Temporary Health Insurance Between Jobs

Introduction to Temporary Health Insurance

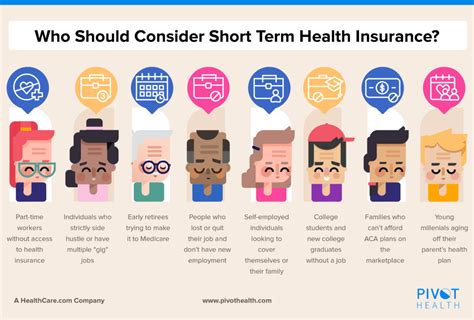

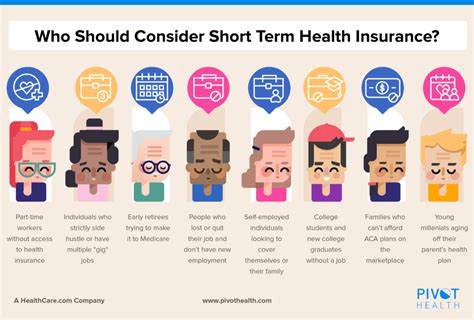

When individuals find themselves between jobs, one of the most pressing concerns is often how to maintain health insurance coverage. Temporary health insurance, also known as short-term health insurance or gap insurance, is designed to provide temporary medical coverage for individuals who are transitioning between jobs or experiencing a period of unemployment. This type of insurance is crucial for protecting against unexpected medical expenses that could arise during this transitional period.

Understanding Temporary Health Insurance

Temporary health insurance plans are typically short-term, lasting from a few months to up to a year, although some plans may offer the option to renew for longer periods. These plans are often less expensive than traditional health insurance plans because they usually do not provide the same level of coverage. It’s essential for individuals to carefully review the terms and conditions of any temporary health insurance plan before enrolling, as pre-existing conditions may not be covered, and out-of-pocket costs can be higher.

Key Features of Temporary Health Insurance Plans

Some key features of temporary health insurance plans include: * Coverage for unexpected medical expenses: Temporary health insurance plans typically cover unexpected medical expenses, such as emergency room visits, hospital stays, and surgical procedures. * Lower premiums: Temporary health insurance plans often have lower premiums compared to traditional health insurance plans. * Limited coverage: Temporary health insurance plans usually have limited coverage, excluding pre-existing conditions, preventive care, and other essential health benefits. * Flexibility: Temporary health insurance plans can be purchased for a specific period, making them a flexible option for individuals between jobs.

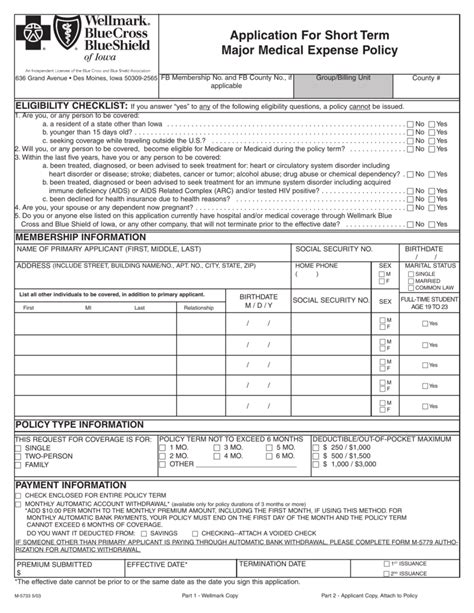

Eligibility and Enrollment

To be eligible for temporary health insurance, individuals typically must: * Be between 18 and 64 years old * Not be eligible for Medicare or Medicaid * Not have any disqualifying pre-existing conditions * Meet the insurer’s underwriting requirements

Enrollment in temporary health insurance plans usually involves: * Submitting an application * Providing medical history information * Undergoing medical underwriting * Paying the premium

Pros and Cons of Temporary Health Insurance

Temporary health insurance plans have both advantages and disadvantages. Some of the pros include: * Affordability: Lower premiums make temporary health insurance plans more accessible to individuals who are between jobs or experiencing financial difficulties. * Flexibility: Temporary health insurance plans can be purchased for a specific period, providing flexibility for individuals with changing circumstances. * Quick enrollment: Enrollment in temporary health insurance plans is often faster compared to traditional health insurance plans.

Some of the cons include: * Limited coverage: Temporary health insurance plans usually have limited coverage, excluding essential health benefits and pre-existing conditions. * Higher out-of-pocket costs: Temporary health insurance plans often have higher deductibles, copays, and coinsurance, making them less comprehensive than traditional health insurance plans. * No guarantee of renewal: Temporary health insurance plans may not be renewable, leaving individuals without coverage after the policy term ends.

Alternatives to Temporary Health Insurance

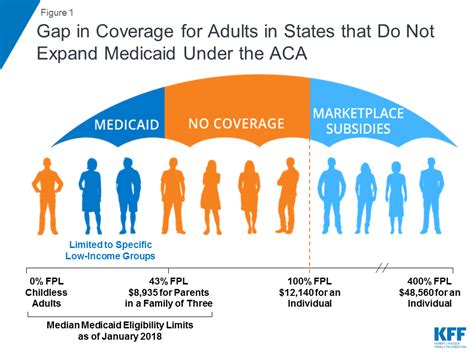

Individuals who are between jobs may also consider alternative options, such as: * COBRA: The Consolidated Omnibus Budget Reconciliation Act (COBRA) allows individuals to continue their previous employer’s group health plan for a limited time. * Affordable Care Act (ACA) plans: Individuals may be eligible for ACA plans, which provide comprehensive coverage, including essential health benefits and pre-existing condition coverage. * Spouse’s or partner’s plan: Individuals may be eligible to join their spouse’s or partner’s employer-sponsored health plan.

💡 Note: It's essential to carefully review and compare the features, benefits, and costs of temporary health insurance plans and alternative options to determine the best choice for individual circumstances.

Conclusion and Final Thoughts

In conclusion, temporary health insurance plans can provide essential medical coverage for individuals between jobs or experiencing a period of unemployment. While these plans have limitations, they can be a vital safety net for unexpected medical expenses. It’s crucial for individuals to carefully evaluate their options, consider their unique circumstances, and choose the plan that best meets their needs. By doing so, individuals can ensure they have the necessary protection and peace of mind during transitional periods.

What is temporary health insurance?

+

Temporary health insurance, also known as short-term health insurance or gap insurance, provides temporary medical coverage for individuals who are transitioning between jobs or experiencing a period of unemployment.

How long do temporary health insurance plans last?

+

Temporary health insurance plans typically last from a few months to up to a year, although some plans may offer the option to renew for longer periods.

Do temporary health insurance plans cover pre-existing conditions?

+

Temporary health insurance plans usually do not cover pre-existing conditions, making them less comprehensive than traditional health insurance plans.

Can I enroll in a temporary health insurance plan at any time?

+

Enrollment in temporary health insurance plans usually involves submitting an application, providing medical history information, and undergoing medical underwriting. Individuals must meet the insurer’s eligibility requirements to enroll.

What are the alternatives to temporary health insurance plans?

+

Alternatives to temporary health insurance plans include COBRA, Affordable Care Act (ACA) plans, and spouse’s or partner’s employer-sponsored health plan. Individuals should carefully review and compare these options to determine the best choice for their unique circumstances.

Related Terms:

- Health insurance gap coverage

- Best medical gap insurance

- COBRA insurance

- Health insurance Marketplace

- United healthcare

- short term health insurance rules