Military

5 Tips Military Life Insurance

Introduction to Military Life Insurance

Military life insurance is a vital aspect of financial planning for military personnel and their families. It provides a safety net in the event of unexpected death or injury, ensuring that loved ones are protected and can maintain their standard of living. With numerous options available, navigating the world of military life insurance can be overwhelming. In this article, we will delve into the key aspects of military life insurance, exploring the benefits, types, and tips for making informed decisions.

Understanding Military Life Insurance Benefits

Military life insurance offers a range of benefits, including: * Financial Protection: A lump-sum payment to beneficiaries in the event of the insured’s death. * Injury Coverage: Compensation for service-related injuries or disabilities. * Supplemental Income: Additional income to support families in the event of the insured’s death or injury. * Tax-Free Benefits: Benefits are generally tax-free, providing more financial support to beneficiaries. * Portability: The ability to maintain coverage even after leaving the military.

Types of Military Life Insurance

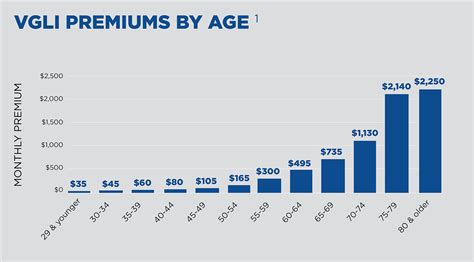

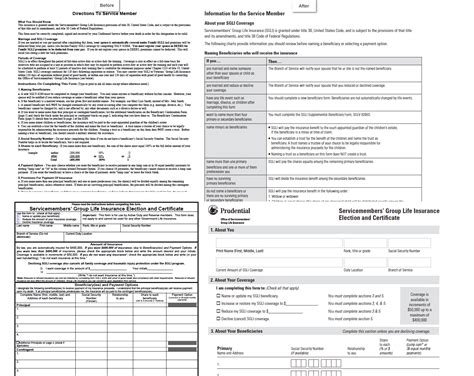

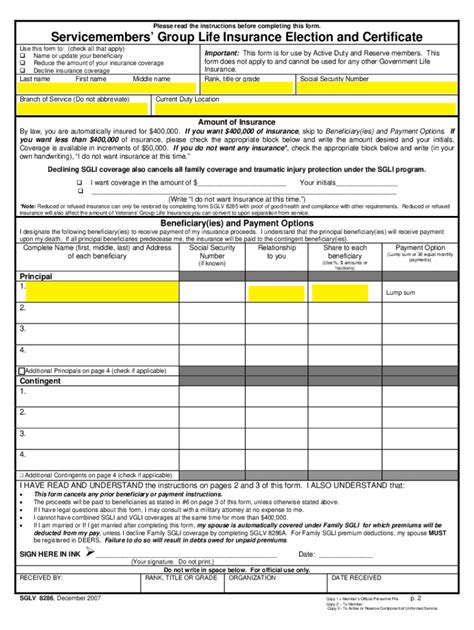

There are several types of military life insurance, each with its unique features and benefits: * Servicemembers’ Group Life Insurance (SGLI): A low-cost, automatic life insurance coverage for eligible service members. * Veterans’ Group Life Insurance (VGLI): A program allowing service members to convert their SGLI coverage to a civilian life insurance policy. * Family Servicemembers’ Group Life Insurance (FSGLI): Spousal and dependent coverage for service members with SGLI. * Traumatic Injury Protection (TSGLI): Additional coverage for service members who suffer traumatic injuries.

5 Tips for Military Life Insurance

When it comes to military life insurance, making informed decisions is crucial. Here are five tips to consider: * Assess Your Needs: Evaluate your financial situation, including income, debts, and dependents, to determine the right level of coverage. * Understand Policy Terms: Familiarize yourself with policy terms, including coverage amounts, premiums, and exclusions. * Compare Options: Research and compare different types of military life insurance to find the best fit for your needs. * Consider Supplemental Coverage: Look into supplemental coverage options, such as private life insurance policies, to ensure adequate protection. * Review and Update: Regularly review and update your life insurance coverage to reflect changes in your financial situation or dependents.

Additional Considerations

When navigating military life insurance, it’s essential to consider the following: * Cost: Weigh the costs of different policies, including premiums and fees. * Coverage Limits: Understand the maximum coverage amounts available and whether they meet your needs. * Exclusions: Review policy exclusions, such as pre-existing conditions or hazardous activities. * Beneficiary Designations: Ensure beneficiary designations are up-to-date and reflect your wishes.

💡 Note: It's crucial to carefully review and understand policy terms and conditions before making a decision.

Conclusion and Next Steps

In conclusion, military life insurance is a vital aspect of financial planning for military personnel and their families. By understanding the benefits, types, and tips outlined in this article, you can make informed decisions about your life insurance coverage. Remember to regularly review and update your coverage to ensure it remains aligned with your changing needs. With the right coverage in place, you can have peace of mind knowing that your loved ones are protected.

What is the purpose of military life insurance?

+

Military life insurance provides financial protection for military personnel and their families in the event of unexpected death or injury.

What types of military life insurance are available?

+

There are several types of military life insurance, including SGLI, VGLI, FSGLI, and TSGLI, each with its unique features and benefits.

How do I choose the right military life insurance policy?

+

To choose the right policy, assess your needs, understand policy terms, compare options, consider supplemental coverage, and review and update your coverage regularly.

Related Terms:

- Military Life insurance payout

- Military retirement insurance

- VGLI

- VGLI retired military

- SGLI

- Best life insurance for Veterans