Optima Health Insurance Plans

Introduction to Optima Health Insurance Plans

Optima Health Insurance Plans are designed to provide comprehensive coverage to individuals, families, and groups. With a focus on delivering high-quality healthcare services, Optima Health aims to make a positive impact on the lives of its policyholders. The company offers a range of plans that cater to diverse needs, ensuring that everyone can access affordable and reliable health insurance. In this article, we will delve into the features, benefits, and types of Optima Health Insurance Plans, as well as provide guidance on how to choose the right plan for your needs.

Types of Optima Health Insurance Plans

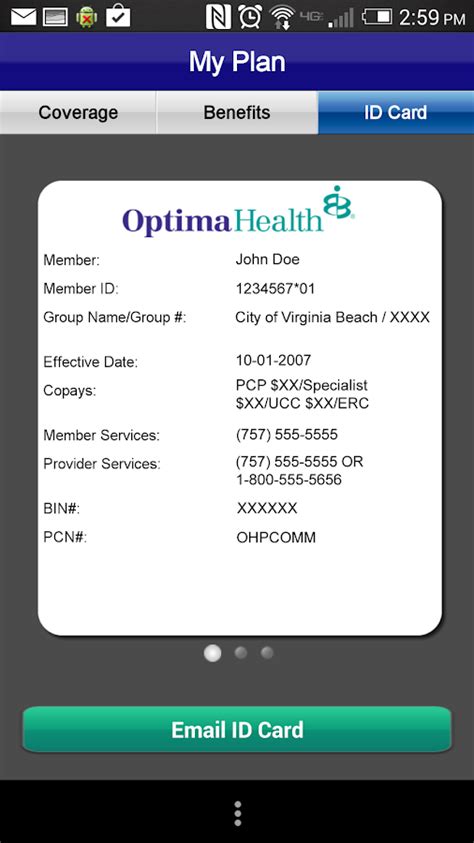

Optima Health offers various types of insurance plans, including: * Individual and Family Plans: These plans are designed for individuals and families who are not covered by their employer. They offer flexible options, including catastrophic plans, bronze plans, silver plans, gold plans, and platinum plans. * Group Plans: These plans are designed for businesses and organizations that want to provide health insurance coverage to their employees. Group plans offer a range of options, including HMOs, PPOs, and POS plans. * Medicare Plans: Optima Health offers Medicare Advantage plans, which provide additional benefits beyond traditional Medicare coverage. These plans include Medicare HMOs, Medicare PPOs, and Medicare POS plans. * Dental and Vision Plans: Optima Health also offers standalone dental and vision plans, which can be purchased separately or in conjunction with medical plans.

Features and Benefits of Optima Health Insurance Plans

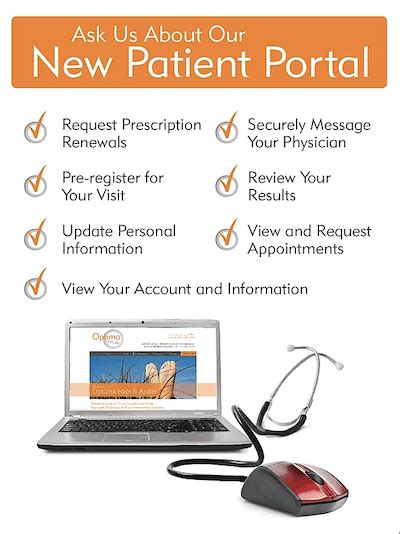

Optima Health Insurance Plans come with a range of features and benefits, including: * Comprehensive coverage: Optima Health plans cover a wide range of medical services, including doctor visits, hospital stays, prescriptions, and more. * Affordable premiums: Optima Health offers competitive pricing, making it easier for individuals and families to access health insurance. * Extensive network: Optima Health has a large network of healthcare providers, including doctors, hospitals, and specialists. * Preventive care: Optima Health plans cover preventive care services, such as routine check-ups, screenings, and vaccinations. * Wellness programs: Optima Health offers wellness programs, which provide incentives and resources to help policyholders maintain a healthy lifestyle.

How to Choose the Right Optima Health Insurance Plan

Choosing the right Optima Health Insurance Plan can be overwhelming, but here are some tips to help you make an informed decision: * Assess your needs: Consider your health status, lifestyle, and budget when selecting a plan. * Compare plans: Research and compare different Optima Health plans to find the one that best meets your needs. * Check the network: Ensure that your healthcare providers are part of the Optima Health network. * Review the benefits: Carefully review the benefits and features of each plan to ensure they align with your needs. * Consider the cost: Calculate the total cost of the plan, including premiums, deductibles, and copays.

👍 Note: It's essential to carefully review the plan's benefits, network, and costs before making a decision.

Optima Health Insurance Plan Enrollment Process

The enrollment process for Optima Health Insurance Plans is straightforward: * Visit the website: Go to the Optima Health website to explore available plans and get a quote. * Contact a broker: Reach out to a licensed insurance broker for guidance and support. * Apply online: Submit an online application, and Optima Health will review your eligibility. * Receive confirmation: Once your application is approved, you will receive confirmation and instructions on how to access your benefits.

Optima Health Insurance Plan Rates and Pricing

Optima Health Insurance Plan rates and pricing vary depending on factors such as age, location, and plan selection. Here is a sample table illustrating the estimated monthly premiums for individual plans:

| Plan | Age 25-34 | Age 35-44 | Age 45-54 |

|---|---|---|---|

| Catastrophic Plan | 250-300 | 300-350 | 350-400 |

| Bronze Plan | 300-350 | 350-400 | 400-450 |

| Silver Plan | 400-450 | 450-500 | 500-550 |

As we near the end of our exploration of Optima Health Insurance Plans, it’s clear that these plans offer a range of benefits and features that can help individuals and families access high-quality healthcare. By considering your needs, comparing plans, and carefully reviewing the benefits and costs, you can make an informed decision and find the right plan for you.

What is the difference between an HMO and a PPO plan?

+

An HMO (Health Maintenance Organization) plan requires you to receive medical care from a specific network of providers, while a PPO (Preferred Provider Organization) plan allows you to see any healthcare provider, both in-network and out-of-network, although out-of-network care typically costs more.

Can I purchase an Optima Health Insurance Plan if I have a pre-existing condition?

+

Yes, Optima Health Insurance Plans are available to individuals with pre-existing conditions. The Affordable Care Act (ACA) prohibits health insurance companies from denying coverage based on pre-existing conditions.

How do I enroll in an Optima Health Insurance Plan?

+

You can enroll in an Optima Health Insurance Plan by visiting the Optima Health website, contacting a licensed insurance broker, or applying online during the open enrollment period or special enrollment period, if eligible.

Related Terms:

- Optima Group Health BNI Life

- Optima Health Provider phone number

- Optima Health Insurance phone number

- Is Optima Health insurance good

- Optima Medical

- Optima Medical AZ