SEGIP Health Insurance Cost After Retirement

Introduction to SEGIP Health Insurance

SEGIP (State Employee Group Insurance Program) is a health insurance program designed for state employees in certain jurisdictions. The program provides comprehensive health insurance coverage to eligible employees, including medical, dental, and vision care. One of the key benefits of SEGIP is that it can be continued into retirement, but the cost and coverage details may change. Understanding these changes is crucial for retirees to make informed decisions about their health insurance.

Eligibility for SEGIP After Retirement

To be eligible for SEGIP health insurance after retirement, individuals must have been enrolled in the program as active employees. The specific eligibility criteria may vary, but generally, retirees must meet certain age and service requirements. For example, they might need to be at least 55 years old with a specified number of years of service. It’s essential to review the program’s rules, as they can change and may affect an individual’s eligibility.

Cost of SEGIP Health Insurance After Retirement

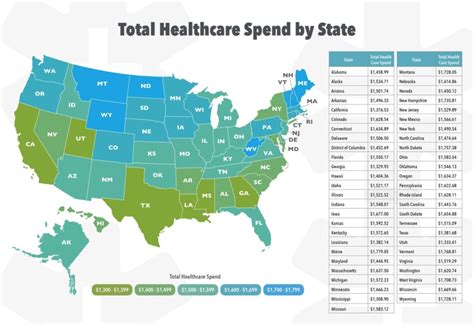

The cost of SEGIP health insurance for retirees can differ significantly from the rates during active employment. Generally, retirees pay a larger portion of the premium, as the employer’s contribution decreases or stops upon retirement. The exact cost depends on several factors, including: - Age: Older retirees may pay higher premiums due to the increased cost of health care with age. - Retirement Date: The timing of retirement can impact premiums, as rates may increase over time. - Plan Selection: The type of health insurance plan chosen (e.g., individual, family, Medicare supplement) affects the premium cost. - Location: Geographic location can influence health insurance premiums, as health care costs vary by region.

Understanding Premium Increases

Premium increases for SEGIP health insurance after retirement can be substantial due to the factors mentioned above. It’s crucial for retirees to budget accordingly and consider these increases when planning their retirement finances. Sometimes, retirees may opt for Medicare and a Medicare Supplement plan to manage their health care costs, especially if they are 65 or older.

Managing Health Insurance Costs in Retirement

To manage health insurance costs in retirement, individuals should: - Review and Compare Plans: Annually review the available plans and their costs to ensure they have the best option for their needs and budget. - Budget for Increases: Anticipate premium increases and factor them into retirement financial planning. - Consider Medicare Options: If eligible, explore Medicare and Medicare Supplement plans as potentially more affordable alternatives. - Utilize Health Savings Accounts (HSAs): Contributing to an HSA during working years can provide a tax-advantaged way to save for health care expenses in retirement.

📝 Note: It's vital for retirees to stay informed about any changes to the SEGIP program, including eligibility, coverage, and costs, to ensure they can make the best decisions for their health insurance needs.

Conclusion and Future Planning

In summary, the cost of SEGIP health insurance after retirement can be significant, and understanding the factors that influence these costs is key to managing them effectively. Retirees should stay informed about the program, review their options annually, and plan their finances accordingly to ensure they can afford the health care they need. By being proactive and considering all available options, including Medicare and supplemental plans, retirees can navigate the complexities of health insurance in retirement with confidence.

How do I enroll in SEGIP health insurance after retirement?

+

To enroll in SEGIP health insurance after retirement, you typically need to meet the program’s eligibility criteria, which includes being enrolled in the program as an active employee and meeting specific age and service requirements. You should contact your state’s insurance program administrator for detailed instructions and to confirm your eligibility.

Can I change my SEGIP health insurance plan after retirement?

+

Yes, you can change your SEGIP health insurance plan after retirement, but there may be limitations and specific windows during which you can make changes. Typically, changes can be made during annual open enrollment periods or due to qualifying life events. It’s essential to review the plan’s rules and contact the plan administrator for guidance.

How does Medicare affect my SEGIP health insurance costs and coverage?

+

Medicare can significantly affect your SEGIP health insurance costs and coverage, especially if you are 65 or older. Depending on your situation, enrolling in Medicare and possibly purchasing a Medicare Supplement plan might be more cost-effective than continuing with SEGIP alone. It’s crucial to understand how Medicare interacts with your SEGIP coverage and to consult with a benefits advisor to make the best decision for your situation.

Related Terms:

- SEGIP retirement

- State Employee retiree health insurance

- Minnesota teachers retirement health insurance

- Retirement medical insurance

- SEGIP Open Enrollment 2025

- SEGIP Schedule of Benefits