Scan Health Plan Choices Wisely

Introduction to Health Plan Choices

When it comes to selecting a health plan, there are numerous options available, each with its own set of benefits and drawbacks. With the rising costs of healthcare, it’s essential to scan health plan choices wisely to ensure you’re getting the best value for your money. In this article, we’ll delve into the world of health plans, exploring the various types, their features, and what to consider when making a decision.

Types of Health Plans

There are several types of health plans to choose from, including: * Health Maintenance Organization (HMO): A type of plan that requires you to receive medical care from a specific network of providers. * Preferred Provider Organization (PPO): A plan that offers a network of providers, but also allows you to see doctors outside of the network at a higher cost. * Exclusive Provider Organization (EPO): A plan that offers a network of providers, but does not cover care from doctors outside of the network, except in emergency situations. * Point of Service (POS): A plan that combines features of HMO and PPO plans, allowing you to choose between different types of care. * High-Deductible Health Plan (HDHP): A plan that has a higher deductible than traditional plans, but often comes with lower premiums.

Factors to Consider When Choosing a Health Plan

When selecting a health plan, there are several factors to consider, including: * Premium costs: The amount you pay each month for your health plan. * Deductible: The amount you must pay out-of-pocket before your health plan begins to cover costs. * Co-payments and co-insurance: The amount you pay for medical services after meeting your deductible. * Network of providers: The list of doctors, hospitals, and other healthcare providers that participate in your health plan. * Coverage for pre-existing conditions: Whether your health plan covers pre-existing medical conditions. * Maximum out-of-pocket expenses: The maximum amount you can be required to pay for medical expenses in a given year.

Benefits of Each Type of Health Plan

Each type of health plan has its own set of benefits, including: * HMO: Lower premiums, comprehensive coverage, and a focus on preventive care. * PPO: Flexibility to see doctors outside of the network, comprehensive coverage, and a wide range of providers. * EPO: Lower premiums, comprehensive coverage, and a focus on preventive care. * POS: Flexibility to choose between different types of care, comprehensive coverage, and a wide range of providers. * HDHP: Lower premiums, tax benefits, and a health savings account (HSA) to help pay for medical expenses.

Drawbacks of Each Type of Health Plan

Each type of health plan also has its own set of drawbacks, including: * HMO: Limited flexibility to see doctors outside of the network, higher costs for non-network care. * PPO: Higher premiums, higher costs for non-network care. * EPO: Limited flexibility to see doctors outside of the network, higher costs for non-network care. * POS: Higher premiums, higher costs for non-network care. * HDHP: Higher deductible, higher out-of-pocket expenses.

Table Comparing Health Plans

| Health Plan | Premium Costs | Deductible | Co-payments and Co-insurance | Network of Providers |

|---|---|---|---|---|

| HMO | Lower | Lower | Lower | Limited |

| PPO | Higher | Higher | Higher | Wide |

| EPO | Lower | Lower | Lower | Limited |

| POS | Higher | Higher | Higher | Wide |

| HDHP | Lower | Higher | Higher | Varies |

📝 Note: When choosing a health plan, it's essential to consider your individual needs and circumstances, including your health status, budget, and lifestyle.

Final Thoughts on Choosing a Health Plan

Choosing a health plan can be a daunting task, but by considering your individual needs and circumstances, you can make an informed decision. Remember to scan health plan choices wisely, considering factors such as premium costs, deductible, co-payments and co-insurance, network of providers, coverage for pre-existing conditions, and maximum out-of-pocket expenses. By doing your research and weighing the benefits and drawbacks of each type of health plan, you can find the best plan for you and your family.

In the end, selecting a health plan is a personal decision that requires careful consideration of your individual needs and circumstances. By taking the time to research and compare different health plans, you can make an informed decision and find the best plan for you and your family. It’s crucial to prioritize your health and well-being by choosing a plan that provides comprehensive coverage and fits your budget. With the right health plan, you can have peace of mind knowing that you’re protected in case of unexpected medical expenses.

What is the main difference between an HMO and a PPO?

+

The main difference between an HMO and a PPO is the flexibility to see doctors outside of the network. HMOs typically require you to receive medical care from a specific network of providers, while PPOs offer more flexibility to see doctors outside of the network at a higher cost.

What is a high-deductible health plan (HDHP)?

+

A high-deductible health plan (HDHP) is a type of health plan that has a higher deductible than traditional plans, but often comes with lower premiums. HDHPs are designed to be used in conjunction with a health savings account (HSA), which allows you to set aside pre-tax dollars to pay for medical expenses.

What should I consider when choosing a health plan?

+

When choosing a health plan, you should consider factors such as premium costs, deductible, co-payments and co-insurance, network of providers, coverage for pre-existing conditions, and maximum out-of-pocket expenses. You should also consider your individual needs and circumstances, including your health status, budget, and lifestyle.

Related Terms:

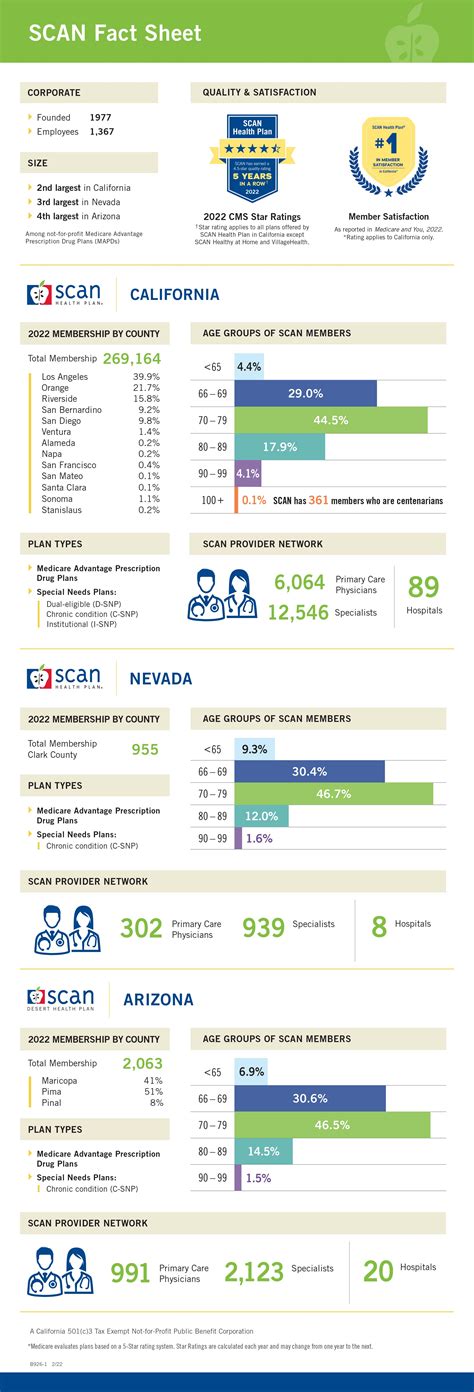

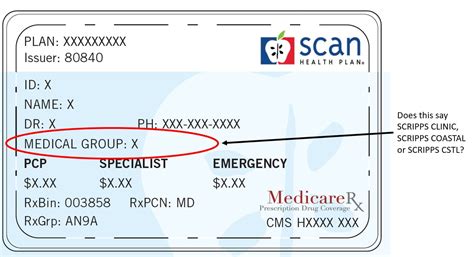

- SCAN Health Plan Provider Portal

- SCAN Health Plan complaints

- SCAN Health Plan 2025

- SCAN Health Plan benefits

- SCAN Health Plan providers

- SCAN Health Plan hospitals