Health

Setting Up Gusto Health Deductions

Introduction to Gusto Health Deductions

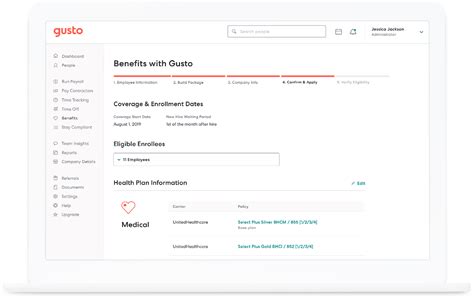

Gusto is a popular platform for managing payroll, benefits, and human resources. One of the key features of Gusto is its ability to handle health deductions, making it easier for employers to manage their employees’ health benefits. In this post, we will walk through the steps of setting up Gusto health deductions, highlighting the importance of accuracy and compliance with regulations.

Understanding Gusto Health Deductions

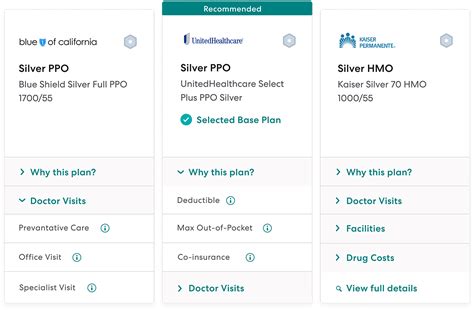

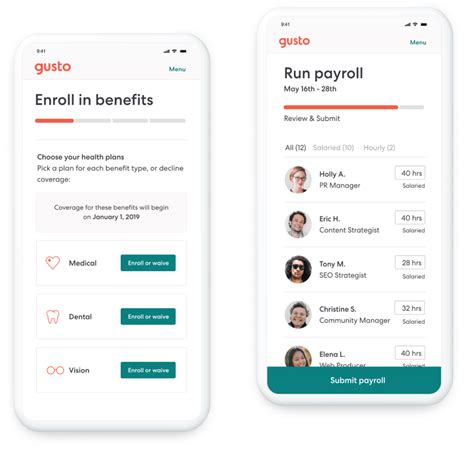

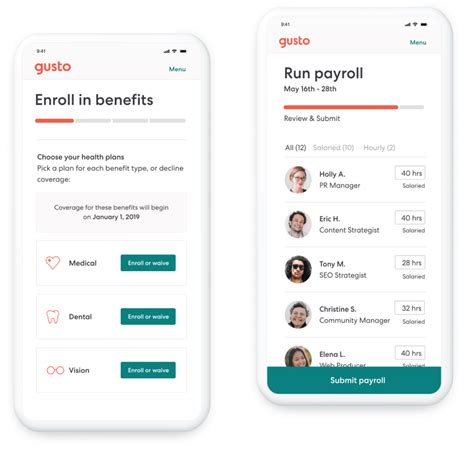

Before diving into the setup process, it’s essential to understand how Gusto health deductions work. Gusto health deductions allow employers to deduct premiums for health insurance from their employees’ paychecks. This feature is particularly useful for companies that offer group health insurance plans to their employees. By setting up health deductions in Gusto, employers can ensure that the correct amounts are deducted from each employee’s paycheck and that the deductions are accurately reported for tax purposes.

Setting Up Gusto Health Deductions

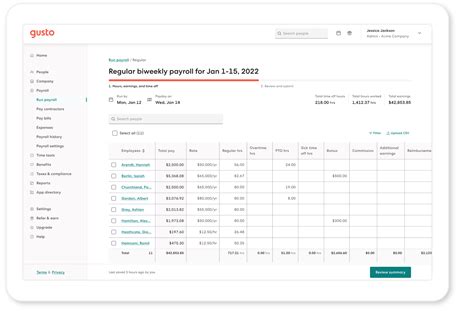

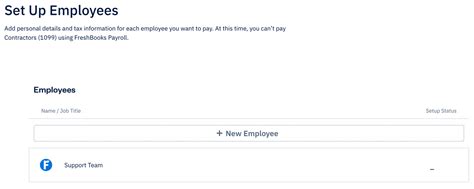

To set up Gusto health deductions, follow these steps: * Log in to your Gusto account and navigate to the Benefits tab. * Click on Health Insurance and then select Add a Health Insurance Plan. * Enter the details of your health insurance plan, including the plan name, provider, and premium amounts. * Configure the deduction settings, including the deduction amount, frequency, and start date. * Assign the health insurance plan to the relevant employees, either individually or in bulk.

📝 Note: Make sure to review and verify the accuracy of the plan details and deduction settings before saving the changes.

Key Considerations for Gusto Health Deductions

When setting up Gusto health deductions, there are several key considerations to keep in mind: * Compliance with regulations: Ensure that your health deductions comply with relevant regulations, such as the Affordable Care Act (ACA) and the Employee Retirement Income Security Act (ERISA). * Accurate reporting: Verify that the deductions are accurately reported for tax purposes, including on the employees’ W-2 forms. * Employee communication: Communicate the health deduction details to your employees, including the amount, frequency, and start date of the deductions. * Plan administration: Ensure that the health insurance plan is administered correctly, including timely payments and accurate enrollment and disenrollment of employees.

Common Challenges with Gusto Health Deductions

While setting up Gusto health deductions can be straightforward, there are common challenges that employers may encounter: * Inaccurate plan details: Incorrect or incomplete plan details can lead to errors in deductions and reporting. * Deduction discrepancies: Discrepancies between the deduction amounts and the actual premium payments can cause issues with the health insurance plan administration. * Employee confusion: Poor communication or lack of transparency can lead to confusion among employees about their health deductions.

Best Practices for Managing Gusto Health Deductions

To ensure smooth management of Gusto health deductions, follow these best practices: * Regularly review and update plan details: Verify the accuracy of plan details and update them as necessary to reflect changes in the health insurance plan. * Monitor deduction discrepancies: Regularly review deduction amounts and actual premium payments to identify and address any discrepancies. * Communicate clearly with employees: Provide transparent and timely communication to employees about their health deductions, including any changes or updates.

Conclusion and Final Thoughts

Setting up Gusto health deductions requires attention to detail and a thorough understanding of the platform’s features and regulations. By following the steps outlined in this post and keeping key considerations in mind, employers can ensure accurate and compliant health deductions for their employees. Remember to regularly review and update plan details, monitor deduction discrepancies, and communicate clearly with employees to ensure a smooth and efficient management of Gusto health deductions.

What is the purpose of Gusto health deductions?

+

Gusto health deductions allow employers to deduct premiums for health insurance from their employees’ paychecks, making it easier to manage group health insurance plans.

How do I set up Gusto health deductions?

+

To set up Gusto health deductions, log in to your Gusto account, navigate to the Benefits tab, and follow the prompts to add a health insurance plan and configure the deduction settings.

What are some common challenges with Gusto health deductions?

+

Common challenges with Gusto health deductions include inaccurate plan details, deduction discrepancies, and employee confusion. Regular review and communication can help mitigate these issues.

Related Terms:

- gusto health insurance benefits

- gusto health insurance for employees