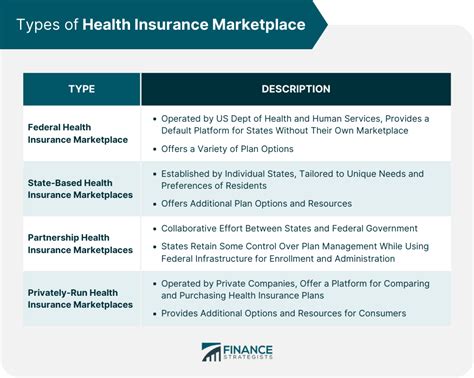

The Michigan Health Insurance Exchange, also known as the Michigan Health Insurance Marketplace, is a platform where individuals, families, and small businesses can purchase health insurance plans. The exchange is operated by the federal government, and it offers a variety of plans from different insurance companies. In this article, we will discuss the options available on the Michigan Health Insurance Exchange, as well as the benefits and drawbacks of using the exchange to purchase health insurance.

Types of Plans Available on the Michigan Health Insurance Exchange

The Michigan Health Insurance Exchange offers a range of plans from different insurance companies, including Blue Cross Blue Shield of Michigan, Aetna, UnitedHealthcare, and Humana. The plans are categorized into four metal tiers: Bronze, Silver, Gold, and Platinum. Each tier offers a different level of coverage, with Bronze plans having the lowest premiums and highest out-of-pocket costs, and Platinum plans having the highest premiums and lowest out-of-pocket costs.

Benefits of Using the Michigan Health Insurance Exchange

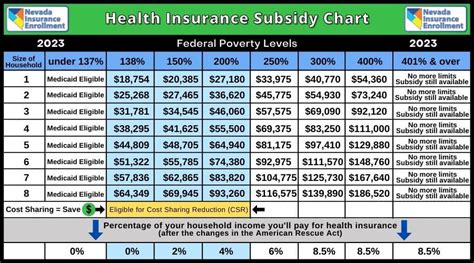

Using the Michigan Health Insurance Exchange to purchase health insurance has several benefits, including: * Subsidies: Individuals and families with incomes between 100% and 400% of the federal poverty level may be eligible for subsidies to help lower their premiums. * Choice: The exchange offers a range of plans from different insurance companies, allowing individuals and families to choose the plan that best meets their needs and budget. * Standardized plans: All plans on the exchange must meet certain standards, ensuring that individuals and families have access to comprehensive coverage. * Easy comparison: The exchange allows individuals and families to easily compare plans and prices, making it easier to make an informed decision.

Drawbacks of Using the Michigan Health Insurance Exchange

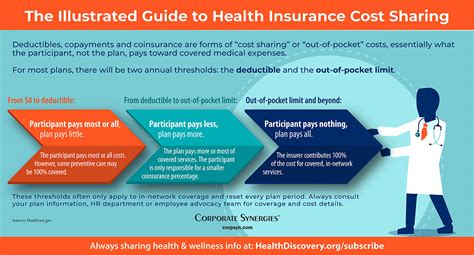

While the Michigan Health Insurance Exchange offers many benefits, there are also some drawbacks to consider, including: * Limited provider networks: Some plans on the exchange may have limited provider networks, which can make it difficult to find a doctor or hospital that is in-network. * High deductibles: Some plans on the exchange may have high deductibles, which can make it difficult for individuals and families to afford out-of-pocket costs. * Complexity: The exchange can be complex and difficult to navigate, especially for individuals and families who are not familiar with health insurance.

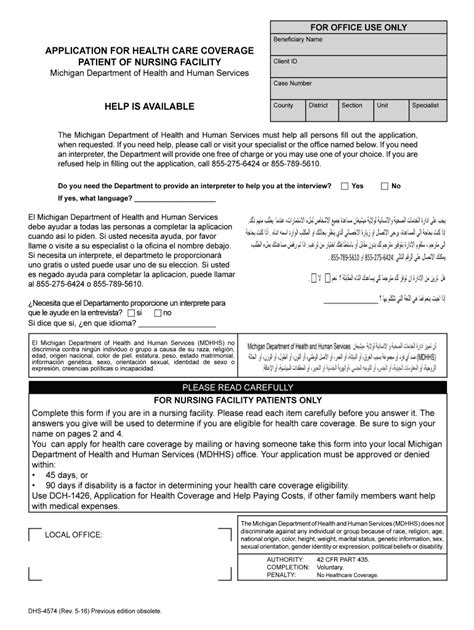

How to Apply for Health Insurance on the Michigan Health Insurance Exchange

To apply for health insurance on the Michigan Health Insurance Exchange, individuals and families can follow these steps: * Visit the exchange website: The first step is to visit the exchange website, which can be found at healthcare.gov. * Create an account: Individuals and families will need to create an account on the exchange website, which will require providing some basic information, such as name, address, and date of birth. * Apply for coverage: Once an account has been created, individuals and families can apply for coverage by providing more detailed information, such as income and family size. * Choose a plan: After applying for coverage, individuals and families can choose a plan from the available options.

📝 Note: Individuals and families can also apply for coverage over the phone or in-person with the help of a licensed insurance agent or broker.

Special Enrollment Periods on the Michigan Health Insurance Exchange

In addition to the annual open enrollment period, the Michigan Health Insurance Exchange also offers special enrollment periods for individuals and families who experience certain life events, such as: * Loss of job-based coverage * Divorce or separation * Death of a spouse or dependent * Having a baby or adopting a child * Moving to a new area

Individuals and families who experience one of these life events may be eligible for a special enrollment period, which will allow them to enroll in a plan outside of the annual open enrollment period.

Michigan Health Insurance Exchange Plan Options

The Michigan Health Insurance Exchange offers a range of plan options from different insurance companies. The following table provides a summary of the plan options available on the exchange:

| Insurance Company | Plan Name | Premium | Deductible | Out-of-Pocket Maximum |

|---|---|---|---|---|

| Blue Cross Blue Shield of Michigan | Bronze Plan | $300 | $6,000 | $8,000 |

| Aetna | Silver Plan | $400 | $4,000 | $7,000 |

| UnitedHealthcare | Gold Plan | $500 | $2,000 | $6,000 |

| Humana | Platinum Plan | $600 | $1,000 | $5,000 |

As the health insurance landscape continues to evolve, it’s essential for individuals and families to stay informed about their options and make informed decisions about their health insurance coverage. By understanding the options available on the Michigan Health Insurance Exchange and taking advantage of the benefits and resources available, individuals and families can find the coverage that best meets their needs and budget.

In the end, navigating the complex world of health insurance requires patience, research, and a clear understanding of the options available. By taking the time to explore the Michigan Health Insurance Exchange and its many plan options, individuals and families can make informed decisions about their health insurance coverage and find the peace of mind that comes with knowing they are protected in case of unexpected medical expenses.

What is the Michigan Health Insurance Exchange?

+

The Michigan Health Insurance Exchange is a platform where individuals, families, and small businesses can purchase health insurance plans.

How do I apply for health insurance on the Michigan Health Insurance Exchange?

+

To apply for health insurance on the Michigan Health Insurance Exchange, individuals and families can visit the exchange website, create an account, apply for coverage, and choose a plan.

What are the different metal tiers available on the Michigan Health Insurance Exchange?

+

The Michigan Health Insurance Exchange offers four metal tiers: Bronze, Silver, Gold, and Platinum. Each tier offers a different level of coverage, with Bronze plans having the lowest premiums and highest out-of-pocket costs, and Platinum plans having the highest premiums and lowest out-of-pocket costs.

Can I apply for health insurance on the Michigan Health Insurance Exchange outside of the annual open enrollment period?

+

Yes, individuals and families who experience certain life events, such as loss of job-based coverage or having a baby, may be eligible for a special enrollment period, which will allow them to enroll in a plan outside of the annual open enrollment period.

How do I choose the right health insurance plan on the Michigan Health Insurance Exchange?

+

To choose the right health insurance plan on the Michigan Health Insurance Exchange, individuals and families should consider their income, family size, and health needs, as well as the premiums, deductibles, and out-of-pocket costs associated with each plan.

Related Terms:

- Health insurance Marketplace Michigan

- Healthcare Marketplace michigan login

- Free Michigan health insurance

- Cheapest health insurance in Michigan

- Marketplace health insurance

- Obamacare Michigan