Priority Health Coverage Options

Introduction to Priority Health Coverage Options

In today’s world, having the right health coverage is essential for maintaining financial stability and ensuring access to quality medical care. With the rising costs of healthcare, it’s crucial to understand the various options available and choose the one that best suits your needs. Priority health coverage refers to a type of health insurance that provides comprehensive coverage for essential medical services, often with a focus on preventive care and chronic disease management. In this article, we will delve into the world of priority health coverage options, exploring the different types, benefits, and considerations to keep in mind when selecting a plan.

Types of Priority Health Coverage Options

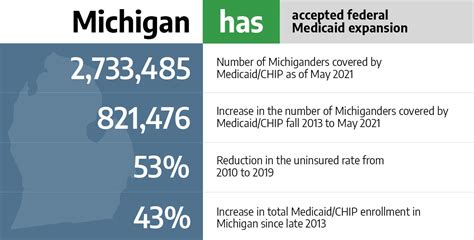

There are several types of priority health coverage options available, each with its unique features and advantages. Some of the most common types include: * Employer-sponsored plans: These plans are offered by employers to their employees and often provide comprehensive coverage, including medical, dental, and vision care. * Individual and family plans: These plans are designed for individuals and families who are not eligible for employer-sponsored coverage or prefer to purchase their own insurance. * Medicaid and CHIP: These government-sponsored programs provide coverage to low-income individuals and families, including children and pregnant women. * Medicare: This federal program provides coverage to seniors and people with disabilities. * Short-term limited-duration insurance: These plans provide temporary coverage for individuals who are between jobs, waiting for other coverage to start, or need a short-term solution.

Benefits of Priority Health Coverage Options

Priority health coverage options offer numerous benefits, including: * Comprehensive coverage: Priority health coverage options often provide coverage for a wide range of medical services, including doctor visits, hospital stays, prescription medications, and preventive care. * Financial protection: Having priority health coverage can help protect you from financial ruin in the event of a medical emergency or unexpected illness. * Access to quality care: Priority health coverage options can provide access to quality medical care, including specialist care and hospital services. * Preventive care: Many priority health coverage options place a strong emphasis on preventive care, including routine check-ups, screenings, and vaccinations.

Considerations When Selecting a Priority Health Coverage Option

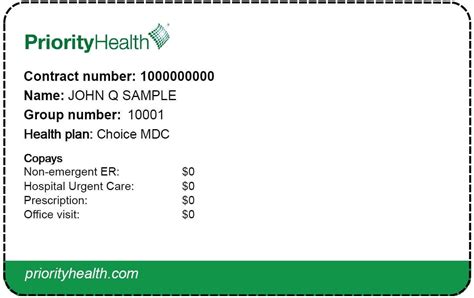

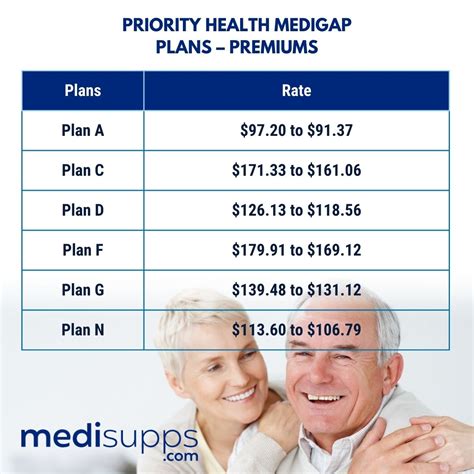

When selecting a priority health coverage option, there are several considerations to keep in mind, including: * Cost: The cost of the plan, including premiums, deductibles, and out-of-pocket expenses. * Network: The network of doctors, hospitals, and other healthcare providers that participate in the plan. * Coverage: The types of medical services and treatments that are covered under the plan. * Maximum out-of-pocket: The maximum amount you will have to pay out-of-pocket for medical expenses. * Pre-existing conditions: Whether the plan covers pre-existing conditions and if so, what the waiting period is.

📝 Note: It's essential to carefully review the plan's details, including the summary of benefits and coverage documents, to ensure you understand what is covered and what is not.

Priority Health Coverage Options Comparison

The following table provides a comparison of some of the most common priority health coverage options:

| Plan Type | Premium | Deductible | Out-of-Pocket Maximum | Network |

|---|---|---|---|---|

| Employer-Sponsored Plan | 200-500 | 500-1,000 | 5,000-10,000 | Large network of doctors and hospitals |

| Individual and Family Plan | 300-700 | 1,000-2,000 | 7,000-15,000 | Smaller network of doctors and hospitals |

| Medicaid and CHIP | 0-50 | 0-100 | 1,000-3,000 | Small network of doctors and hospitals |

| Medicare | 100-300 | 200-500 | 3,000-6,000 | Large network of doctors and hospitals |

In conclusion, priority health coverage options provide comprehensive coverage for essential medical services, often with a focus on preventive care and chronic disease management. When selecting a plan, it’s crucial to consider factors such as cost, network, coverage, and maximum out-of-pocket expenses. By carefully reviewing the plan’s details and comparing different options, you can choose the best priority health coverage option for your needs and ensure access to quality medical care.

What is priority health coverage?

+

Priority health coverage refers to a type of health insurance that provides comprehensive coverage for essential medical services, often with a focus on preventive care and chronic disease management.

What are the different types of priority health coverage options?

+

The different types of priority health coverage options include employer-sponsored plans, individual and family plans, Medicaid and CHIP, Medicare, and short-term limited-duration insurance.

What should I consider when selecting a priority health coverage option?

+

When selecting a priority health coverage option, you should consider factors such as cost, network, coverage, and maximum out-of-pocket expenses. It’s also essential to carefully review the plan’s details, including the summary of benefits and coverage documents.

Related Terms:

- Priority Health login

- Priority Health provider portal

- Free Michigan health insurance

- Priority Health Customer Service

- Priority Health Medicare

- Priority Health Medicaid