Health

Payflex Health Savings Account Benefits

Introduction to Payflex Health Savings Account Benefits

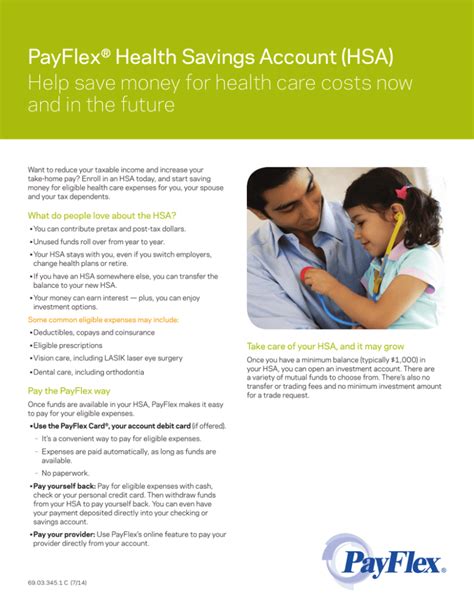

The Payflex Health Savings Account (HSA) is a valuable tool for individuals and families looking to manage their healthcare expenses in a tax-advantaged manner. By offering a unique combination of benefits, the Payflex HSA empowers account holders to save for current and future medical needs while reducing their taxable income. In this article, we will delve into the key benefits of the Payflex Health Savings Account, exploring how it can be a vital component of a comprehensive financial and health strategy.

Understanding Health Savings Accounts (HSAs)

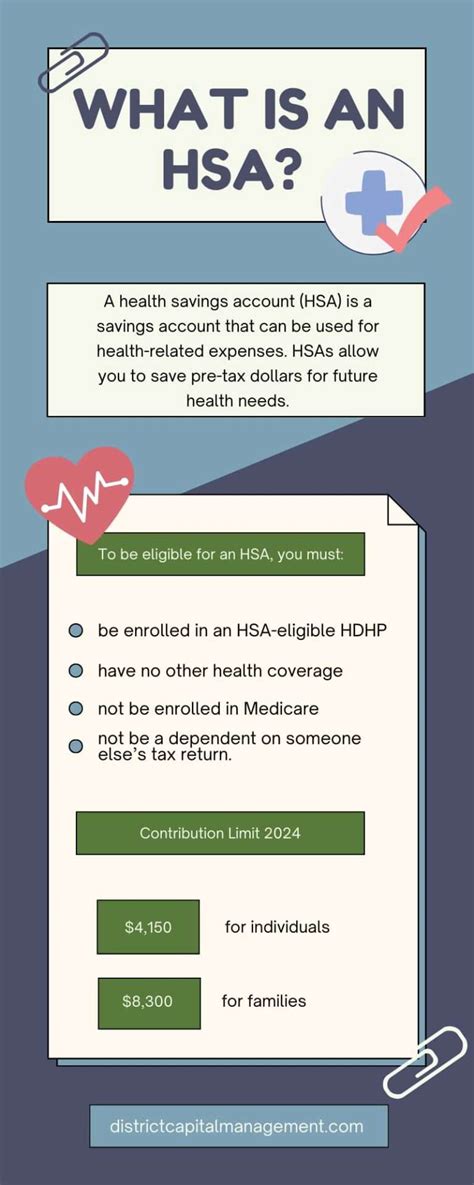

Before diving into the specifics of the Payflex HSA, it’s essential to understand what a Health Savings Account is. An HSA is a type of savings account that allows individuals with high-deductible health plans (HDHPs) to set aside money on a tax-free basis to pay for qualified medical expenses. The funds contributed to an HSA are not subject to federal income tax, and the money grows tax-free. Withdrawals for qualified medical expenses are also tax-free, making HSAs a powerful tool for managing healthcare costs.

Key Benefits of Payflex Health Savings Account

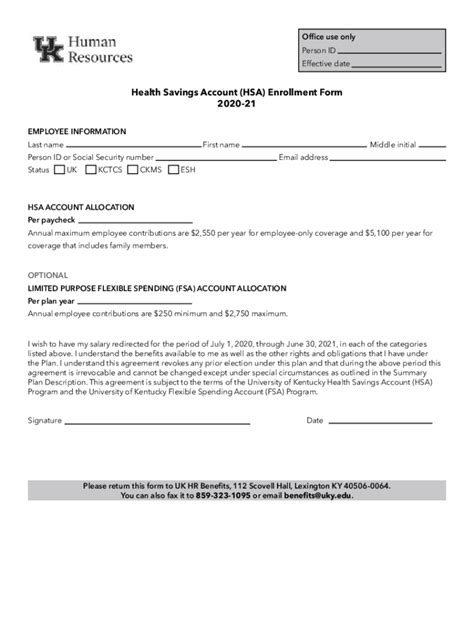

The Payflex HSA offers several key benefits that make it an attractive option for those eligible for an HSA. These benefits include: - Tax Advantages: Contributions are tax-deductible, and the funds grow tax-free. Withdrawals for qualified medical expenses are also tax-free. - Flexibility: HSAs allow account holders to use their funds for a wide range of qualified medical expenses, including doctor visits, prescriptions, glasses, and more. - Portability: The account is yours, and you can take it with you even if you change jobs or retire. - Investment Opportunities: Once your account balance reaches a certain threshold, you may be able to invest your HSA funds in various investment options, allowing your account to grow over time.

How to Use Your Payflex HSA

Using your Payflex HSA is straightforward. Here are the basic steps: - Contribute: Add money to your HSA through payroll deductions or direct contributions. - Grow: Watch your money grow over time, tax-free. - Use: Use your HSA funds to pay for qualified medical expenses. - Invest: If available, invest your HSA funds to potentially increase your savings over time.

Qualified Medical Expenses

It’s crucial to understand what qualifies as a medical expense for HSA purposes. Qualified medical expenses include: - Doctor visits and copays - Prescription medications - Dental and vision care - Medical equipment and supplies - Transportation costs related to medical care

📝 Note: It's essential to keep receipts and records of your medical expenses to ensure you can properly document and claim them as qualified expenses.

Managing Your Payflex HSA

Managing your Payflex HSA involves regularly checking your account balance, ensuring you understand your contribution limits, and being mindful of how you use your funds. It’s also important to review any investment options available through your HSA and consider consulting with a financial advisor to make the most of your account.

Conclusion and Final Thoughts

In summary, the Payflex Health Savings Account offers a compelling way to save for healthcare expenses while providing significant tax benefits. By understanding the key benefits, knowing how to use your HSA, and managing your account wisely, you can make the most of this valuable financial tool. Whether you’re looking to save for current medical needs or planning for future healthcare expenses, the Payflex HSA can be a smart choice for eligible individuals and families.

What is the main advantage of a Payflex Health Savings Account?

+

The main advantage of a Payflex Health Savings Account is its triple tax advantage: contributions are tax-deductible, funds grow tax-free, and withdrawals for qualified medical expenses are tax-free.

Can I use my Payflex HSA for any medical expense?

+

No, you can only use your Payflex HSA for qualified medical expenses as defined by the IRS. It’s essential to review the list of qualified expenses to ensure you’re using your HSA funds correctly.

Do I lose my HSA funds if I don’t use them by the end of the year?

+

No, HSA funds roll over from year to year, so you won’t lose your money if you don’t use it by the end of the year. This makes HSAs a great long-term savings tool for healthcare expenses.

Related Terms:

- PayFlex employee login

- Aetna PayFlex

- PayFlex Card

- PayFlex employer login

- PayFlex HSA balance

- HSA PayFlex login