Orlando Health 403b Plan Details

Introduction to the Orlando Health 403b Plan

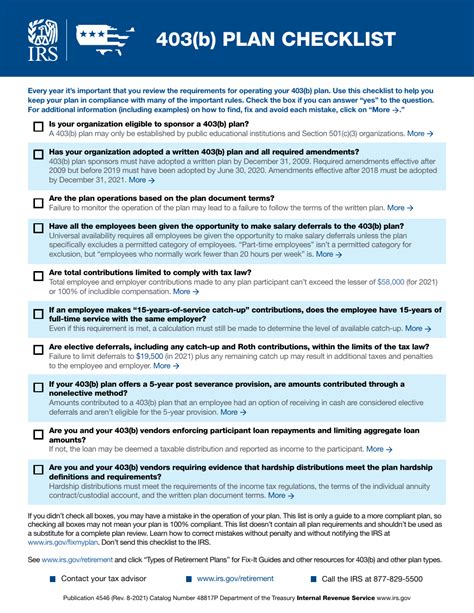

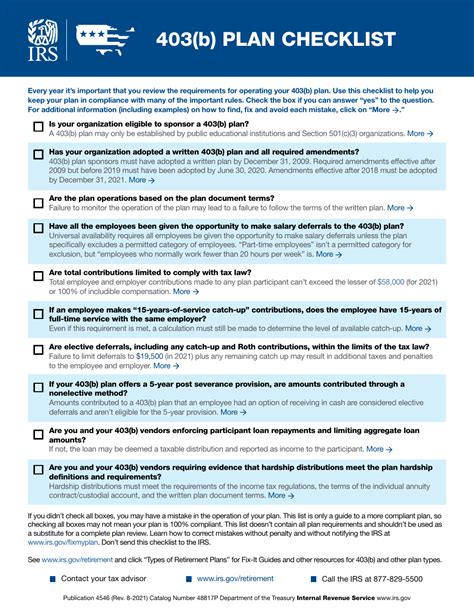

The Orlando Health 403b plan is a defined contribution plan that allows eligible employees to save for retirement on a tax-deferred basis. This plan is designed to provide employees with a flexible and convenient way to invest in their future, while also receiving potential employer matching contributions. In this article, we will delve into the details of the Orlando Health 403b plan, including eligibility, contributions, investment options, and more.

Eligibility and Enrollment

To be eligible for the Orlando Health 403b plan, employees must meet certain criteria, such as: * Being a regular full-time or part-time employee * Completing a specified waiting period (if applicable) * Receiving a qualified election from the employer Eligible employees can enroll in the plan by submitting an application and electing to contribute a portion of their compensation to the plan.

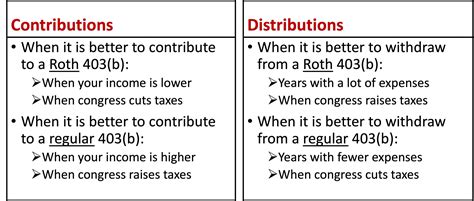

Contributions

The Orlando Health 403b plan allows employees to make pre-tax contributions through salary reduction agreements. Employees can choose to contribute a percentage of their compensation or a fixed amount each pay period. The plan may also offer catch-up contributions for employees aged 50 and older. It is essential to review the plan document for specific contribution limits and rules.

Employer Matching Contributions

Orlando Health may offer employer matching contributions to encourage employees to participate in the plan. The employer match can be a percentage of the employee’s contributions, up to a certain limit. For example, the employer might match 50% of employee contributions up to 6% of compensation. This can be a valuable benefit, as it essentially provides employees with free money for their retirement savings.

Investment Options

The Orlando Health 403b plan offers a range of investment options, including: * Mutual funds * Target date funds * Index funds * Annuities * Other investment vehicles Employees can choose from these options to create a diversified portfolio that aligns with their individual risk tolerance and investment goals.

Loan Provisions

The plan may allow employees to take loans from their account balance, subject to certain conditions and limitations. Loan provisions can be an attractive feature, as they enable employees to access their retirement savings in case of financial hardship or other qualified expenses.

Vesting Schedule

The Orlando Health 403b plan may have a vesting schedule, which determines when employees own the employer contributions. The vesting schedule can be immediate, graded, or cliff, depending on the plan’s design. It is crucial to understand the vesting schedule, as it affects the portability of employer contributions.

Withdrawal and Distribution Rules

The plan has specific rules regarding withdrawals and distributions. Employees may be able to take in-service withdrawals or loans from their account balance, subject to certain conditions and limitations. Upon separation from service, employees may be eligible for a lump-sum distribution or annuity payments. It is essential to review the plan document for specific withdrawal and distribution rules.

📝 Note: The Orlando Health 403b plan is subject to ERISA and IRS regulations, which govern the administration and operation of the plan. Employees should consult the plan document and seek professional advice to ensure compliance with applicable laws and regulations.

Plan Administration and Fees

The Orlando Health 403b plan is administered by a third-party administrator (TPA) or recordkeeper, which is responsible for: * Plan accounting and recordkeeping * Investment management * Compliance and reporting * Participant communication and education The plan may also involve fees and expenses, such as: * Administration fees * Investment management fees * Recordkeeping fees * Other expenses Employees should review the plan document and fee disclosure statements to understand the costs associated with the plan.

| Plan Feature | Description |

|---|---|

| Eligibility | Regular full-time or part-time employees |

| Contributions | Pre-tax contributions through salary reduction agreements |

| Employer Matching Contributions | 50% of employee contributions up to 6% of compensation |

| Investment Options | Mutual funds, target date funds, index funds, annuities, and other investment vehicles |

| Loan Provisions | Loans from account balance, subject to certain conditions and limitations |

In summary, the Orlando Health 403b plan is a valuable benefit that allows employees to save for retirement on a tax-deferred basis. By understanding the plan’s features, including eligibility, contributions, investment options, and loan provisions, employees can make informed decisions about their retirement savings. It is essential to review the plan document and seek professional advice to ensure compliance with applicable laws and regulations.

What is the Orlando Health 403b plan?

+

The Orlando Health 403b plan is a defined contribution plan that allows eligible employees to save for retirement on a tax-deferred basis.

How do I enroll in the Orlando Health 403b plan?

+

To enroll in the plan, eligible employees must submit an application and elect to contribute a portion of their compensation to the plan.

What are the investment options available in the Orlando Health 403b plan?

+

The plan offers a range of investment options, including mutual funds, target date funds, index funds, annuities, and other investment vehicles.

Related Terms:

- orlando health doctors reddit

- orlando health rn rates reddit

- orlando doctors leaving hospital reddit