Texas Health Credit Union Austin Services

Introduction to Texas Health Credit Union Austin Services

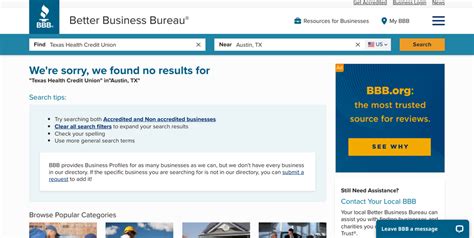

Texas Health Credit Union is a financial institution that provides a wide range of services to its members, particularly those in the healthcare industry. With its presence in Austin, Texas, the credit union aims to offer personalized and affordable financial solutions to individuals and families. In this article, we will delve into the various services offered by Texas Health Credit Union in Austin, highlighting their benefits and features.

Membership and Eligibility

To take advantage of the services offered by Texas Health Credit Union, individuals must first become members. Membership eligibility is generally extended to those who work in the healthcare industry, including doctors, nurses, and other medical professionals. Additionally, family members of existing members may also be eligible to join. The credit union’s membership criteria are designed to ensure that its services are accessible to those who need them most.

Checking and Savings Accounts

Texas Health Credit Union offers a variety of checking and savings accounts that cater to different financial needs. These accounts come with features such as: * Low or no monthly maintenance fees * Competitive interest rates * Online banking and mobile banking services * Debit card and ATM access These accounts are designed to provide members with easy access to their funds while earning interest on their balances.

Loans and Credit Services

The credit union provides an array of loan and credit services, including: * Personal loans for unexpected expenses or debt consolidation * Auto loans for new or used vehicle purchases * Mortgage loans for homebuyers or those looking to refinance * Credit cards with competitive interest rates and rewards programs These loan and credit services are tailored to meet the unique financial needs of members, offering flexible repayment terms and competitive interest rates.

Investment and Insurance Services

Texas Health Credit Union also offers investment and insurance services to help members plan for their financial future. These services include: * Retirement accounts, such as IRAs and 401(k)s * Investment portfolios, including stocks, bonds, and mutual funds * Life insurance and disability insurance to protect members and their loved ones These services are designed to provide members with a comprehensive approach to financial planning, helping them achieve their long-term goals.

Online and Mobile Banking

In today’s digital age, online and mobile banking are essential services that allow members to manage their accounts from anywhere. Texas Health Credit Union’s online and mobile banking platforms provide features such as: * Account balance and transaction history * Bill pay and transfer services * Mobile deposit and remote deposit capture These services enable members to stay connected to their accounts, making it easier to manage their finances on-the-go.

Community Involvement

Texas Health Credit Union is committed to community involvement and giving back to the local community. The credit union participates in various charitable events and sponsorships, supporting organizations that promote healthcare and financial literacy. By investing in the community, the credit union aims to make a positive impact on the lives of its members and the broader community.

💡 Note: Texas Health Credit Union's community involvement initiatives demonstrate its dedication to serving the needs of its members and the local community.

As we summarize the key points of Texas Health Credit Union’s services in Austin, it’s clear that the credit union offers a wide range of financial solutions tailored to the needs of its members. From checking and savings accounts to loan and credit services, investment and insurance services, and online and mobile banking, the credit union is committed to providing personalized and affordable financial solutions. By choosing Texas Health Credit Union, members can trust that their financial well-being is in good hands.

What are the benefits of joining Texas Health Credit Union?

+

Joining Texas Health Credit Union offers numerous benefits, including competitive interest rates, low or no fees, and personalized financial services. Members also gain access to a range of financial products and services, as well as community involvement initiatives.

How do I become a member of Texas Health Credit Union?

+

To become a member of Texas Health Credit Union, you must meet the eligibility criteria, which typically includes working in the healthcare industry or being a family member of an existing member. You can apply for membership online or in-person at a branch location.

What types of loans and credit services does Texas Health Credit Union offer?

+

Texas Health Credit Union offers a range of loan and credit services, including personal loans, auto loans, mortgage loans, and credit cards. These services are designed to meet the unique financial needs of members, offering flexible repayment terms and competitive interest rates.

Related Terms:

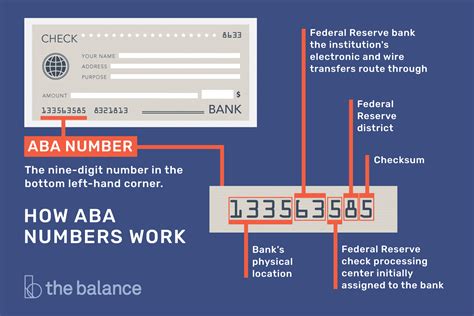

- texas health credit union alamat

- THCU routing number

- Texas Health Credit Union Directory

- Texas Health Credit Union CEO

- Austin credit unions

- Texas DPS Credit Union