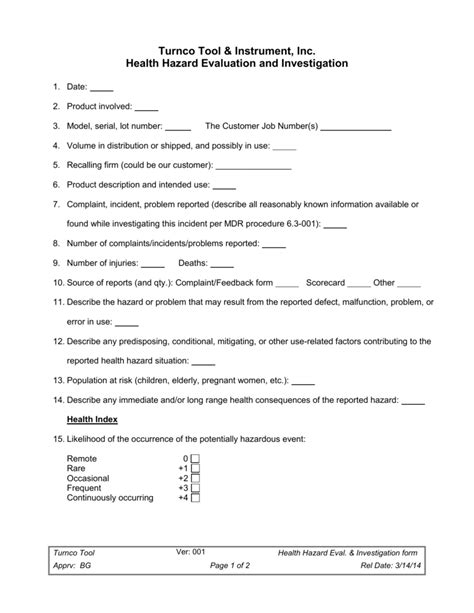

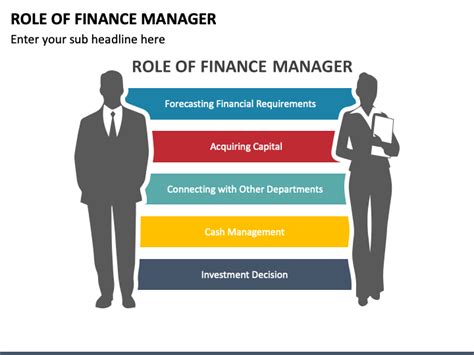

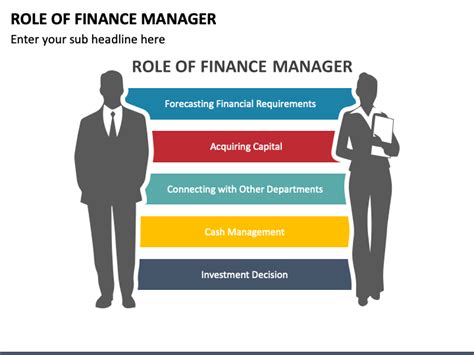

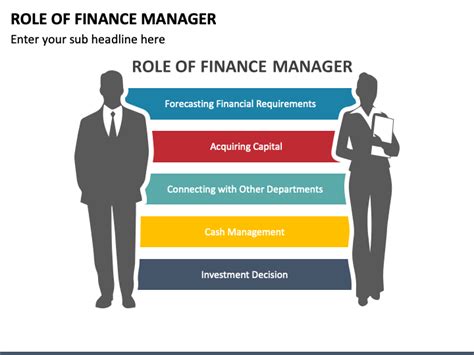

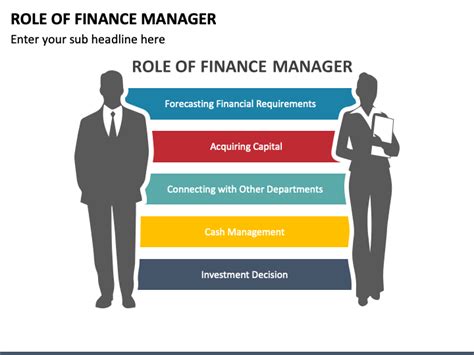

Role of Financial Manager

Introduction to Financial Management

The role of a financial manager is crucial in any organization, as they are responsible for overseeing and managing the financial activities of the company. Financial managers play a vital role in ensuring the financial health and stability of an organization, and their decisions can have a significant impact on the company’s overall performance. In this blog post, we will explore the role of a financial manager in detail, including their key responsibilities, skills, and qualifications.

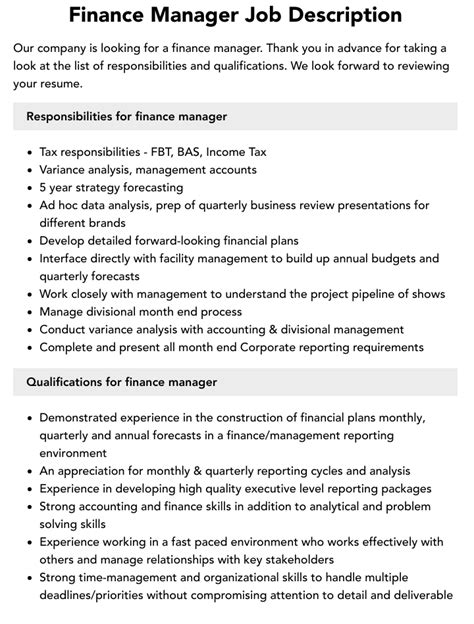

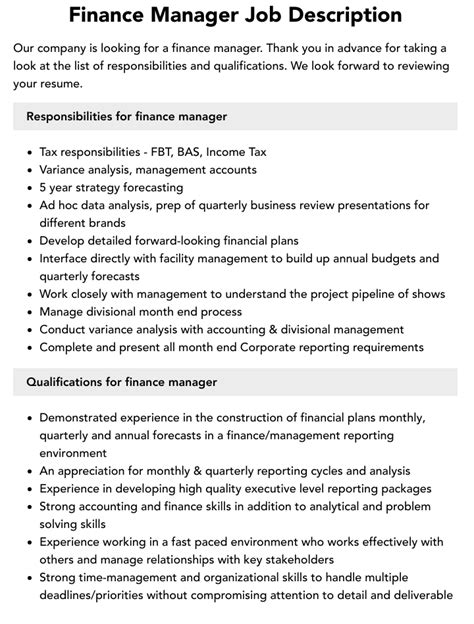

Key Responsibilities of a Financial Manager

A financial manager’s primary responsibilities include: * Financial planning and budgeting: Developing and implementing financial plans and budgets to achieve the company’s goals and objectives. * Financial reporting and analysis: Preparing and analyzing financial reports, such as balance sheets and income statements, to provide insights into the company’s financial performance. * Investment and funding: Managing the company’s investments and funding requirements, including sourcing and securing funding from various sources, such as banks and investors. * Risk management: Identifying and mitigating financial risks, such as market risk, credit risk, and operational risk, to ensure the company’s financial stability. * Cash management: Managing the company’s cash flow and ensuring that there is sufficient liquidity to meet its financial obligations.

Skills and Qualifications of a Financial Manager

To be a successful financial manager, one requires a combination of technical, business, and interpersonal skills. Some of the key skills and qualifications include: * Financial knowledge and expertise: A strong understanding of financial concepts, principles, and practices, including accounting, finance, and economics. * Analytical and problem-solving skills: The ability to analyze financial data, identify problems, and develop effective solutions. * Communication and interpersonal skills: The ability to communicate financial information and plans to various stakeholders, including management, employees, and investors. * Leadership and management skills: The ability to lead and manage teams, including financial staff, and make strategic decisions. * Professional certifications: Relevant professional certifications, such as Chartered Financial Analyst (CFA) or Certified Public Accountant (CPA), can be beneficial in demonstrating expertise and commitment to the field.

Types of Financial Managers

There are several types of financial managers, including: * Controller: Responsible for managing the company’s accounting and financial reporting functions. * Treasurer: Responsible for managing the company’s cash flow, funding, and investment activities. * Financial analyst: Responsible for analyzing financial data and providing insights to support business decisions. * Risk manager: Responsible for identifying and mitigating financial risks to ensure the company’s financial stability. * Investment manager: Responsible for managing the company’s investments and portfolio.

Importance of Financial Management

Financial management is essential for any organization, as it helps to: * Achieve business objectives: Financial management helps to ensure that the company has the necessary financial resources to achieve its business objectives. * Maximize shareholder value: Financial management helps to maximize shareholder value by making informed investment and funding decisions. * Minimize risk: Financial management helps to identify and mitigate financial risks, ensuring the company’s financial stability and security. * Improve financial performance: Financial management helps to improve financial performance by analyzing financial data, identifying areas for improvement, and developing effective solutions.

📝 Note: Financial management is a critical function that requires a deep understanding of financial concepts, principles, and practices, as well as strong analytical, communication, and leadership skills.

Challenges Facing Financial Managers

Financial managers face several challenges, including: * Global economic uncertainty: Financial managers must navigate global economic uncertainty, including market volatility, currency fluctuations, and trade tensions. * Regulatory compliance: Financial managers must ensure that the company complies with relevant financial regulations, including tax laws, accounting standards, and securities laws. * Technological disruption: Financial managers must adapt to technological disruption, including the use of artificial intelligence, blockchain, and cloud computing. * Cybersecurity risks: Financial managers must mitigate cybersecurity risks, including data breaches, phishing attacks, and ransomware attacks.

Best Practices for Financial Managers

To be a successful financial manager, one should follow best practices, including: * Stay up-to-date with industry trends: Stay informed about industry trends, including regulatory changes, technological advancements, and market developments. * Develop a strong financial plan: Develop a comprehensive financial plan that aligns with the company’s business objectives and strategy. * Monitor and analyze financial performance: Regularly monitor and analyze financial performance, identifying areas for improvement and developing effective solutions. * Communicate effectively: Communicate financial information and plans to various stakeholders, including management, employees, and investors.

Conclusion

In summary, the role of a financial manager is critical in any organization, as they are responsible for overseeing and managing the financial activities of the company. Financial managers must possess a combination of technical, business, and interpersonal skills, including financial knowledge and expertise, analytical and problem-solving skills, and communication and leadership skills. By following best practices, including staying up-to-date with industry trends, developing a strong financial plan, monitoring and analyzing financial performance, and communicating effectively, financial managers can help to achieve business objectives, maximize shareholder value, minimize risk, and improve financial performance.

What is the primary role of a financial manager?

+

The primary role of a financial manager is to oversee and manage the financial activities of an organization, including financial planning, budgeting, reporting, and analysis.

What skills and qualifications are required to be a successful financial manager?

+

To be a successful financial manager, one requires a combination of technical, business, and interpersonal skills, including financial knowledge and expertise, analytical and problem-solving skills, and communication and leadership skills.

What are some of the challenges facing financial managers?

+

Financial managers face several challenges, including global economic uncertainty, regulatory compliance, technological disruption, and cybersecurity risks.

Related Terms:

- Role of financial manager PDF

- Role of financial manager ppt

- Five role of financial manager

- Financial management definition

- Career financial management

- Skill finance manager