Florida Small Business Health Insurance Options

Introduction to Florida Small Business Health Insurance

In Florida, small businesses have various health insurance options to choose from, catering to different needs and budgets. Providing health insurance to employees can be a significant decision for small business owners, as it not only affects the well-being of their staff but also impacts the overall productivity and success of the business. Understanding the available options is crucial for making informed decisions that balance the needs of both the business and its employees.

Types of Health Insurance Plans for Small Businesses in Florida

Florida offers a range of health insurance plans designed specifically for small businesses. These include: - Group Health Insurance Plans: These plans are designed for businesses with a small number of employees, typically fewer than 50. They can offer comprehensive coverage, including medical, dental, and vision insurance. - Professional Employer Organizations (PEOs): PEOs allow small businesses to outsource their HR tasks, including health insurance. By pooling resources with other businesses, PEOs can offer more competitive rates and a broader range of benefits. - Association Health Plans (AHPs): AHPs enable small businesses to band together to purchase health insurance as a group, potentially reducing costs and expanding coverage options. - Short-Term Limited-Duration Insurance (STLDI): These plans offer temporary health insurance coverage for a limited period, typically up to 12 months. They are generally more affordable but provide less comprehensive coverage.

Key Considerations for Choosing a Health Insurance Plan

When selecting a health insurance plan for their small business, owners in Florida should consider the following key factors: - Cost: The premium costs for the business and the portion that employees may need to contribute. - Coverage: The types of medical services covered, including preventive care, hospital stays, and prescription medications. - Network: The healthcare providers and facilities that are part of the plan’s network, ensuring accessibility for employees. - Deductibles and Out-of-Pocket Expenses: The amounts that employees must pay before insurance coverage kicks in and the maximum out-of-pocket expenses they might incur. - Pre-existing Conditions: How the plan handles pre-existing health conditions, especially if employees have ongoing health issues.

Benefits of Offering Health Insurance to Employees

Offering health insurance can have numerous benefits for both the business and its employees: - Attracting and Retaining Talent: Comprehensive health insurance is a valuable benefit that can attract top talent and encourage employee retention. - Improving Productivity: When employees have access to necessary healthcare, they are more likely to be healthy and productive, benefiting the business as a whole. - Tax Benefits: Small businesses may be eligible for tax credits or deductions for providing health insurance to their employees.

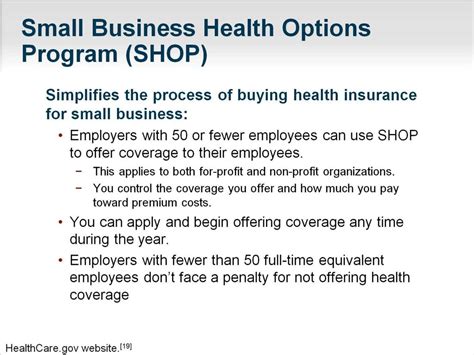

Florida Small Business Health Insurance Marketplace

The health insurance marketplace in Florida offers small businesses a platform to find and compare various health insurance plans. This platform can help businesses navigate the complexities of health insurance and make informed decisions about their coverage needs.

📝 Note: Small businesses should consult with a licensed health insurance broker or agent who is knowledgeable about the Florida market to get the most suitable plan for their specific needs.

Conclusion and Future Outlook

In conclusion, navigating the world of small business health insurance in Florida requires careful consideration of various factors, including plan types, costs, coverage, and the specific needs of the business and its employees. By understanding the available options and their implications, small business owners can make informed decisions that support the well-being of their employees and the long-term success of their business. As the healthcare landscape continues to evolve, staying informed about changes in health insurance options and regulations will be crucial for small businesses in Florida.

What types of health insurance plans are available for small businesses in Florida?

+

Small businesses in Florida can choose from group health insurance plans, Professional Employer Organizations (PEOs), Association Health Plans (AHPs), and Short-Term Limited-Duration Insurance (STLDI) plans, each catering to different needs and budgets.

How do I choose the right health insurance plan for my small business in Florida?

+

Consider factors such as cost, coverage, network, deductibles, out-of-pocket expenses, and how the plan handles pre-existing conditions. It’s also beneficial to consult with a licensed health insurance broker or agent familiar with the Florida market.

What are the benefits of offering health insurance to my employees?

+

Offering health insurance can help attract and retain top talent, improve employee productivity, and may provide tax benefits for the business. It also contributes to the overall well-being and job satisfaction of employees.

Related Terms:

- Small business health insurance costs

- Small business health insurance Texas

- affordable florida group health insurance

- desantis small business health insurance

- florida blue small business plans

- florida small business insurance requirements