New Hampshire Health Insurance Options

New Hampshire Health Insurance Options

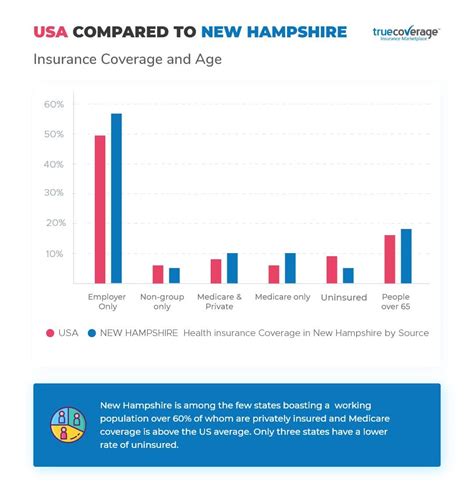

New Hampshire offers a variety of health insurance options for its residents, including individual and family plans, group plans, and public programs like Medicaid and the Children’s Health Insurance Program (CHIP). The state’s health insurance marketplace, also known as the exchange, allows individuals and families to compare and purchase health plans from various insurance providers. In this article, we will explore the different health insurance options available in New Hampshire and provide guidance on how to choose the best plan for your needs.

Individual and Family Plans

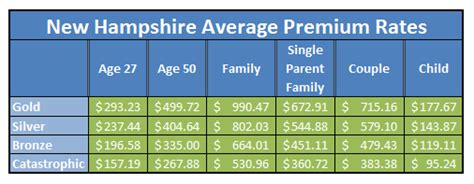

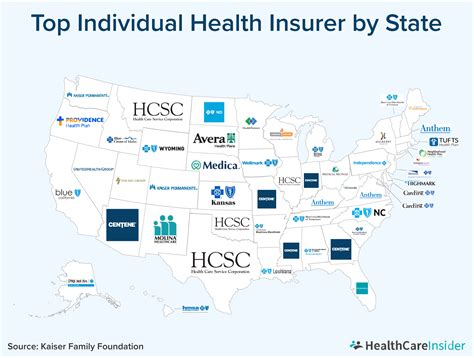

Individual and family plans are available through the health insurance marketplace or directly from insurance providers. These plans are designed for people who do not have access to employer-sponsored coverage or who are not eligible for public programs. In New Hampshire, individual and family plans are offered by several insurance companies, including Ambetter, Anthem, and Harvard Pilgrim. These plans vary in terms of their premium costs, deductibles, copays, and coverage levels.

Group Plans

Group plans are available to businesses and organizations with two or more employees. These plans are often more affordable than individual plans and offer a range of benefits, including preventive care, prescription drug coverage, and mental health services. In New Hampshire, group plans are offered by several insurance companies, including Anthem and Harvard Pilgrim. Small businesses and self-employed individuals may also be eligible for group plans through the Small Business Health Options Program (SHOP).

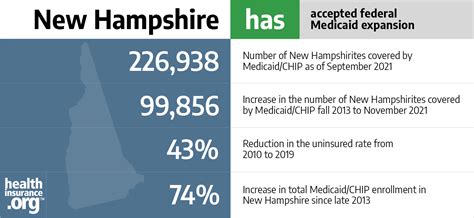

Medicaid and CHIP

Medicaid and CHIP are public programs that provide health coverage to low-income individuals and families. In New Hampshire, Medicaid is available to adults with incomes up to 138% of the federal poverty level, as well as to children and pregnant women with incomes up to 200% of the federal poverty level. CHIP is available to children with incomes up to 200% of the federal poverty level. These programs offer a range of benefits, including doctor visits, hospital stays, and prescription medications.

Short-Term Limited-Duration Insurance

Short-term limited-duration insurance (STLDI) plans are temporary plans that provide coverage for a limited period, typically up to 12 months. These plans are designed for people who are between jobs, waiting for other coverage to start, or need temporary coverage. In New Hampshire, STLDI plans are available from several insurance companies, including UnitedHealthcare and Allstate. However, these plans are not required to provide the same level of coverage as major medical plans and may not cover pre-existing conditions.

Catastrophic Plans

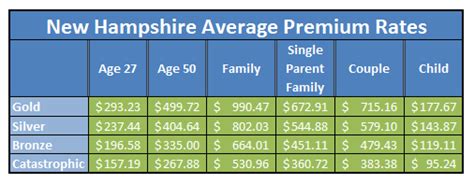

Catastrophic plans are a type of health insurance plan that provides limited coverage at a lower cost. These plans are designed for young adults under the age of 30 or for people who are exempt from the individual mandate. In New Hampshire, catastrophic plans are available from several insurance companies, including Ambetter and Anthem. These plans typically have high deductibles and limited coverage, but may be more affordable than other types of plans.

👍 Note: It's essential to carefully review the coverage and costs of any health insurance plan before purchasing to ensure it meets your needs and budget.

How to Choose the Best Plan

Choosing the best health insurance plan in New Hampshire can be overwhelming, but there are several factors to consider. Here are some tips to help you get started: * Determine your budget: Calculate how much you can afford to pay each month for premiums, deductibles, copays, and coinsurance. * Assess your health needs: Consider your health status, medical conditions, and anticipated healthcare expenses. * Compare plans: Research and compare different plans from various insurance providers, including their coverage, costs, and provider networks. * Check the provider network: Ensure that your preferred healthcare providers are part of the plan’s network. * Review the plan’s benefits: Check the plan’s coverage for essential health benefits, such as preventive care, prescription medications, and mental health services.

| Plan Type | Premium Cost | Deductible | Copay |

|---|---|---|---|

| Individual Plan | $300-$500 per month | $1,000-$3,000 per year | $20-$50 per visit |

| Family Plan | $600-$1,200 per month | $2,000-$6,000 per year | $20-$50 per visit |

| Group Plan | $200-$500 per month | $500-$2,000 per year | $10-$30 per visit |

As you consider your health insurance options in New Hampshire, it’s essential to weigh the pros and cons of each plan, including the costs, coverage, and provider network. By taking the time to research and compare plans, you can find the best coverage for your needs and budget.

In final thoughts, selecting the right health insurance plan is a critical decision that can have a significant impact on your health and financial well-being. By understanding the different types of plans available, assessing your health needs, and carefully reviewing the coverage and costs of each plan, you can make an informed decision and find the best coverage for your needs.

What is the deadline to enroll in a health insurance plan in New Hampshire?

+

The deadline to enroll in a health insurance plan in New Hampshire varies depending on the type of plan and the individual’s circumstances. For example, the open enrollment period for individual and family plans typically runs from November to December, while special enrollment periods may be available for people who experience qualifying life events, such as losing job-based coverage or getting married.

Can I purchase a health insurance plan outside of the open enrollment period?

+

Yes, you may be able to purchase a health insurance plan outside of the open enrollment period if you experience a qualifying life event, such as losing job-based coverage, getting married, or having a baby. You may also be eligible for a special enrollment period if you are newly eligible for Medicaid or CHIP.

How do I apply for Medicaid or CHIP in New Hampshire?

+

To apply for Medicaid or CHIP in New Hampshire, you can visit the state’s Medicaid website or contact your local Medicaid office. You will need to provide documentation of your income, family size, and citizenship status, as well as other information to determine your eligibility.

Related Terms:

- new hampshire government health insurance

- new hampshire health insurance department

- nh insurance department website

- new hampshire health insurance companies

- affordable health care new hampshire

- new hampshire medicaid website