5 Ways Calculate Pay

Introduction to Calculating Pay

Calculating pay is a crucial aspect of employment, as it directly affects the financial well-being of employees. There are various methods to calculate pay, and understanding these methods is essential for both employees and employers. In this article, we will explore five ways to calculate pay, including hourly wage, salary, commission, piece rate, and bonus. We will also discuss the advantages and disadvantages of each method and provide examples to illustrate how they work.

1. Hourly Wage

The hourly wage method involves paying employees a fixed rate for each hour worked. This method is commonly used in industries where employees work variable hours, such as retail or hospitality. To calculate pay using the hourly wage method, employers multiply the number of hours worked by the hourly rate. For example, if an employee works 40 hours per week at 15 per hour, their weekly pay would be 600.

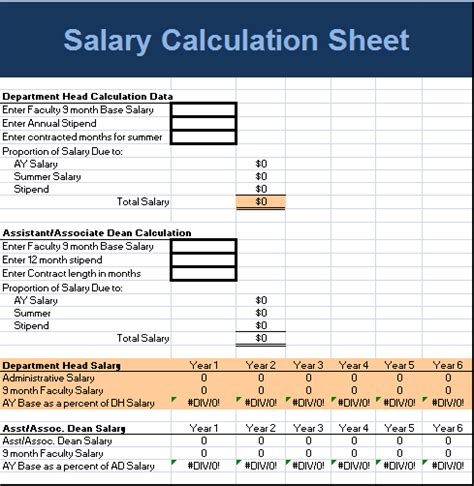

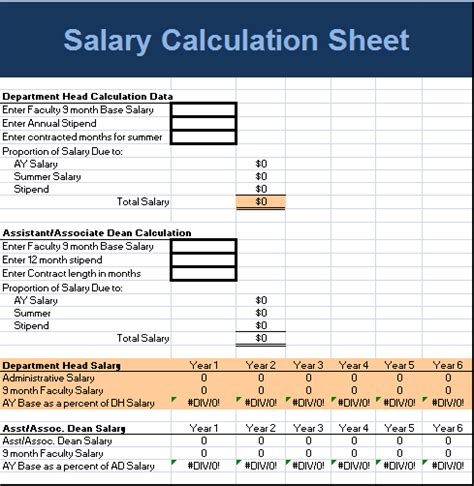

2. Salary

The salary method involves paying employees a fixed amount of money per year, usually paid biweekly or monthly. This method is commonly used in industries where employees work a standard 40-hour week, such as office jobs. To calculate pay using the salary method, employers divide the annual salary by the number of pay periods per year. For example, if an employee has an annual salary of 60,000 and is paid biweekly, their biweekly pay would be 2,308.

3. Commission

The commission method involves paying employees a percentage of their sales or revenue generated. This method is commonly used in industries where employees are responsible for generating sales, such as real estate or car sales. To calculate pay using the commission method, employers multiply the sales amount by the commission rate. For example, if an employee sells 10,000 worth of products and has a 10% commission rate, their pay would be 1,000.

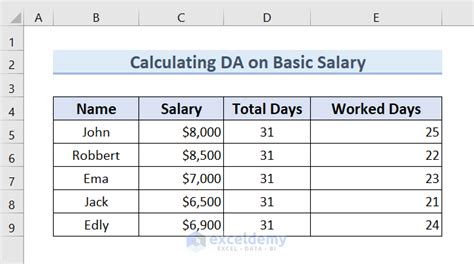

4. Piece Rate

The piece rate method involves paying employees a fixed rate for each unit of work completed. This method is commonly used in industries where employees work on a production line, such as manufacturing. To calculate pay using the piece rate method, employers multiply the number of units completed by the piece rate. For example, if an employee completes 100 units of work at 5 per unit, their pay would be 500.

5. Bonus

The bonus method involves paying employees a one-time payment for achieving specific goals or targets. This method is commonly used in industries where employees are responsible for meeting sales targets or achieving specific performance metrics. To calculate pay using the bonus method, employers multiply the bonus amount by the achievement rate. For example, if an employee achieves 100% of their sales target and has a 1,000 bonus, their pay would be 1,000.

📝 Note: Employers should ensure that they are complying with all relevant labor laws and regulations when calculating pay, including minimum wage and overtime requirements.

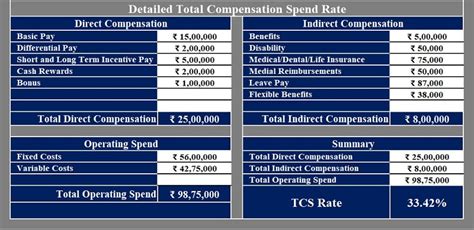

Here is a table summarizing the five ways to calculate pay:

| Method | Description | Example |

|---|---|---|

| Hourly Wage | Paying employees a fixed rate for each hour worked | 15 per hour x 40 hours = 600 |

| Salary | Paying employees a fixed amount of money per year | 60,000 per year / 26 pay periods = 2,308 per pay period |

| Commission | Paying employees a percentage of their sales or revenue generated | 10% of 10,000 = 1,000 |

| Piece Rate | Paying employees a fixed rate for each unit of work completed | 5 per unit x 100 units = 500 |

| Bonus | Paying employees a one-time payment for achieving specific goals or targets | $1,000 bonus for achieving 100% of sales target |

To summarize, calculating pay is a critical aspect of employment, and there are various methods to do so. Employers should choose the method that best suits their business needs and ensures compliance with labor laws and regulations. By understanding the different methods of calculating pay, employees can better navigate their compensation and benefits, and employers can ensure that they are providing fair and competitive compensation to their employees. The key takeaways from this article include the importance of understanding the different methods of calculating pay, the need to comply with labor laws and regulations, and the benefits of choosing the right method for your business. Ultimately, calculating pay is a complex process that requires careful consideration of various factors, including business needs, employee benefits, and labor laws.

What is the difference between hourly wage and salary?

+

The main difference between hourly wage and salary is that hourly wage is paid for each hour worked, while salary is paid a fixed amount per year. Hourly wage is often used for part-time or variable-hour jobs, while salary is used for full-time jobs with a standard 40-hour workweek.

How is commission calculated?

+

Commission is calculated by multiplying the sales amount by the commission rate. For example, if an employee sells 10,000 worth of products and has a 10% commission rate, their pay would be 1,000.

What is the purpose of a bonus?

+

The purpose of a bonus is to reward employees for achieving specific goals or targets. Bonuses can be used to motivate employees to work harder and achieve better results, and can also be used to recognize and reward employees for their contributions to the company.

How do labor laws affect pay calculation?

+

Labor laws, such as minimum wage and overtime requirements, can affect pay calculation by requiring employers to pay employees a certain minimum amount per hour or for overtime work. Employers must ensure that they are complying with all relevant labor laws and regulations when calculating pay.

What are the benefits of choosing the right pay calculation method?

+

The benefits of choosing the right pay calculation method include ensuring compliance with labor laws and regulations, motivating employees to work harder and achieve better results, and providing fair and competitive compensation to employees. By choosing the right method, employers can also reduce the risk of errors and disputes over pay.

Related Terms:

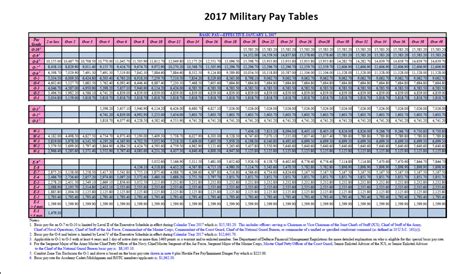

- militarypay defense gov calculator

- air force pay calculator 2024

- 2025 air force pay calculator

- army pay calculator 2025

- usmc pay calculator 2024

- military paycheck calculator with taxes