No Deductible Health Insurance Plans

Introduction to No Deductible Health Insurance Plans

No deductible health insurance plans are a type of health insurance policy where the insured does not have to pay a deductible before the insurance company starts covering the medical expenses. In traditional health insurance plans, the insured has to pay a certain amount, known as the deductible, out of their pocket before the insurance company starts paying for the medical expenses. However, in no deductible health insurance plans, the insurance company starts paying for the medical expenses from the first dollar, without the insured having to pay any deductible.

How No Deductible Health Insurance Plans Work

No deductible health insurance plans work similarly to traditional health insurance plans, except that the insured does not have to pay a deductible. The insured pays a premium to the insurance company, and in return, the insurance company agrees to pay for the medical expenses. The insurance company may have a network of healthcare providers who have agreed to provide medical services to the insured at a discounted rate. The insured can choose to receive medical services from any healthcare provider, but they may have to pay more if they choose a provider outside the network.

Benefits of No Deductible Health Insurance Plans

No deductible health insurance plans have several benefits, including: * No out-of-pocket expenses: The insured does not have to pay any deductible or out-of-pocket expenses, making it easier for them to budget for their medical expenses. * Predictable costs: The insured knows exactly how much they will have to pay for their medical expenses, making it easier for them to plan and budget. * Increased access to healthcare: No deductible health insurance plans can increase access to healthcare, especially for people who may not have been able to afford the deductible in traditional health insurance plans. * Reduced financial burden: No deductible health insurance plans can reduce the financial burden on the insured, especially in cases where they have to pay for expensive medical treatments.

Disadvantages of No Deductible Health Insurance Plans

No deductible health insurance plans also have some disadvantages, including: * Higher premiums: No deductible health insurance plans typically have higher premiums than traditional health insurance plans, since the insurance company has to pay for the medical expenses from the first dollar. * Limited provider network: No deductible health insurance plans may have a limited provider network, which can limit the insured’s choice of healthcare providers. * Higher costs for certain services: No deductible health insurance plans may have higher costs for certain services, such as prescription medications or specialized treatments.

Types of No Deductible Health Insurance Plans

There are several types of no deductible health insurance plans, including: * Health Maintenance Organization (HMO) plans: HMO plans are a type of no deductible health insurance plan where the insured receives medical services from a network of healthcare providers. * Preferred Provider Organization (PPO) plans: PPO plans are a type of no deductible health insurance plan where the insured can choose to receive medical services from any healthcare provider, but may have to pay more if they choose a provider outside the network. * Point of Service (POS) plans: POS plans are a type of no deductible health insurance plan where the insured can choose to receive medical services from any healthcare provider, but may have to pay more if they choose a provider outside the network.

Eligibility for No Deductible Health Insurance Plans

Eligibility for no deductible health insurance plans varies depending on the insurance company and the type of plan. Some common eligibility requirements include: * Age: The insured must be within a certain age range, typically between 18 and 64. * Income: The insured must have a certain income level, typically above a certain threshold. * Health status: The insured must be in good health, without any pre-existing medical conditions. * Employment status: The insured must be employed or have a certain employment status, such as self-employed or retired.

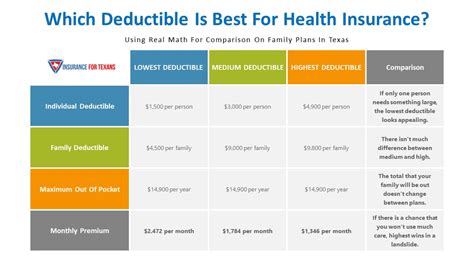

Cost of No Deductible Health Insurance Plans

The cost of no deductible health insurance plans varies depending on several factors, including: * Age: The premium for no deductible health insurance plans typically increases with age. * Income: The premium for no deductible health insurance plans may be higher for people with higher incomes. * Health status: The premium for no deductible health insurance plans may be higher for people with pre-existing medical conditions. * Provider network: The premium for no deductible health insurance plans may be higher for plans with a larger provider network.

| Plan Type | Premium | Deductible | Out-of-pocket expenses |

|---|---|---|---|

| HMO plan | $500/month | $0 | $0 |

| PPO plan | $700/month | $0 | $500/year |

| POS plan | $600/month | $0 | $0 |

📝 Note: The costs and benefits of no deductible health insurance plans may vary depending on the insurance company and the specific plan.

To summarize the key points, no deductible health insurance plans are a type of health insurance policy where the insured does not have to pay a deductible before the insurance company starts covering the medical expenses. These plans have several benefits, including no out-of-pocket expenses, predictable costs, increased access to healthcare, and reduced financial burden. However, they also have some disadvantages, including higher premiums, limited provider network, and higher costs for certain services. The eligibility and cost of no deductible health insurance plans vary depending on several factors, including age, income, health status, and provider network.

What is a no deductible health insurance plan?

+

A no deductible health insurance plan is a type of health insurance policy where the insured does not have to pay a deductible before the insurance company starts covering the medical expenses.

What are the benefits of no deductible health insurance plans?

+

The benefits of no deductible health insurance plans include no out-of-pocket expenses, predictable costs, increased access to healthcare, and reduced financial burden.

What are the disadvantages of no deductible health insurance plans?

+

The disadvantages of no deductible health insurance plans include higher premiums, limited provider network, and higher costs for certain services.

Related Terms:

- No deductible health insurance cost

- No deductible health insurance meaning

- Best no deductible health insurance

- No deductible vs deductible health insurance

- No deductible health insurance reddit

- No deductible car insurance