Health

Molina Healthcare WA Plans

Molina Healthcare WA Plans: An Overview

Molina Healthcare is a well-established health insurance provider that offers a range of plans to individuals and families in Washington state. With a focus on providing high-quality, affordable healthcare, Molina Healthcare has become a trusted name in the industry. In this post, we will delve into the details of Molina Healthcare WA plans, exploring their features, benefits, and what sets them apart from other health insurance providers.

Types of Plans Offered

Molina Healthcare offers a variety of plans to cater to different needs and budgets. Some of the most popular plans include: * Individual and Family Plans: These plans are designed for individuals and families who are not eligible for employer-sponsored coverage or are seeking alternative options. * Medicaid Plans: Molina Healthcare offers Medicaid plans to low-income individuals and families who qualify for the program. * Medicare Plans: For seniors and individuals with disabilities, Molina Healthcare provides Medicare plans that offer comprehensive coverage and benefits. * Group Plans: Employers can offer Molina Healthcare group plans to their employees, providing access to quality healthcare at an affordable cost.

Key Features and Benefits

Molina Healthcare WA plans come with a range of features and benefits, including: * Comprehensive Coverage: Molina Healthcare plans cover essential health benefits, such as doctor visits, hospital stays, prescriptions, and more. * Affordable Premiums: Molina Healthcare offers competitive pricing, making it easier for individuals and families to access quality healthcare. * Extensive Network: With a large network of providers, Molina Healthcare ensures that members have access to quality care when they need it. * Preventive Care: Molina Healthcare plans cover preventive care services, such as routine check-ups, screenings, and vaccinations. * Telehealth Services: Members can access telehealth services, allowing them to receive medical care from the comfort of their own homes.

Plan Options and Pricing

Molina Healthcare WA plans are available in various metal tiers, including: * Bronze Plans: These plans have lower premiums but higher out-of-pocket costs. * Silver Plans: Silver plans offer a balance between premiums and out-of-pocket costs. * Gold Plans: Gold plans have higher premiums but lower out-of-pocket costs. * Platinum Plans: These plans have the highest premiums but the lowest out-of-pocket costs.

| Plan Type | Premium | Out-of-Pocket Costs |

|---|---|---|

| Bronze | $300-$500 | $6,000-$8,000 |

| Silver | $400-$700 | $4,000-$6,000 |

| Gold | $600-$1,000 | $2,000-$4,000 |

| Platinum | $1,000-$1,500 | $1,000-$2,000 |

📝 Note: Premiums and out-of-pocket costs may vary depending on age, location, and other factors.

Enrollment and Eligibility

To enroll in a Molina Healthcare WA plan, individuals and families can: * Visit the Molina Healthcare website to explore plan options and pricing. * Contact a licensed insurance agent or broker for guidance. * Call the Molina Healthcare customer service number to speak with a representative. Eligibility for Molina Healthcare plans varies depending on the type of plan. For example, Medicaid plans require individuals to meet specific income and eligibility requirements.

Conclusion and Final Thoughts

In conclusion, Molina Healthcare WA plans offer a range of benefits and features that make them an attractive option for individuals and families in Washington state. With comprehensive coverage, affordable premiums, and an extensive network of providers, Molina Healthcare is a trusted name in the health insurance industry. When selecting a health insurance plan, it is essential to consider factors such as premium costs, out-of-pocket expenses, and network coverage to ensure that you find the best plan for your needs and budget.

What is the difference between a Bronze and Silver plan?

+

Bronze plans have lower premiums but higher out-of-pocket costs, while Silver plans offer a balance between premiums and out-of-pocket costs.

Can I enroll in a Molina Healthcare plan at any time?

+

No, enrollment in Molina Healthcare plans is typically limited to specific times of the year, such as during the annual open enrollment period or during a special enrollment period due to a qualifying life event.

How do I know which plan is right for me?

+

To determine which plan is right for you, consider factors such as your budget, health needs, and preferred providers. You can also contact a licensed insurance agent or broker for guidance or visit the Molina Healthcare website to explore plan options and pricing.

Related Terms:

- Molina Healthcare Washington phone number

- Molina Healthcare phone number

- Molina Healthcare Customer Service

- Molina Healthcare providers List

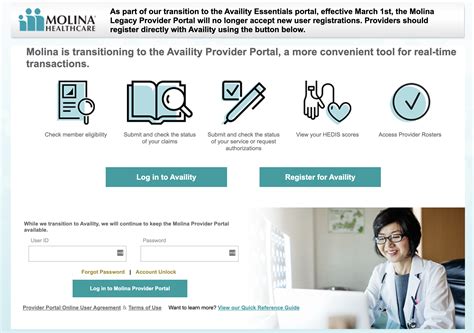

- Molina Healthcare login

- Molina Healthcare find a provider