5 Tips Physicians Insurance

Understanding the Importance of Physicians Insurance

As a physician, having the right insurance coverage is crucial to protect yourself and your practice from potential risks and liabilities. With the ever-changing healthcare landscape, it’s essential to stay informed about the types of insurance available and how they can benefit you. In this article, we’ll explore five tips to help physicians navigate the complex world of insurance and make informed decisions about their coverage.

Tip 1: Assess Your Risk Exposure

Before selecting an insurance policy, it’s essential to assess your risk exposure. This involves identifying potential risks and liabilities associated with your practice, such as medical malpractice, cybersecurity breaches, and employee injuries. Consider factors like your specialty, practice size, and location to determine the level of risk you face. By understanding your risk exposure, you can choose an insurance policy that provides adequate coverage and protection.

Tip 2: Choose the Right Type of Insurance

There are several types of insurance available to physicians, including: * Professional Liability Insurance: protects against medical malpractice claims * General Liability Insurance: covers slip-and-fall accidents, property damage, and other general liability risks * Cyber Liability Insurance: protects against cybersecurity breaches and data theft * Business Owners Policy: combines liability and property coverage for small practices * Workers’ Compensation Insurance: required by law in most states to cover employee injuries It’s essential to choose the right type of insurance to ensure you have adequate coverage for your practice.

Tip 3: Consider Your Policy Limits and Deductibles

When selecting an insurance policy, it’s crucial to consider your policy limits and deductibles. Policy limits refer to the maximum amount of coverage provided by the policy, while deductibles are the amounts you must pay out-of-pocket before the insurance coverage kicks in. Ensure that your policy limits are sufficient to cover potential losses, and consider deductibles that fit within your budget. A higher deductible may lower your premium, but it also means you’ll pay more out-of-pocket in the event of a claim.

Tip 4: Review and Update Your Policy Regularly

Insurance needs can change over time, so it’s essential to review and update your policy regularly. Consider factors like changes in your practice, new laws or regulations, and shifts in the healthcare landscape. Regularly reviewing your policy ensures that you have adequate coverage and can help you avoid gaps in coverage. Additionally, updating your policy can help you take advantage of new discounts or coverage options.

Tip 5: Work with an Experienced Insurance Agent

Finally, working with an experienced insurance agent can help you navigate the complex world of physicians insurance. An experienced agent can help you: * Assess your risk exposure and choose the right type of insurance * Understand policy limits and deductibles * Review and update your policy regularly * Identify potential discounts or coverage options * Navigate the claims process in the event of a loss By working with an experienced agent, you can ensure that you have the right coverage for your practice and can focus on providing excellent patient care.

💡 Note: When selecting an insurance policy, be sure to read the fine print and ask questions to ensure you understand the terms and conditions of the policy.

In summary, having the right insurance coverage is crucial for physicians to protect themselves and their practices from potential risks and liabilities. By assessing your risk exposure, choosing the right type of insurance, considering policy limits and deductibles, reviewing and updating your policy regularly, and working with an experienced insurance agent, you can ensure that you have adequate coverage and can focus on providing excellent patient care.

What is the most important type of insurance for physicians?

+

Professional Liability Insurance is often considered the most important type of insurance for physicians, as it protects against medical malpractice claims.

How often should I review and update my insurance policy?

+

It’s recommended to review and update your insurance policy at least annually, or whenever there are changes in your practice, new laws or regulations, or shifts in the healthcare landscape.

What is the difference between policy limits and deductibles?

+

Policy limits refer to the maximum amount of coverage provided by the policy, while deductibles are the amounts you must pay out-of-pocket before the insurance coverage kicks in.

Related Terms:

- General Dynamics Mission Systems GDMS

- Physicians Health Plan Login

- Physicians Health Plan provider Portal

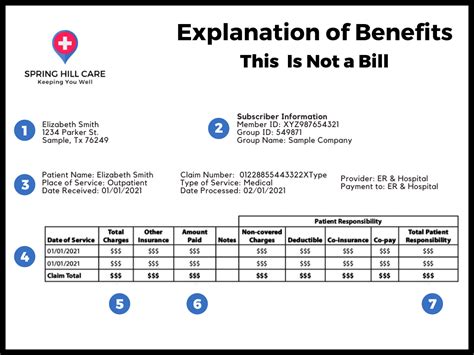

- Physicians Health Plan eligibility verification

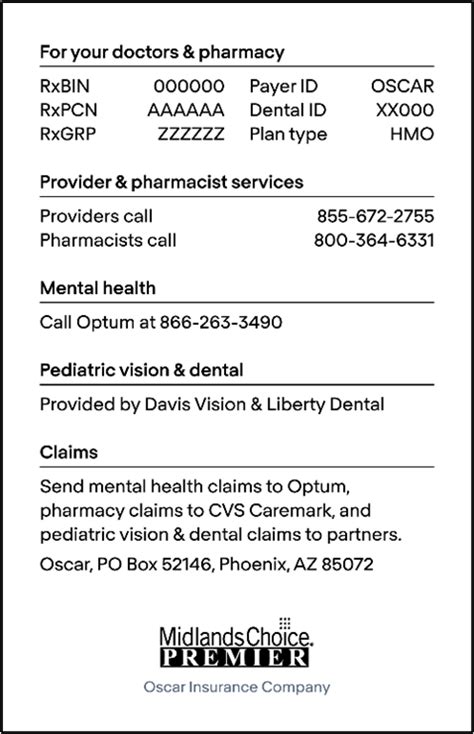

- Physicians Health Plan claims address

- Physicians Health Plan phone number