5 Tips SC State Employee Insurance

Introduction to SC State Employee Insurance

As a state employee in South Carolina, understanding the insurance options available to you is crucial for securing your health and financial well-being. The SC State Employee Insurance program offers a range of benefits designed to support employees and their families. In this article, we will delve into five essential tips to help you navigate and make the most out of your state employee insurance.

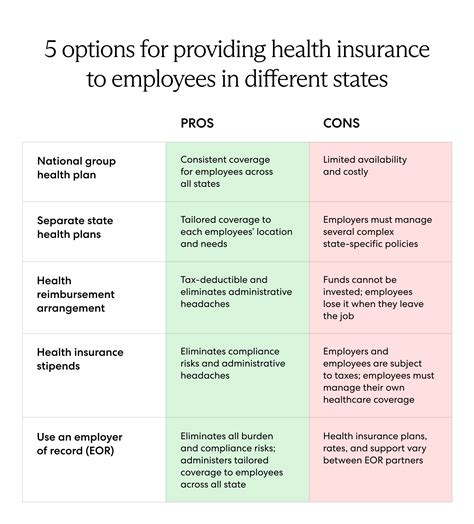

Understanding Your Insurance Options

Before diving into the tips, it’s essential to have a basic understanding of the insurance options provided by the state. The SC State Employee Insurance program typically includes health, dental, vision, life, and disability insurance. Each of these components plays a significant role in ensuring comprehensive coverage.

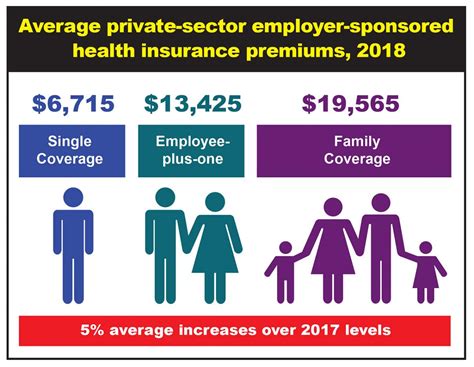

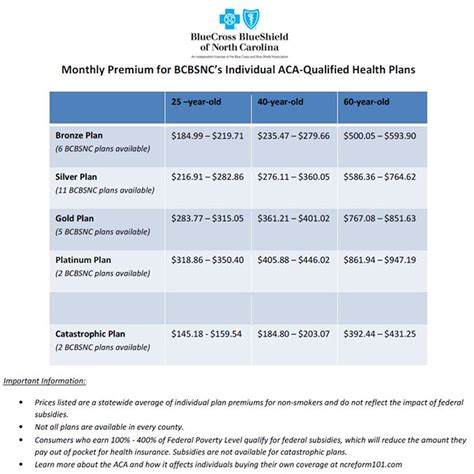

- Health Insurance: Covers medical expenses, including doctor visits, hospital stays, and prescriptions.

- Dental Insurance: Provides coverage for dental care, including routine check-ups, fillings, and more complex procedures.

- Vision Insurance: Offers benefits for eye exams, glasses, and contact lenses.

- Life Insurance: Provides a financial safety net for your family in the event of your passing.

- Disability Insurance: Offers income protection if you become unable to work due to illness or injury.

Tips for Maximizing Your Benefits

Here are five tips to help you make the most out of your SC State Employee Insurance:

Review and Understand Your Coverage: It’s crucial to thoroughly review your insurance plans to understand what is covered and what is not. This includes knowing your deductibles, copays, and any limitations or exclusions.

Utilize Preventive Care Services: Many insurance plans cover preventive care services like annual physicals, vaccinations, and screenings without additional cost. Taking advantage of these services can help prevent health issues and reduce your medical expenses in the long run.

Consider Your Dependent Coverage: If you have a family, ensure you understand how your dependents are covered under your plan. This includes spouses, children, and sometimes other relatives. Knowing how to add or remove dependents and understanding their coverage can help you avoid unexpected medical bills.

Keep Your Information Up-to-Date: Ensure that your personal and beneficiary information is current. This is particularly important for life insurance and other benefits that require beneficiary designations.

Explore Additional Benefits and Discounts: Some insurance plans and employers offer additional benefits or discounts for certain services, such as fitness programs, wellness initiatives, or even discounts on insurance premiums for non-smokers or participants in health programs.

Notes on Open Enrollment

📝 Note: Open enrollment periods are crucial for making changes to your insurance coverage. It’s the time when you can enroll in, change, or cancel your insurance plans. Marking these periods on your calendar and preparing in advance can help you make informed decisions about your coverage.

Using Your Benefits Wisely

To get the most out of your SC State Employee Insurance, consider the following strategies: - Compare Plans: If multiple plan options are available, compare them based on your needs, budget, and health status. - Network Providers: Understanding which healthcare providers are in-network can help reduce your out-of-pocket costs. - Pre-Authorizations: Some services may require pre-authorization from your insurance provider. Knowing which services need pre-approval can prevent claim denials.

| Insurance Type | Description |

|---|---|

| Health Insurance | Covers medical expenses, including doctor visits and hospital stays. |

| Dental Insurance | Provides coverage for dental care, including routine check-ups and fillings. |

| Vision Insurance | Offers benefits for eye exams, glasses, and contact lenses. |

| Life Insurance | Provides a financial safety net for your family in the event of your passing. |

| Disability Insurance | Offers income protection if you become unable to work due to illness or injury. |

In summary, navigating the SC State Employee Insurance program requires a thorough understanding of the available options and how to maximize your benefits. By reviewing your coverage, utilizing preventive care services, considering dependent coverage, keeping your information up-to-date, and exploring additional benefits, you can ensure you and your family are well-protected. Remember, understanding your insurance is key to making informed decisions about your health and financial security.

What is covered under the SC State Employee health insurance plan?

+

The SC State Employee health insurance plan typically covers medical expenses, including doctor visits, hospital stays, prescriptions, and sometimes additional services like mental health support and substance abuse treatment.

How do I enroll in or change my insurance plan?

+

Enrollment and changes to your insurance plan usually occur during the open enrollment period. This is a specific time frame when you can enroll in, change, or cancel your insurance plans. It’s essential to mark these periods on your calendar and prepare in advance to make informed decisions about your coverage.

Can I add or remove dependents from my insurance plan?

+

Related Terms:

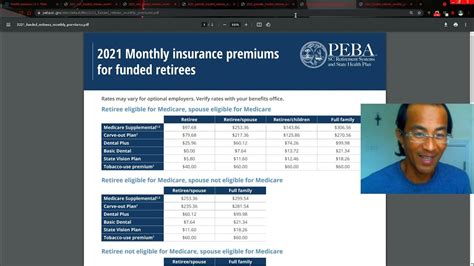

- PEBA Retiree insurance premiums

- Vision insurance sc

- SC PEBA Retirement Health Insurance

- PEBA Life insurance premiums

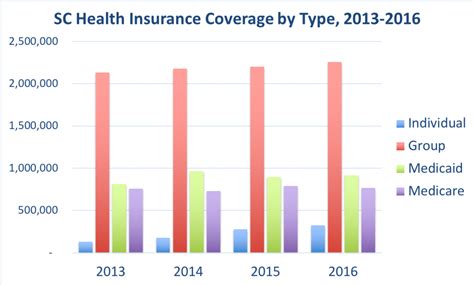

- State health insurance

- SC health insurance