Alabama Health Insurance Board Guide

Introduction to Alabama Health Insurance

The Alabama health insurance landscape is complex, with numerous options available for individuals, families, and groups. Understanding the different types of health insurance plans, their benefits, and how to enroll can be overwhelming. This guide aims to provide a comprehensive overview of the Alabama health insurance market, helping individuals and families make informed decisions about their health coverage.

Types of Health Insurance Plans in Alabama

There are several types of health insurance plans available in Alabama, including:

- Major Medical Plans: These plans provide comprehensive coverage for essential health benefits, including doctor visits, hospital stays, and prescription medications.

- Catastrophic Plans: These plans are designed for individuals under the age of 30 or those who qualify for a hardship exemption. They provide limited coverage at a lower cost.

- Short-Term Limited-Duration Insurance (STLDI) Plans: These plans provide temporary coverage for a limited period, usually up to 12 months. They are not considered minimum essential coverage and may not provide the same level of benefits as major medical plans.

- Medicare and Medicaid: These government-sponsored programs provide health coverage for eligible individuals, including those 65 and older, certain younger people with disabilities, and low-income individuals and families.

Alabama Health Insurance Market

The Alabama health insurance market is dominated by a few major insurance carriers, including:

- Blue Cross and Blue Shield of Alabama

- UnitedHealthcare

- Humana

- Cigna

How to Enroll in Alabama Health Insurance

Enrolling in Alabama health insurance can be done through various channels, including:

- HealthCare.gov: The official website for the Health Insurance Marketplace, where individuals and families can compare plans and enroll in coverage.

- Insurance Company Websites: Many insurance carriers allow individuals to enroll in plans directly through their websites.

- Licensed Insurance Agents: Agents can help individuals and families navigate the enrollment process and choose the best plan for their needs.

- Alabama Department of Insurance: The state’s insurance department can provide information and guidance on health insurance options and enrollment.

Alabama Health Insurance Costs

The cost of health insurance in Alabama varies depending on several factors, including:

- Age: Older individuals typically pay more for health insurance than younger individuals.

- Location: Health insurance costs can vary depending on the region and county.

- Plan Type: Different types of plans, such as major medical or catastrophic plans, can have varying costs.

- Income Level: Individuals and families with lower incomes may be eligible for subsidies or tax credits to help reduce the cost of health insurance.

Alabama Health Insurance Benefits

All major medical plans in Alabama must cover the following essential health benefits:

- Ambulatory Patient Services

- Emergency Services

- Hospitalization

- Maternity and Newborn Care

- Mental Health and Substance Use Disorder Services

- Prescription Drugs

- Rehabilitative and Habilitative Services

- Laboratory Services

- Preventive and Wellness Services

- Pediatric Services

📝 Note: It's crucial to review the specific benefits and coverage of each plan before enrolling, as some plans may offer additional benefits or have varying levels of coverage.

Alabama Health Insurance Enrollment Deadlines

The enrollment deadlines for Alabama health insurance vary depending on the type of plan and the individual’s circumstances. Generally:

- Open Enrollment: The annual open enrollment period for individual and family plans typically runs from November to December.

- Special Enrollment: Individuals who experience a qualifying life event, such as losing job-based coverage or getting married, may be eligible for special enrollment outside of the open enrollment period.

- Medicare and Medicaid: Enrollment in these programs can occur at any time, but there may be specific deadlines for certain plans or coverage.

Conclusion and Final Thoughts

In conclusion, navigating the Alabama health insurance market can be complex, but understanding the different types of plans, their benefits, and how to enroll can help individuals and families make informed decisions about their health coverage. It’s essential to compare plans, review benefits, and consider factors like cost, age, and location to find the best option for your needs. By taking the time to research and understand the Alabama health insurance landscape, you can ensure you have the right coverage to protect your health and well-being.

What is the difference between major medical and catastrophic plans in Alabama?

+

Major medical plans provide comprehensive coverage for essential health benefits, while catastrophic plans offer limited coverage at a lower cost, primarily designed for individuals under 30 or those who qualify for a hardship exemption.

How do I enroll in Alabama health insurance?

+

You can enroll in Alabama health insurance through HealthCare.gov, insurance company websites, licensed insurance agents, or the Alabama Department of Insurance.

What are the essential health benefits covered by major medical plans in Alabama?

+

All major medical plans in Alabama must cover essential health benefits, including ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative and habilitative services, laboratory services, preventive and wellness services, and pediatric services.

Related Terms:

- State of Alabama employee salaries

- Alabama state Health Insurance

- State of Alabama benefits

- Seib Flex Card

- mySEIB

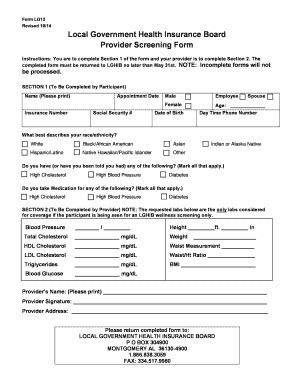

- SEIB Wellness Form