Oregon Health Penalty Explained

Introduction to Oregon Health Penalty

The Oregon health penalty is a fine imposed on individuals and families who do not have minimum essential health coverage. This penalty was put in place to encourage people to enroll in health insurance, thereby reducing the number of uninsured individuals in the state. In this blog post, we will delve into the details of the Oregon health penalty, including who is subject to the penalty, how it is calculated, and what exemptions are available.

Who is Subject to the Oregon Health Penalty?

The Oregon health penalty applies to individuals and families who do not have minimum essential health coverage for themselves and their dependents. Minimum essential health coverage includes employer-sponsored coverage, individual market coverage, Medicare, Medicaid, and certain other types of coverage. Individuals who are not lawfully present in the United States are not subject to the penalty.

How is the Oregon Health Penalty Calculated?

The Oregon health penalty is calculated based on the number of months an individual or family goes without minimum essential health coverage. The penalty is equal to the greater of 2.5% of the individual’s or family’s household income above the filing threshold or 695 per adult and 347.50 per child under the age of 18, up to a maximum of 2,085 per family. For example, if an individual has a household income of 50,000 and does not have minimum essential health coverage for the entire year, their penalty would be 1,250 (2.5% of 50,000).

Exemptions from the Oregon Health Penalty

There are several exemptions available from the Oregon health penalty, including: * Low-income exemption: Individuals and families with income below a certain threshold (150% of the federal poverty level) are exempt from the penalty. * Hardship exemption: Individuals and families who experience a hardship, such as bankruptcy, foreclosure, or domestic violence, may be exempt from the penalty. * Health coverage exemption: Individuals and families who have minimum essential health coverage for at least 9 months of the year are exempt from the penalty. * Religious exemption: Members of certain religious groups who object to health insurance on religious grounds may be exempt from the penalty. * Indian tribe exemption: Members of federally recognized Indian tribes are exempt from the penalty.

Table of Exemptions

| Exemption | Description |

|---|---|

| Low-income exemption | Individuals and families with income below 150% of the federal poverty level |

| Hardship exemption | Individuals and families who experience a hardship, such as bankruptcy or domestic violence |

| Health coverage exemption | Individuals and families who have minimum essential health coverage for at least 9 months of the year |

| Religious exemption | Members of certain religious groups who object to health insurance on religious grounds |

| Indian tribe exemption | Members of federally recognized Indian tribes |

Applying for an Exemption

To apply for an exemption from the Oregon health penalty, individuals and families must submit an application to the Oregon Health Authority. The application must include documentation to support the exemption, such as proof of income or a letter from a religious organization. It is essential to apply for an exemption as soon as possible, as the penalty can be substantial.

📝 Note: The Oregon health penalty is subject to change, and individuals and families should check with the Oregon Health Authority for the most up-to-date information.

Alternatives to the Oregon Health Penalty

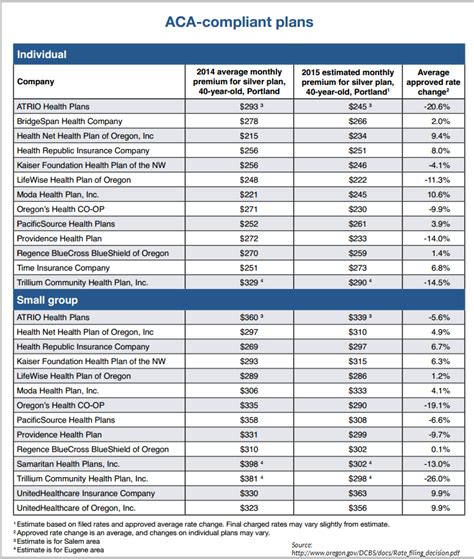

Instead of paying the penalty, individuals and families can enroll in health insurance through the Oregon Health Insurance Marketplace or through an employer-sponsored plan. It is essential to compare plans and prices to find the best option for your needs and budget. Additionally, some individuals and families may be eligible for subsidies or tax credits to help lower the cost of health insurance.

In summary, the Oregon health penalty is a fine imposed on individuals and families who do not have minimum essential health coverage. However, there are several exemptions available, including low-income, hardship, health coverage, religious, and Indian tribe exemptions. Individuals and families can apply for an exemption by submitting an application to the Oregon Health Authority, and alternatives to the penalty include enrolling in health insurance through the Oregon Health Insurance Marketplace or an employer-sponsored plan.

To wrap things up, understanding the Oregon health penalty and its exemptions is crucial for individuals and families to make informed decisions about their health insurance. By exploring the available options and exemptions, individuals and families can avoid the penalty and find affordable health insurance that meets their needs.

What is the Oregon health penalty?

+

The Oregon health penalty is a fine imposed on individuals and families who do not have minimum essential health coverage.

Who is subject to the Oregon health penalty?

+

Individuals and families who do not have minimum essential health coverage for themselves and their dependents are subject to the penalty.

How is the Oregon health penalty calculated?

+

The penalty is calculated based on the number of months an individual or family goes without minimum essential health coverage, and is equal to the greater of 2.5% of the individual’s or family’s household income above the filing threshold or 695 per adult and 347.50 per child under the age of 18, up to a maximum of $2,085 per family.

Related Terms:

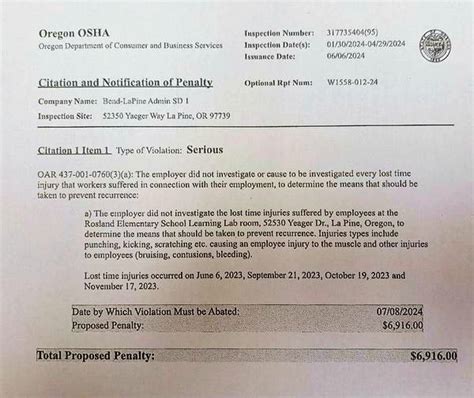

- oregon osha violations

- oregon osha citation penalties

- osha penalties for violations

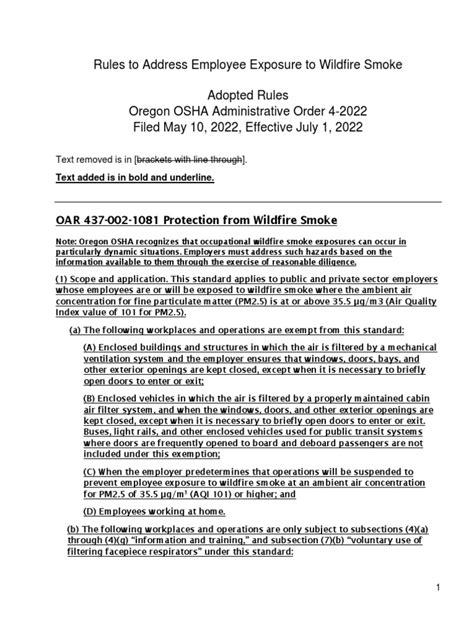

- oregon penalty adjustment

- oregon osha regulations

- oregon penalty adjustments 2022