Montana Health Insurance Options

Introduction to Montana Health Insurance Options

Montana, known for its vast open spaces and picturesque landscapes, is home to a diverse population with varying health insurance needs. The state offers a range of health insurance options to its residents, including individual and family plans, group plans, and government-sponsored programs. In this article, we will delve into the different health insurance options available in Montana, highlighting their features, benefits, and eligibility criteria.

Individual and Family Health Insurance Plans

Individual and family health insurance plans in Montana are designed for those who are not covered by their employer or a government-sponsored program. These plans can be purchased through the health insurance marketplace or directly from insurance providers. Key features of individual and family plans include: * Comprehensive coverage: Including doctor visits, hospital stays, prescription medications, and more * Network providers: Access to a network of healthcare providers, including primary care physicians and specialists * Cost-sharing: Options for cost-sharing, such as copayments, coinsurance, and deductibles Some popular insurance providers in Montana offering individual and family plans include Blue Cross and Blue Shield of Montana, Montana Health CO-OP, and PacificSource Health Plans.

Group Health Insurance Plans

Group health insurance plans in Montana are designed for employers who want to provide health insurance coverage to their employees. These plans can be more affordable than individual plans and often offer more comprehensive coverage. Benefits of group plans include: * Lower premiums: Employers can negotiate lower premiums with insurance providers * Guaranteed issue: Employees are guaranteed coverage, regardless of their health status * Tax benefits: Employers can deduct premiums as a business expense, reducing their tax liability

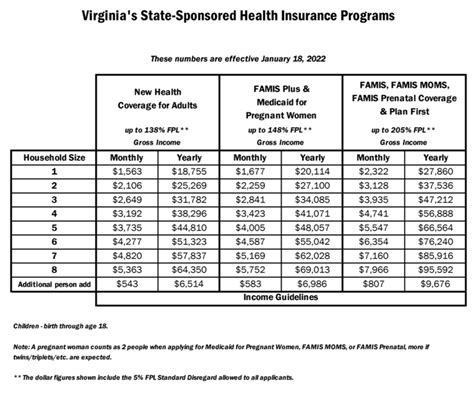

Government-Sponsored Health Insurance Programs

Montana offers several government-sponsored health insurance programs, including Medicaid and the Children’s Health Insurance Program (CHIP). These programs provide affordable health insurance coverage to low-income individuals and families. Eligibility criteria for these programs include: * Income level: Household income must be below a certain threshold * Family size: Family size is taken into account when determining eligibility * Residency: Applicants must be residents of Montana

Short-Term Health Insurance Plans

Short-term health insurance plans in Montana are designed for individuals who need temporary health insurance coverage. These plans can be purchased for a limited period, usually up to 12 months, and can provide basic coverage for doctor visits, hospital stays, and prescription medications. Key features of short-term plans include: * Affordability: Lower premiums compared to individual and family plans * Flexibility: Plans can be purchased for a limited period * Limited coverage: May not provide comprehensive coverage, including pre-existing conditions

💡 Note: Short-term health insurance plans are not considered minimum essential coverage under the Affordable Care Act and may not provide the same level of coverage as individual and family plans.

Comparing Health Insurance Options in Montana

When comparing health insurance options in Montana, it’s essential to consider several factors, including: * Premiums: The cost of the plan * Network providers: The network of healthcare providers included in the plan * Cost-sharing: The out-of-pocket costs associated with the plan * Coverage: The level of coverage provided by the plan

| Plan Type | Premiums | Network Providers | Cost-Sharing | Coverage |

|---|---|---|---|---|

| Individual and Family Plans | Varying premiums | Comprehensive network | Cost-sharing options | Comprehensive coverage |

| Group Health Insurance Plans | Lower premiums | Comprehensive network | Cost-sharing options | Comprehensive coverage |

| Government-Sponsored Programs | No premiums or low premiums | Limited network | Limited cost-sharing | Basic coverage |

| Short-Term Health Insurance Plans | Lower premiums | Limited network | Limited cost-sharing | Basic coverage |

In conclusion, Montana residents have a range of health insurance options to choose from, including individual and family plans, group plans, government-sponsored programs, and short-term plans. When selecting a plan, it’s essential to consider factors such as premiums, network providers, cost-sharing, and coverage to ensure you find the best plan for your needs.

What is the difference between individual and family health insurance plans in Montana?

+

Individual health insurance plans in Montana are designed for one person, while family plans are designed for two or more people. Family plans can be more affordable than individual plans and often offer more comprehensive coverage.

Am I eligible for Medicaid in Montana?

+

To be eligible for Medicaid in Montana, you must meet certain income and family size requirements. You can apply for Medicaid through the Montana Department of Public Health and Human Services or through the health insurance marketplace.

Can I purchase short-term health insurance plans in Montana?

+

Yes, you can purchase short-term health insurance plans in Montana. These plans are designed for individuals who need temporary health insurance coverage and can provide basic coverage for doctor visits, hospital stays, and prescription medications.

Related Terms:

- montana health care gov state

- health insurance providers in montana

- cheapest health insurance in montana

- affordable health insurance in montana

- health insurance companies in montana

- montana self employed health insurance