Short Term Health Care Plans Options

Introduction to Short Term Health Care Plans

Short term health care plans are a type of health insurance that provides temporary coverage for individuals and families. These plans are designed to fill gaps in coverage, providing protection against unexpected medical expenses. With the rising costs of healthcare, short term plans have become increasingly popular as a affordable alternative to traditional major medical insurance. Key benefits of short term plans include lower premiums, flexibility, and quick enrollment.

How Short Term Health Care Plans Work

Short term health care plans typically offer coverage for a limited period, usually between 1-12 months, depending on the state and insurance provider. These plans often have lower premiums compared to traditional major medical insurance, but they also have limited benefits. Short term plans usually cover essential medical services such as doctor visits, hospital stays, and surgical procedures, but may not include coverage for pre-existing conditions, preventive care, or prescription medications.

Types of Short Term Health Care Plans

There are several types of short term health care plans available, including: * Standard short term plans: These plans provide basic coverage for medical services, including doctor visits, hospital stays, and surgical procedures. * Premium short term plans: These plans offer more comprehensive coverage, including coverage for pre-existing conditions, preventive care, and prescription medications. * Catastrophic short term plans: These plans provide limited coverage for catastrophic medical events, such as accidents or illnesses that require hospitalization. * Limited benefit short term plans: These plans provide limited coverage for specific medical services, such as doctor visits or prescription medications.

Benefits of Short Term Health Care Plans

Short term health care plans offer several benefits, including: * Lower premiums: Short term plans typically have lower premiums compared to traditional major medical insurance. * Flexibility: Short term plans can be tailored to meet individual needs, with flexible coverage periods and benefits. * Quick enrollment: Short term plans often have quick enrollment processes, with coverage starting as soon as the next day. * No open enrollment period: Short term plans can be purchased at any time, without the need to wait for an open enrollment period.

Drawbacks of Short Term Health Care Plans

While short term health care plans offer several benefits, they also have some drawbacks, including: * Limited benefits: Short term plans often have limited benefits, which may not provide adequate coverage for unexpected medical expenses. * Pre-existing condition exclusions: Short term plans may exclude coverage for pre-existing conditions, which can leave individuals with limited coverage options. * No guarantee of renewal: Short term plans often have no guarantee of renewal, which can leave individuals without coverage at the end of the plan period.

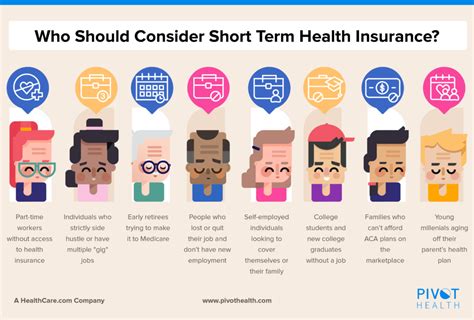

Who Should Consider Short Term Health Care Plans

Short term health care plans may be a good option for: * Individuals between jobs: Short term plans can provide temporary coverage for individuals between jobs or waiting for new employer-sponsored coverage to start. * Students: Short term plans can provide affordable coverage for students who are no longer eligible for parental coverage. * Retirees: Short term plans can provide temporary coverage for retirees waiting for Medicare coverage to start. * Self-employed individuals: Short term plans can provide affordable coverage for self-employed individuals who do not have access to employer-sponsored coverage.

📝 Note: Short term health care plans are not a substitute for traditional major medical insurance, and individuals should carefully review the plan benefits and limitations before purchasing.

How to Choose the Right Short Term Health Care Plan

When choosing a short term health care plan, individuals should consider the following factors: * Coverage period: Consider the length of time you need coverage, and choose a plan that meets your needs. * Benefits: Review the plan benefits and limitations, and choose a plan that provides adequate coverage for your needs. * Premiums: Compare premiums from different insurance providers, and choose a plan that fits your budget. * Insurance provider: Research the insurance provider, and choose a reputable company with good customer service.

| Plan Type | Coverage Period | Benefits | Premiums |

|---|---|---|---|

| Standard short term plan | 1-12 months | Basic medical services | $100-$300 per month |

| Premium short term plan | 1-12 months | Comprehensive medical services | $300-$600 per month |

| Catastrophic short term plan | 1-12 months | Catastrophic medical events | $50-$100 per month |

In summary, short term health care plans can provide temporary coverage for individuals and families, offering lower premiums, flexibility, and quick enrollment. However, these plans often have limited benefits, pre-existing condition exclusions, and no guarantee of renewal. Individuals should carefully review the plan benefits and limitations before purchasing, and consider their individual needs and circumstances.

What is a short term health care plan?

+

A short term health care plan is a type of health insurance that provides temporary coverage for individuals and families.

Who should consider short term health care plans?

+

Short term health care plans may be a good option for individuals between jobs, students, retirees, and self-employed individuals who do not have access to employer-sponsored coverage.

How do I choose the right short term health care plan?

+

When choosing a short term health care plan, consider the coverage period, benefits, premiums, and insurance provider. Carefully review the plan benefits and limitations before purchasing.

Related Terms:

- Best short term health insurance

- Short term health insurance Massachusetts

- Aetna short term health insurance

- Short term health insurance Virginia

- Cigna short term health insurance

- Anthem short term health insurance