5 PEO Health Insurance Tips

Introduction to PEO Health Insurance

Professional Employer Organizations (PEOs) offer a unique approach to health insurance for small to medium-sized businesses. By pooling resources and risks, PEOs can provide more comprehensive and affordable health insurance options to their clients. When navigating the complex world of health insurance, it’s essential to understand the benefits and considerations of PEO health insurance. In this article, we will explore five key tips for optimizing your PEO health insurance experience.

Tip 1: Understand the Basics of PEO Health Insurance

Before diving into the world of PEO health insurance, it’s crucial to understand the fundamentals. PEOs act as co-employers, sharing responsibilities and risks with their client companies. This arrangement allows PEOs to offer larger group rates and more comprehensive coverage options. When selecting a PEO, consider the following factors: * The PEO’s reputation and experience in the industry * The range of health insurance options offered * The level of administrative support provided * The potential for cost savings and reduced risk

Tip 2: Assess Your Business Needs

Every business is unique, with its own set of needs and priorities. When evaluating PEO health insurance options, consider the following: * The size and demographics of your workforce * The current health insurance coverage and benefits offered to employees * The budget allocated for health insurance and benefits * The level of administrative support required By understanding your business needs, you can select a PEO that offers tailored solutions and personalized support.

Tip 3: Evaluate PEO Health Insurance Options

PEOs often offer a range of health insurance options, including: * Major Medical Plans: Comprehensive coverage for medical expenses * Self-Funded Plans: Customized plans that allow businesses to manage their own risk * Level-Funded Plans: Hybrid plans that combine elements of self-funded and fully insured plans * Minimum Essential Coverage (MEC) Plans: Basic coverage that meets the minimum requirements of the Affordable Care Act (ACA) When evaluating these options, consider the trade-offs between cost, coverage, and flexibility.

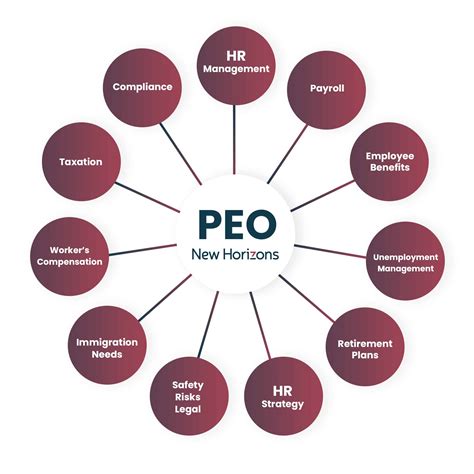

Tip 4: Consider the Administrative Benefits

One of the primary advantages of working with a PEO is the reduction in administrative burdens. PEOs can handle tasks such as: * Benefits administration * Payroll processing * Compliance management * Employee onboarding and support By outsourcing these responsibilities, businesses can free up resources and focus on core operations.

Tip 5: Monitor and Adjust Your PEO Health Insurance Plan

The health insurance landscape is constantly evolving, with changes in regulations, market trends, and employee needs. To ensure your PEO health insurance plan remains effective and efficient, it’s essential to: * Regularly review and assess your plan’s performance * Monitor changes in regulations and market trends * Adjust your plan as needed to reflect changes in your business or workforce * Communicate with your PEO and employees to ensure a smooth and transparent experience

💡 Note: When selecting a PEO, consider their ability to adapt to changing market conditions and regulatory requirements.

In summary, PEO health insurance offers a unique solution for small to medium-sized businesses. By understanding the basics of PEO health insurance, assessing your business needs, evaluating PEO health insurance options, considering the administrative benefits, and monitoring and adjusting your plan, you can optimize your health insurance experience and provide valuable benefits to your employees.

What is a Professional Employer Organization (PEO)?

+

A PEO is a company that provides a range of HR services, including health insurance, benefits administration, and payroll processing, to small to medium-sized businesses.

What are the benefits of working with a PEO for health insurance?

+

The benefits of working with a PEO for health insurance include access to larger group rates, more comprehensive coverage options, and reduced administrative burdens.

How do I choose the right PEO for my business?

+

When choosing a PEO, consider factors such as the PEO’s reputation and experience, the range of health insurance options offered, the level of administrative support provided, and the potential for cost savings and reduced risk.

Related Terms:

- PEO health insurance rates

- PEO vs PPO

- TriNet PEO

- Paychex PEO

- ADP PEO

- PEO retirement plan