5 Missouri CE Requirements

Missouri CE Requirements for Insurance Professionals

In Missouri, insurance professionals are required to complete continuing education (CE) courses to maintain their licenses and stay up-to-date with industry developments. The Missouri Department of Insurance oversees the CE requirements, which vary depending on the type of license held. Understanding these requirements is crucial for insurance professionals to avoid penalties and ensure compliance with state regulations.

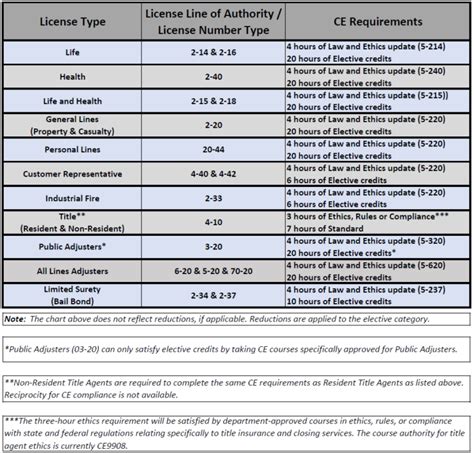

Types of Licenses and CE Requirements

There are several types of licenses issued by the Missouri Department of Insurance, each with its own set of CE requirements. These include: * Life Insurance License: 16 hours of CE, including 6 hours of ethics and law, every 2 years * Health Insurance License: 16 hours of CE, including 6 hours of ethics and law, every 2 years * Property and Casualty Insurance License: 16 hours of CE, including 6 hours of ethics and law, every 2 years * Adjuster License: 24 hours of CE, including 6 hours of ethics and law, every 2 years

CE Course Requirements

To meet the CE requirements, insurance professionals in Missouri must complete courses approved by the state. These courses cover various topics, including: * Ethics and law * Insurance principles * Risk management * Industry-specific topics, such as long-term care or flood insurance * Technical courses, such as underwriting or claims adjusting

Course Delivery Methods

CE courses in Missouri can be completed through various delivery methods, including: * Classroom instruction * Online courses * Self-study courses * Webinars * Correspondence courses, which allow students to complete coursework at their own pace

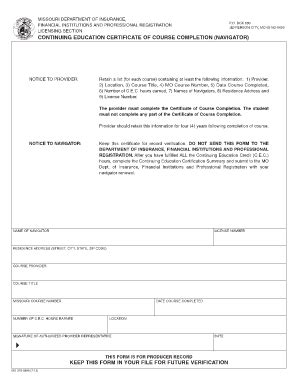

Tracking CE Credits

Insurance professionals in Missouri are responsible for tracking their CE credits and ensuring they meet the state’s requirements. The Missouri Department of Insurance uses a tracking system to monitor CE credits, and licensees can access their accounts online to view their credit history. It is essential to maintain accurate records, as failure to comply with CE requirements can result in penalties and license suspension.

Exemptions and Waivers

Certain individuals may be exempt from CE requirements or eligible for waivers, including: * Newly licensed professionals, who are exempt from CE requirements for the first 2 years * Licensees who are 65 or older and have been licensed for at least 20 years * Licensees who are unable to complete CE requirements due to illness or disability * Out-of-state licensees, who may be exempt from CE requirements if they meet specific criteria

📝 Note: Insurance professionals should verify their exemption or waiver status with the Missouri Department of Insurance to ensure compliance with state regulations.

Important Dates and Deadlines

Insurance professionals in Missouri must be aware of important dates and deadlines related to CE requirements, including: * License renewal dates: Typically every 2 years * CE course completion deadlines: Vary depending on the course provider and type of license * Reporting deadlines for CE credits: Typically within 30 days of course completion

| License Type | CE Requirement | Renewal Cycle |

|---|---|---|

| Life Insurance | 16 hours | Every 2 years |

| Health Insurance | 16 hours | Every 2 years |

| Property and Casualty Insurance | 16 hours | Every 2 years |

| Adjuster License | 24 hours | Every 2 years |

In summary, insurance professionals in Missouri must complete CE courses to maintain their licenses and stay compliant with state regulations. By understanding the CE requirements, course delivery methods, and tracking systems, licensees can ensure they meet the necessary standards and avoid penalties. It is essential to stay informed about important dates and deadlines, as well as any exemptions or waivers that may apply. By doing so, insurance professionals in Missouri can provide the best possible service to their clients while maintaining the integrity of the insurance industry.

What are the CE requirements for life insurance professionals in Missouri?

+

Life insurance professionals in Missouri must complete 16 hours of CE, including 6 hours of ethics and law, every 2 years.

Can I complete CE courses online?

+

How do I track my CE credits in Missouri?

+

The Missouri Department of Insurance uses a tracking system to monitor CE credits, and licensees can access their accounts online to view their credit history.

Related Terms:

- Missouri Insurance continuing education requirements

- Missouri Insurance Continuing Education lookup

- Missouri Department of insurance

- Missouri Insurance license Lookup

- Missouri insurance license Renewal

- How to get CE credits