Persistency Factor in Health Insurance Matters

Introduction to Persistency in Health Insurance

The persistency factor in health insurance refers to the degree to which policyholders continue to renew their policies over time. It is a crucial aspect of the insurance industry, as it directly impacts the profitability and sustainability of insurance companies. Persistency rates are used to measure the percentage of policyholders who retain their coverage from one year to the next. A high persistency rate indicates that a significant number of policyholders are satisfied with their coverage and choose to continue their policies, whereas a low persistency rate may suggest that policyholders are dissatisfied or are seeking better options elsewhere.

Factors Influencing Persistency in Health Insurance

Several factors can influence the persistency factor in health insurance, including: * Premium costs: High premium costs can lead to lower persistency rates, as policyholders may seek more affordable options. * Coverage and benefits: Policyholders who are satisfied with their coverage and benefits are more likely to renew their policies. * Customer service: Good customer service can contribute to higher persistency rates, as policyholders feel valued and supported. * Claims experience: Policyholders who have positive claims experiences are more likely to continue their policies. * Market competition: A competitive market can lead to lower persistency rates, as policyholders may be tempted to switch to other providers offering better rates or coverage.

Importance of Persistency in Health Insurance

The persistency factor is essential in health insurance because it: * Reduces administrative costs: High persistency rates mean that insurance companies spend less on marketing and administrative costs associated with acquiring new policyholders. * Increases customer loyalty: Policyholders who renew their policies are more likely to become loyal customers, which can lead to positive word-of-mouth and referrals. * Improves risk assessment: Insurance companies can better assess risk and adjust premiums accordingly when they have a stable and consistent pool of policyholders. * Enhances profitability: High persistency rates can contribute to increased profitability, as insurance companies can reduce costs associated with policyholder turnover.

Strategies to Improve Persistency in Health Insurance

Insurance companies can implement several strategies to improve persistency rates, including: * Offering competitive premiums: Insurance companies can offer competitive premiums to attract and retain policyholders. * Providing excellent customer service: Insurance companies can invest in customer service to ensure that policyholders feel valued and supported. * Enhancing coverage and benefits: Insurance companies can offer comprehensive coverage and benefits to meet the evolving needs of policyholders. * Streamlining claims processes: Insurance companies can simplify and accelerate claims processes to ensure that policyholders receive timely and efficient service. * Implementing retention programs: Insurance companies can develop retention programs, such as loyalty rewards or discounts, to incentivize policyholders to renew their policies.

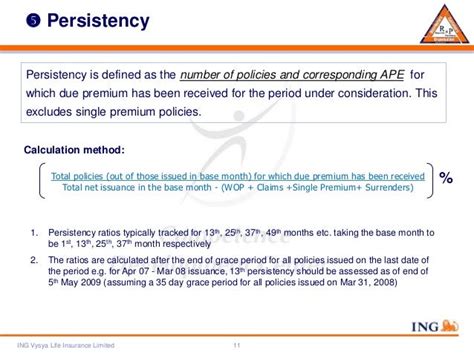

Measuring Persistency in Health Insurance

Insurance companies can measure persistency rates using various metrics, including: * Renewal rates: The percentage of policyholders who renew their policies at the end of each policy term. * Retention rates: The percentage of policyholders who retain their coverage over a specified period. * Lapse rates: The percentage of policyholders who allow their policies to lapse or terminate.

| Metric | Description |

|---|---|

| Retail persistency | The percentage of individual policyholders who renew their policies. |

| Group persistency | The percentage of group policyholders who renew their policies. |

| Voluntary persistency | The percentage of policyholders who voluntarily renew their policies. |

💡 Note: Insurance companies can use data analytics and machine learning algorithms to identify factors that influence persistency rates and develop targeted strategies to improve retention.

In the end, the persistency factor plays a vital role in the health insurance industry, as it directly impacts the profitability and sustainability of insurance companies. By understanding the factors that influence persistency rates and implementing effective strategies to improve retention, insurance companies can build strong relationships with policyholders, reduce costs, and increase profitability. The key to success lies in providing competitive premiums, excellent customer service, and comprehensive coverage and benefits that meet the evolving needs of policyholders.

What is the persistency factor in health insurance?

+

The persistency factor refers to the degree to which policyholders continue to renew their policies over time.

What are the factors that influence persistency rates in health insurance?

+

Factors that influence persistency rates include premium costs, coverage and benefits, customer service, claims experience, and market competition.

Why is the persistency factor important in health insurance?

+

The persistency factor is important because it reduces administrative costs, increases customer loyalty, improves risk assessment, and enhances profitability.

Related Terms:

- persistency factor in health insurance

- Persistency ratio formula

- Persistency ratio Meaning

- What is persistency in insurance

- Persistency vs retention insurance

- Premium persistency vs lapse