5 Tips Sickle Cell Insurance

Understanding Sickle Cell Disease and Insurance

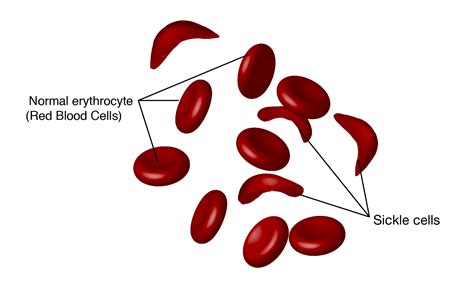

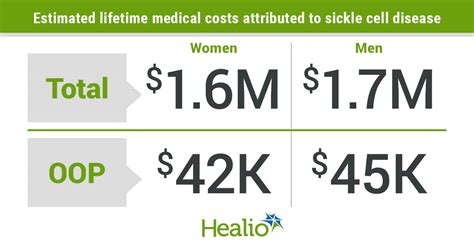

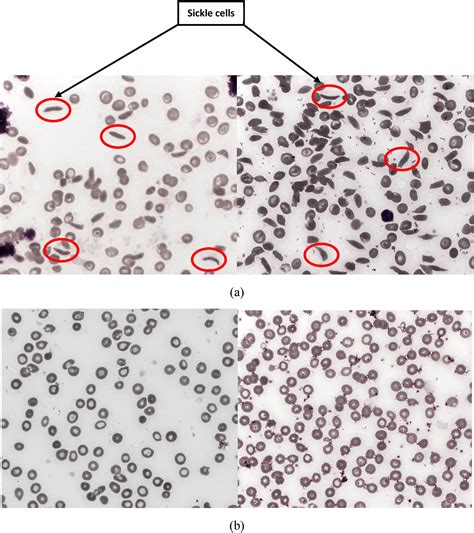

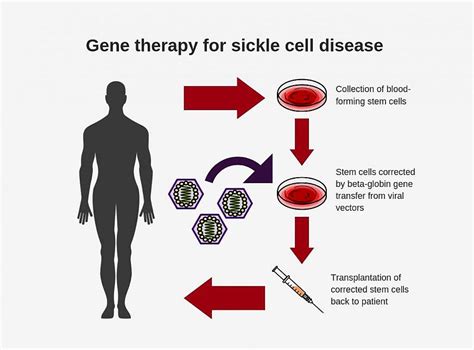

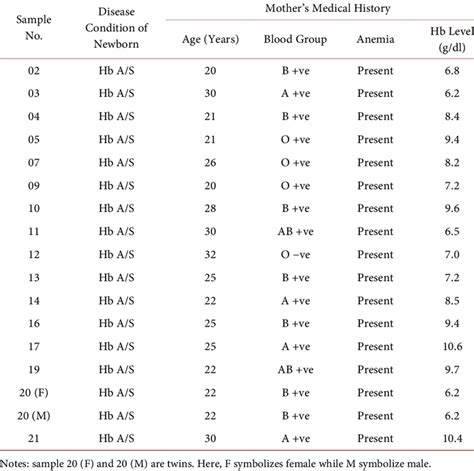

Sickle cell disease is a genetic disorder that affects the production of hemoglobin, a protein in red blood cells that carries oxygen to different parts of the body. It leads to the production of abnormal hemoglobin, causing red blood cells to be misshapen and break down. People with sickle cell disease may experience a range of symptoms, from mild to severe, including episodes of pain, increased risk of infections, and potential damage to organs such as the heart, lungs, and liver. Managing the disease requires regular medical care, which can be costly. Therefore, having the right insurance coverage is crucial for individuals with sickle cell disease.

Tip 1: Choose the Right Health Insurance Plan

Choosing the right health insurance plan is vital for managing the costs associated with sickle cell disease. Look for plans that cover pre-existing conditions without exclusions or waiting periods. Also, consider the plan’s network of healthcare providers to ensure that your current healthcare team is included. It’s also important to understand the plan’s out-of-pocket costs, including deductibles, copays, and coinsurance, as these can significantly impact your expenses.

Tip 2: Understand Your Prescription Coverage

Many individuals with sickle cell disease require ongoing medication to manage their condition. Understanding your prescription coverage is essential to ensure that you have access to the medications you need without incurring significant out-of-pocket costs. Check your plan’s formulary to see which medications are covered and at what cost. Some plans may offer specialty tiers for certain medications, which can affect your copay or coinsurance.

Tip 3: Consider Supplemental Insurance

Supplemental insurance can provide additional financial protection against the high costs of medical care for sickle cell disease. This can include disability insurance to replace income if you’re unable to work due to your condition, or critical illness insurance that provides a lump sum payment if you’re diagnosed with a critical illness. Evaluate your needs and consider whether supplemental insurance could provide valuable protection for you and your family.

Tip 4: Utilize Patient Assistance Programs

Many pharmaceutical companies offer patient assistance programs (PAPs) to help make their medications more affordable. These programs can provide significant savings on prescription medications. Additionally, some organizations specialize in helping patients with chronic conditions, including sickle cell disease, access affordable healthcare. Research available programs and apply to those that can help reduce your medical expenses.

Tip 5: Advocate for Yourself

Advocating for yourself is crucial when navigating the healthcare and insurance systems. This means understanding your rights under the Affordable Care Act (ACA), such as the prohibition against denying coverage for pre-existing conditions. It also involves keeping detailed records of your medical care, including bills, insurance claims, and communications with your healthcare providers and insurance company. Don’t hesitate to reach out to your insurance company or a patient advocate for help when you need it.

📝 Note: Always review the terms and conditions of your insurance plan carefully and ask questions if you're unsure about any aspect of your coverage.

In summary, managing sickle cell disease requires a comprehensive approach that includes the right health insurance coverage, understanding of prescription benefits, consideration of supplemental insurance, utilization of patient assistance programs, and self-advocacy. By taking these steps, individuals with sickle cell disease can better navigate the healthcare system and reduce the financial burden of their condition, ensuring they receive the care they need to manage their health effectively.

What is the primary challenge in managing sickle cell disease from an insurance perspective?

+

The primary challenge is often the high cost of ongoing medical care and medications, which can be mitigated by choosing the right health insurance plan and understanding available financial assistance programs.

How can individuals with sickle cell disease advocate for themselves in the healthcare system?

+

Individuals can advocate for themselves by keeping detailed records of their care, understanding their insurance coverage, and not hesitating to ask questions or seek help from patient advocates when needed.

What role do patient assistance programs play in managing the cost of sickle cell disease treatment?

+

Patient assistance programs can significantly reduce the cost of prescription medications and other aspects of care, making treatment more affordable for individuals with sickle cell disease.

Related Terms:

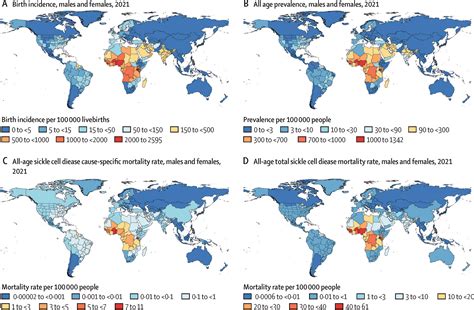

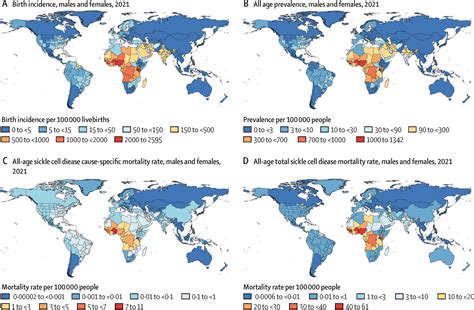

- Sickle cell disease statistics worldwide

- Sickle cell anemia

- Burden of sickle cell disease

- Cost of sickle cell disease

- Sickle cell disease life expectancy

- Sickle cell dataset