Physician Assistant Health Insurance Options

Introduction to Physician Assistant Health Insurance Options

As a physician assistant, having the right health insurance is crucial not only for personal health and well-being but also for financial security. The healthcare landscape is complex, and navigating through the various insurance options can be overwhelming. This article aims to guide physician assistants through the process of selecting the most appropriate health insurance plan, considering factors such as coverage, cost, and personal health needs.

Understanding Health Insurance Basics

Before diving into the specifics of health insurance options for physician assistants, it’s essential to understand the basics of health insurance. Health insurance is a type of insurance coverage that pays for medical and surgical expenses incurred by the insured. The primary purpose of health insurance is to protect individuals and families from financial hardship due to unexpected medical expenses. Key components of health insurance include premiums, deductibles, copays, and coinsurance.

- Premiums are the monthly or annual payments made to the insurance company to maintain coverage.

- Deductibles are the amounts that must be paid out-of-pocket before the insurance plan starts to pay its share of costs.

- Copays are fixed amounts paid for specific healthcare services, such as doctor visits or prescriptions.

- Coinsurance refers to the percentage of healthcare costs that the insured must pay after meeting the deductible.

Types of Health Insurance Plans

There are several types of health insurance plans available to physician assistants, each with its advantages and disadvantages. The main types include:

- Health Maintenance Organization (HMO) Plans: These plans require the selection of a primary care physician from within the network, and referrals are often needed to see specialists. HMOs can be cost-effective but may limit flexibility in choosing healthcare providers.

- Preferred Provider Organization (PPO) Plans: PPO plans offer more flexibility than HMOs, allowing visits to any healthcare provider, both in-network and out-of-network, though out-of-network care is typically more expensive. PPOs do not require the selection of a primary care physician or referrals to see specialists.

- Exclusive Provider Organization (EPO) Plans: EPO plans combine elements of HMO and PPO plans but do not cover out-of-network care except in emergency situations. They often require the selection of a primary care physician and may need referrals for specialist visits.

- Point of Service (POS) Plans: POS plans are a type of managed care plan that combines features of HMO and PPO plans. They require the selection of a primary care physician and often need referrals for specialist care, but they also allow for out-of-network care at a higher cost.

- High-Deductible Health Plans (HDHPs): HDHPs are plans with lower premiums but higher deductibles. They are often paired with Health Savings Accounts (HSAs), which allow for tax-advantaged savings for medical expenses.

Choosing the Right Health Insurance Plan

Choosing the right health insurance plan as a physician assistant involves considering several factors, including:

- Network and Providers: Ensure that your preferred healthcare providers, including primary care physicians and specialists, are part of the plan’s network.

- Cost and Budget: Evaluate the total cost of the plan, including premiums, deductibles, copays, and coinsurance, to ensure it fits within your budget.

- Coverage and Benefits: Consider the plan’s coverage for essential health benefits, such as preventive care, hospital stays, and prescription medications, as well as any additional benefits that may be important to you, like dental or vision care.

- Personal Health Needs: If you have ongoing health issues or anticipate needing specific medical services, choose a plan that offers adequate coverage for these needs.

Special Considerations for Physician Assistants

As healthcare professionals, physician assistants may have unique health insurance needs. Some special considerations include:

- Professional Liability Insurance: While not a traditional health insurance, professional liability insurance (malpractice insurance) is crucial for protecting against claims of negligence or wrongdoing in the course of professional duties.

- Disability Insurance: Given the physical and mental demands of the profession, disability insurance can provide financial protection in case of an injury or illness that prevents working.

- Life Insurance: Life insurance can offer peace of mind and financial security for dependents in the event of death.

💡 Note: When selecting a health insurance plan, it's also important to review the plan's policy on pre-existing conditions, especially if you have any ongoing health issues.

Utilizing Employer-Sponsored Plans

Many physician assistants are offered health insurance as part of their employment benefits. These employer-sponsored plans can be an attractive option due to the employer’s contribution to the premium costs. However, it’s essential to review the plan’s details, including coverage, cost, and network, to ensure it meets your health insurance needs.

Individual and Family Plans

For those not covered by an employer-sponsored plan, individual and family plans purchased through the health insurance marketplace or directly from insurers can provide essential coverage. The Affordable Care Act (ACA) has expanded access to health insurance for many individuals and families, offering subsidies to make premiums more affordable for those who qualify.

Conclusion and Final Thoughts

In conclusion, navigating the complex landscape of health insurance options as a physician assistant requires careful consideration of personal health needs, budget, and the specifics of each insurance plan. By understanding the types of health insurance plans available, their benefits and drawbacks, and considering special professional needs, physician assistants can make informed decisions to secure the right health insurance coverage. Whether through an employer-sponsored plan or an individual and family plan, having adequate health insurance is vital for protecting against financial hardship due to medical expenses and ensuring access to necessary healthcare services.

What are the key factors to consider when choosing a health insurance plan as a physician assistant?

+

Key factors include the plan’s network and providers, cost and budget, coverage and benefits, and personal health needs. Additionally, considering professional liability insurance, disability insurance, and life insurance can provide comprehensive protection.

What is the difference between an HMO and a PPO health insurance plan?

+

HMO (Health Maintenance Organization) plans typically require the selection of a primary care physician and may need referrals for specialist care, with limited or no coverage for out-of-network care. PPO (Preferred Provider Organization) plans offer more flexibility, allowing visits to any healthcare provider, both in-network and out-of-network, though out-of-network care is usually more expensive.

How can physician assistants find health insurance plans that meet their specific needs?

+

Physician assistants can start by evaluating employer-sponsored plans, if available. For individual and family plans, utilizing the health insurance marketplace or working with a licensed insurance agent can help in finding plans that meet specific health needs and budgets. It’s also crucial to read plan documents carefully and ask questions before enrolling.

Related Terms:

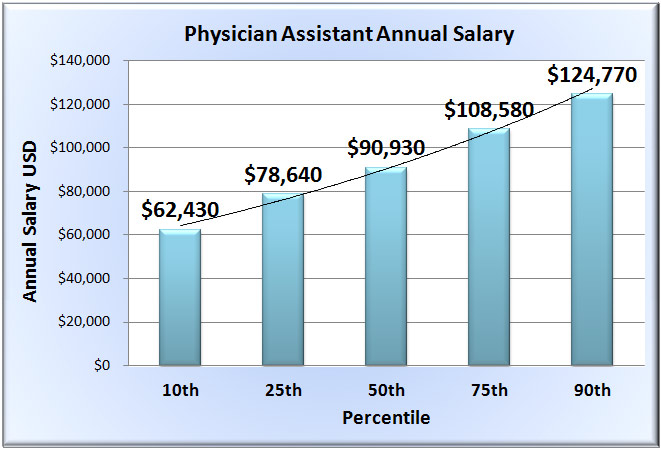

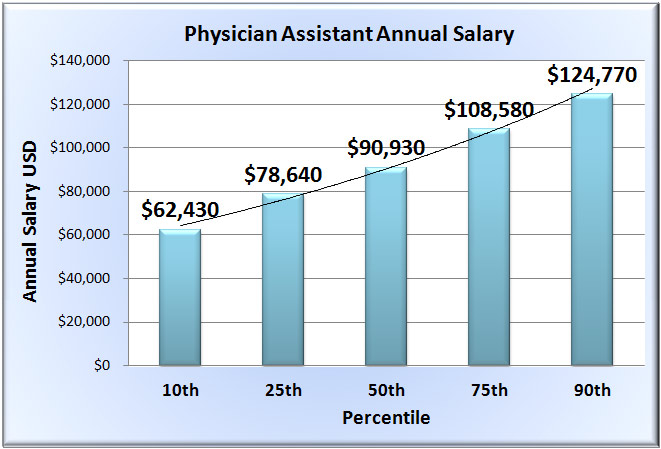

- Physician Assistant benefits and salary

- Physician Assistant benefits package

- Physician Assistant salary

- Physician assistant malpractice insurance

- physician assistant medical malpractice insurance

- professional liability insurance physician assistant