State Farm Group Health Insurance Plans

Introduction to State Farm Group Health Insurance Plans

State Farm is a well-known insurance provider that offers a wide range of insurance products, including group health insurance plans. These plans are designed to provide coverage to employees and their families, helping to protect them from the financial burden of medical expenses. In this article, we will delve into the details of State Farm group health insurance plans, including their features, benefits, and how to choose the right plan for your business.

Features of State Farm Group Health Insurance Plans

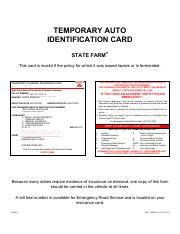

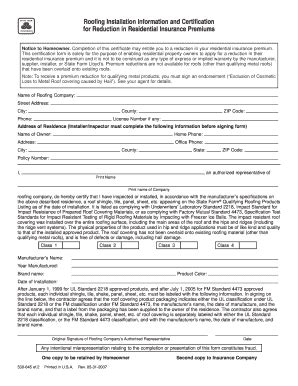

State Farm group health insurance plans offer a variety of features that make them an attractive option for businesses. Some of the key features include: * Comprehensive coverage: State Farm plans provide comprehensive coverage for a wide range of medical services, including doctor visits, hospital stays, surgeries, and prescriptions. * Network of providers: State Farm has a large network of healthcare providers, making it easy for employees to find a doctor or hospital in their area. * Flexible plan options: State Farm offers a range of plan options, allowing businesses to choose the plan that best fits their needs and budget. * Discounts and incentives: State Farm offers discounts and incentives for businesses that promote healthy lifestyles and wellness programs.

Benefits of State Farm Group Health Insurance Plans

There are many benefits to offering State Farm group health insurance plans to your employees. Some of the key benefits include: * Attracting and retaining top talent: Offering a comprehensive health insurance plan can help attract and retain top talent in your industry. * Improving employee morale and productivity: When employees have access to quality healthcare, they are more likely to be happy and productive at work. * Reducing turnover and absenteeism: By providing a valuable benefit like health insurance, you can reduce turnover and absenteeism, saving your business time and money. * Tax benefits: The cost of providing group health insurance is tax-deductible, providing a valuable tax benefit to your business.

Types of State Farm Group Health Insurance Plans

State Farm offers a range of group health insurance plans, including: * HMO (Health Maintenance Organization) plans: These plans require employees to receive care from a specific network of providers. * PPO (Preferred Provider Organization) plans: These plans offer more flexibility, allowing employees to receive care from any provider, both in and out of network. * HDHP (High-Deductible Health Plan) plans: These plans have a higher deductible, but often lower premiums, and are often paired with a health savings account (HSA).

How to Choose the Right State Farm Group Health Insurance Plan

Choosing the right group health insurance plan for your business can be a complex and overwhelming process. Here are some steps to follow: * Assess your business needs: Consider the size and demographics of your business, as well as your budget and goals. * Research plan options: Compare the features and benefits of different plan options, including HMO, PPO, and HDHP plans. * Consider employee needs: Think about the needs and preferences of your employees, including their age, health status, and family size. * Consult with a broker or agent: A licensed broker or agent can help you navigate the process and choose the right plan for your business.

💡 Note: It's essential to carefully review and compare plan options to ensure you choose the right plan for your business and employees.

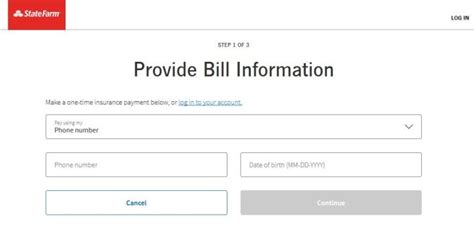

Enrolling in a State Farm Group Health Insurance Plan

Enrolling in a State Farm group health insurance plan is a straightforward process. Here are the steps to follow: * Contact a licensed broker or agent: Reach out to a licensed broker or agent who specializes in group health insurance. * Provide required information: You’ll need to provide information about your business, including the number of employees, their ages, and their health status. * Choose a plan: Work with your broker or agent to choose the right plan for your business. * Complete the application process: Once you’ve chosen a plan, you’ll need to complete the application process, which may include providing additional information and documentation.

Managing Your State Farm Group Health Insurance Plan

Once you’ve enrolled in a State Farm group health insurance plan, it’s essential to manage it effectively. Here are some tips: * Communicate with your employees: Make sure your employees understand the benefits and features of the plan, as well as any changes or updates. * Monitor claims and expenses: Keep track of claims and expenses to ensure you’re getting the most value from your plan. * Review and adjust the plan as needed: Regularly review your plan to ensure it’s meeting the needs of your business and employees, and make adjustments as needed.

| Plan Type | Features | Benefits |

|---|---|---|

| HMO | Comprehensive coverage, network of providers | Lower premiums, predictable costs |

| PPO | Flexible plan options, comprehensive coverage | More flexibility, higher premiums |

| HDHP | High deductible, lower premiums | Lower premiums, paired with HSA |

In summary, State Farm group health insurance plans offer a range of features and benefits that can help businesses attract and retain top talent, improve employee morale and productivity, and reduce turnover and absenteeism. By carefully reviewing and comparing plan options, businesses can choose the right plan for their needs and budget. Effective management of the plan is also essential to ensure it continues to meet the needs of the business and employees. Ultimately, offering a comprehensive group health insurance plan can be a valuable investment in the health and well-being of your employees, and the success of your business.

What is the difference between an HMO and PPO plan?

+

An HMO plan requires employees to receive care from a specific network of providers, while a PPO plan offers more flexibility, allowing employees to receive care from any provider, both in and out of network.

How do I choose the right group health insurance plan for my business?

+

To choose the right plan, assess your business needs, research plan options, consider employee needs, and consult with a licensed broker or agent.

What is a health savings account (HSA)?

+

A health savings account (HSA) is a tax-advantaged savings account that allows employees to set aside money for medical expenses, often paired with a high-deductible health plan (HDHP).

Related Terms:

- who owns state farm insurance

- www statefarm com login

- state farm insurance headquarters

- www statefarm com pay bill

- state farm eligibility and benefits

- www statefarm com