5 Ways Insurers Use Data

Introduction to Data Usage in Insurance

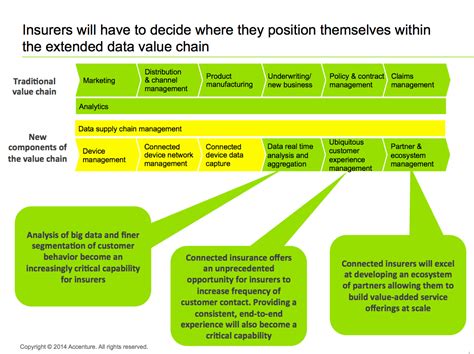

The insurance industry has undergone significant transformations in recent years, primarily driven by the advent of advanced technologies and the increasing availability of large datasets. Insurers are now leveraging data analytics to enhance their operations, improve customer experiences, and make informed decisions. The strategic use of data enables insurers to navigate complex risks, optimize pricing, and develop tailored products that meet the evolving needs of their policyholders. In this context, understanding how insurers utilize data is crucial for appreciating the modern insurance landscape.

Enhancing Risk Assessment

One of the primary ways insurers use data is to enhance risk assessment. By analyzing historical data, real-time information, and external data sources, insurers can better understand potential risks and adjust their policies accordingly. This includes assessing the likelihood of natural disasters, predicting the severity of diseases, and evaluating the safety of drivers. Advanced data analytics tools, such as machine learning algorithms, enable insurers to process vast amounts of data quickly and accurately, leading to more precise risk evaluations.

Personalizing Insurance Products

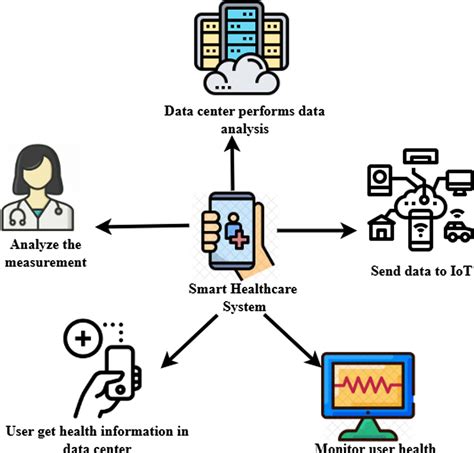

Data analytics also plays a critical role in personalizing insurance products. Insurers can use customer data to develop policies that are tailored to individual needs and preferences. For example, usage-based insurance for vehicles uses data from telematics devices to offer premiums based on actual driving habits, rather than general assumptions. Similarly, health insurance can be personalized by analyzing wearable device data, medical records, and lifestyle information to provide policies that are more relevant and cost-effective for each customer.

Improving Claims Processing

Another significant application of data in insurance is improving claims processing. Insurers can leverage advanced analytics and artificial intelligence to automate and streamline the claims handling process. This includes using image recognition software to assess damage, natural language processing to analyze claim descriptions, and predictive models to identify potential fraud. By reducing manual intervention and enhancing the accuracy of claims assessments, insurers can expedite the payout process, improve customer satisfaction, and minimize losses.

Optimizing Pricing Strategies

Data-driven insights are also essential for optimizing pricing strategies in insurance. By analyzing market trends, competitor pricing, and customer behavior, insurers can develop pricing models that are both competitive and profitable. Dynamic pricing, which involves adjusting premiums in real-time based on changing market conditions and customer preferences, is a notable example of how data analytics can inform pricing decisions. Furthermore, data analytics can help insurers identify high-value customers and offer them tailored pricing and services to enhance loyalty and retention.

Enhancing Customer Engagement

Lastly, insurers use data to enhance customer engagement and build stronger relationships with their policyholders. By analyzing customer interaction data, feedback, and social media activity, insurers can gain a deeper understanding of customer needs, preferences, and pain points. This information can be used to develop targeted marketing campaigns, offer personalized advice and support, and create engaging customer experiences across various touchpoints. Moreover, data analytics can help insurers identify opportunities to cross-sell and upsell relevant products and services, further enhancing customer value and loyalty.

💡 Note: The effective use of data in insurance requires a strong emphasis on data privacy and security, ensuring that customer information is protected and used responsibly.

In summary, the strategic use of data is transforming the insurance industry by enabling insurers to enhance risk assessment, personalize products, improve claims processing, optimize pricing strategies, and enhance customer engagement. As the availability and complexity of data continue to grow, insurers that leverage advanced data analytics and technologies will be better positioned to innovate, compete, and thrive in a rapidly evolving market.

What is the primary benefit of using data analytics in insurance?

+

The primary benefit of using data analytics in insurance is to enhance risk assessment, allowing insurers to make more informed decisions and develop tailored products that meet the evolving needs of their policyholders.

How do insurers use data to personalize insurance products?

+

Insurers use customer data, such as driving habits, medical records, and lifestyle information, to develop policies that are tailored to individual needs and preferences. This includes usage-based insurance and personalized health insurance policies.

What role does data analytics play in improving claims processing?

+

Data analytics plays a critical role in improving claims processing by automating and streamlining the claims handling process. This includes using image recognition software, natural language processing, and predictive models to assess damage, analyze claim descriptions, and identify potential fraud.