5 Tips Report Owner Health Insurance

Introduction to Health Insurance for Report Owners

As a report owner, understanding the intricacies of health insurance is crucial for making informed decisions about your coverage. Health insurance is a type of insurance that covers the cost of medical expenses incurred by the insured. It can provide financial protection against unexpected medical expenses, ensuring that you receive the necessary care without incurring significant debt. In this article, we will delve into the world of health insurance, exploring five essential tips that every report owner should know.

Tip 1: Understanding Your Coverage Options

When it comes to health insurance, there are numerous coverage options available. It is essential to understand the different types of plans, including Individual and Family Plans, Group Plans, Medicare, and Medicaid. Each plan has its unique features, advantages, and disadvantages. For instance, individual and family plans are ideal for those who are self-employed or do not have access to group coverage through their employer. On the other hand, group plans are often offered by employers and can provide more comprehensive coverage at a lower cost.

Tip 2: Evaluating Your Healthcare Needs

To choose the right health insurance plan, you need to evaluate your healthcare needs. Consider factors such as your age, health status, and medical history. If you have a pre-existing condition, you may want to opt for a plan that provides more comprehensive coverage. Additionally, think about your lifestyle and the type of care you may need in the future. For example, if you are planning to start a family, you may want to choose a plan that includes maternity coverage and pediatric care.

Tip 3: Comparing Plan Networks and Providers

When selecting a health insurance plan, it is crucial to compare the plan networks and providers. A plan’s network refers to the group of healthcare providers who have agreed to provide care to plan members at a negotiated rate. Make sure to check if your primary care physician and any specialists you see are part of the plan’s network. You should also research the plan’s provider directory to ensure that it includes a wide range of healthcare providers, including hospitals, clinics, and pharmacies.

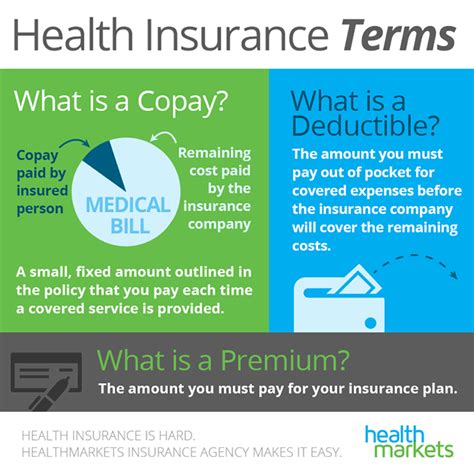

Tip 4: Understanding Out-of-Pocket Costs

Out-of-pocket costs refer to the expenses that you pay directly for medical care, such as deductibles, copays, and coinsurance. It is essential to understand how these costs work and how they can impact your budget. For example, a plan with a high deductible may have lower premiums, but you will need to pay more out-of-pocket for medical expenses before the insurance kicks in. On the other hand, a plan with a low deductible may have higher premiums, but you will pay less out-of-pocket for medical expenses.

Tip 5: Reviewing and Updating Your Coverage

Finally, it is crucial to review and update your health insurance coverage regularly. Your healthcare needs may change over time, and your plan may need to be adjusted accordingly. For example, if you get married or have a child, you may need to add them to your plan. Additionally, you should review your plan’s summary of benefits and coverage documents to ensure that you understand what is covered and what is not.

📝 Note: Always keep a record of your health insurance documents, including your policy number, coverage dates, and contact information for your insurance provider.

To illustrate the different types of health insurance plans, the following table provides a comparison of the key features:

| Plan Type | Premiums | Coverage | Network |

|---|---|---|---|

| Individual and Family Plans | Higher | Varies | Smaller |

| Group Plans | Lower | Comprehensive | Larger |

| Medicare | Varies | Standardized | National |

| Medicaid | Lower | Basic | State-specific |

In summary, choosing the right health insurance plan requires careful consideration of your coverage options, healthcare needs, plan networks, out-of-pocket costs, and regular review of your coverage. By following these five tips, you can make informed decisions about your health insurance and ensure that you have the necessary coverage to protect your health and well-being.

What is the difference between a deductible and copay?

+

A deductible is the amount you pay out-of-pocket for medical expenses before your insurance kicks in, while a copay is a fixed amount you pay for a specific medical service, such as a doctor’s visit or prescription medication.

Can I change my health insurance plan at any time?

+

Typically, you can only change your health insurance plan during the annual open enrollment period or if you experience a qualifying life event, such as getting married or having a child.

What is the purpose of a provider directory?

+

A provider directory is a list of healthcare providers who participate in a health insurance plan’s network, making it easier for you to find a doctor or hospital that accepts your insurance.

Related Terms:

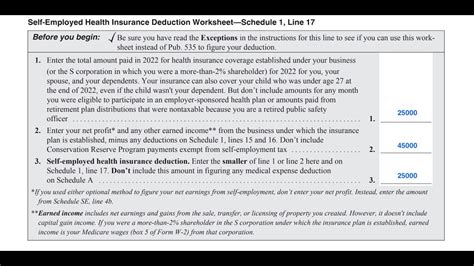

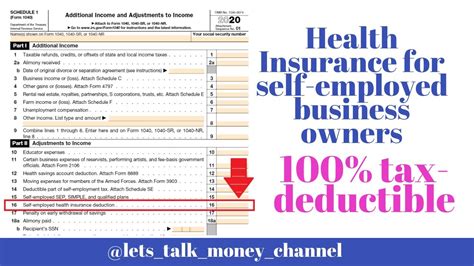

- Partnership health insurance deduction

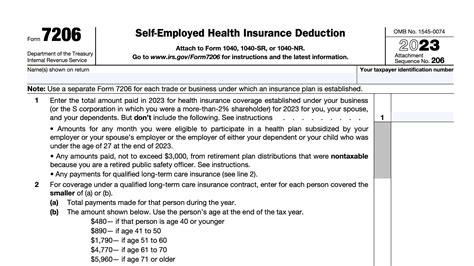

- self employed health insurance deduction irs

- Self employed health insurance deduction limit

- Form 7206 instructions

- 1065 partner health insurance

- partner health insurance deductible amount