PNC Health Savings Account Benefits

Introduction to PNC Health Savings Account Benefits

A Health Savings Account (HSA) is a type of savings account that allows individuals with high-deductible health plans (HDHPs) to set aside pre-tax dollars for medical expenses. PNC Bank offers a comprehensive HSA program that provides numerous benefits to its account holders. In this article, we will delve into the advantages of having a PNC Health Savings Account and explore how it can help individuals and families manage their healthcare costs.

Key Benefits of a PNC Health Savings Account

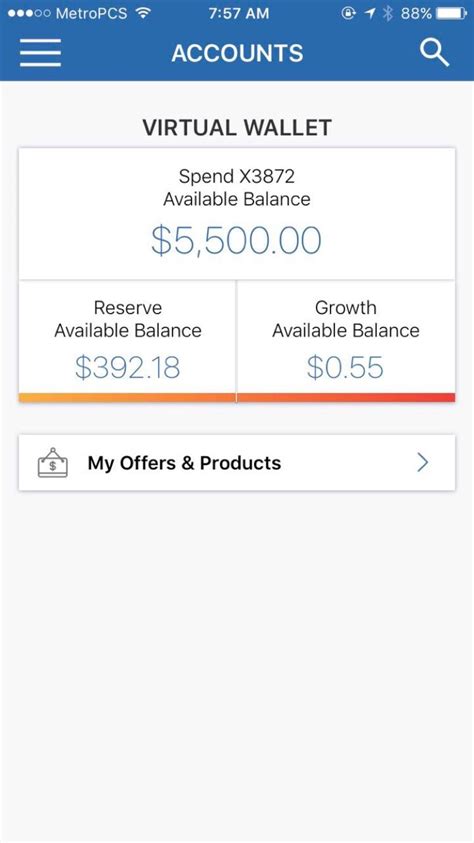

The PNC Health Savings Account offers several benefits, including: * Tax advantages: Contributions to an HSA are tax-deductible, and the funds grow tax-free. Withdrawals for qualified medical expenses are also tax-free. * Portability: HSAs are portable, meaning that account holders can take their account with them if they change jobs or retire. * Investment options: PNC offers a range of investment options for HSA funds, allowing account holders to grow their savings over time. * Convenience: PNC HSAs come with a debit card and online account management, making it easy to access and manage funds. * No “use it or lose it” rule: Unlike Flexible Spending Accounts (FSAs), HSAs do not have a “use it or lose it” rule, meaning that account holders can carry over unused funds from year to year.

Eligibility and Contribution Limits

To be eligible for a PNC Health Savings Account, individuals must have a high-deductible health plan (HDHP) and meet certain income requirements. The contribution limits for HSAs vary from year to year, but in general, individuals can contribute up to a certain amount per year, and families can contribute up to a higher amount per year. It’s essential to check the current contribution limits and eligibility requirements before opening an HSA.

Qualified Medical Expenses

HSAs can be used to pay for a wide range of qualified medical expenses, including: * Doctor visits and copays * Prescription medications * Hospital stays and surgery * Dental and vision care * Medical equipment and supplies * Chiropractic care and acupuncture * Mental health and substance abuse treatment

📝 Note: It's crucial to keep receipts and records of qualified medical expenses, as these may be required for tax purposes or to support HSA withdrawals.

Investment Options and Fees

PNC offers a range of investment options for HSA funds, including: * Stocks and bonds * Mutual funds * Exchange-traded funds (ETFs) * Money market funds It’s essential to review the fees associated with each investment option, as these can vary. Some common fees include: * Management fees * Administrative fees * Investment fees

| Investment Option | Fees |

|---|---|

| Stocks and bonds | Management fees: 0.05%-0.20% |

| Mutual funds | Management fees: 0.10%-0.50% |

| ETFs | Management fees: 0.05%-0.20% |

| Money market funds | Administrative fees: $0-$10 per year |

Conclusion and Summary

In summary, a PNC Health Savings Account offers numerous benefits, including tax advantages, portability, investment options, and convenience. By understanding the eligibility and contribution limits, qualified medical expenses, and investment options and fees, individuals can make informed decisions about their HSA and take control of their healthcare costs. With a PNC HSA, individuals can save for medical expenses, reduce their taxable income, and build a safety net for unexpected medical bills.

What is the difference between an HSA and an FSA?

+

An HSA is a type of savings account that allows individuals with high-deductible health plans to set aside pre-tax dollars for medical expenses, while an FSA is a type of savings account that allows individuals to set aside pre-tax dollars for medical expenses, but has a “use it or lose it” rule.

Can I use my HSA funds for non-medical expenses?

+

Yes, but you will be subject to a 20% penalty and income tax on the withdrawal amount if you use your HSA funds for non-medical expenses before age 65.

How do I open a PNC Health Savings Account?

+

You can open a PNC Health Savings Account online, by phone, or in person at a PNC branch. You will need to provide identification and proof of eligibility for an HDHP.

Related Terms:

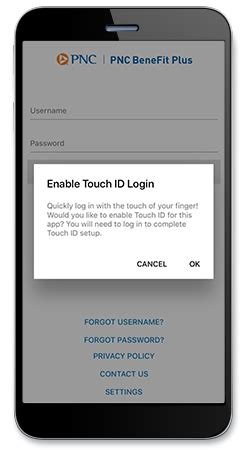

- PNC BeneFit Plus login

- PNC HSA Employer login

- PNC BeneFit Plus HSA

- PNC BeneFit Plus Customer Service

- PNC BeneFit Plus app

- Participant PNC BeneFit Plus