5 Ways Calculate Military Pay

Introduction to Military Pay Calculation

Calculating military pay can be a complex process, involving various factors such as rank, time in service, family size, and deployment status. Understanding these factors is crucial for servicemembers to manage their finances effectively. In this article, we will explore five ways to calculate military pay, highlighting the key considerations and online resources that can assist in this process.

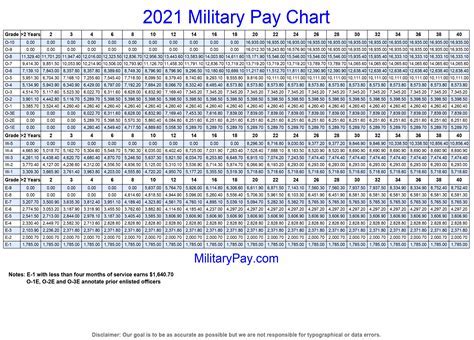

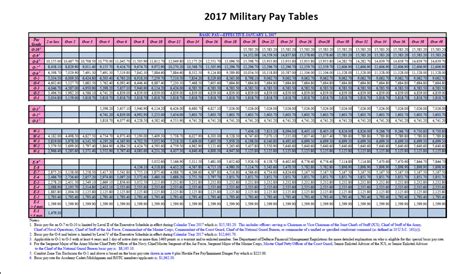

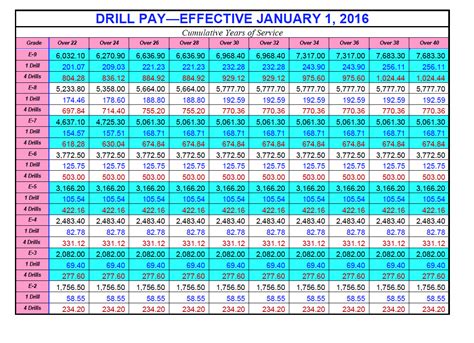

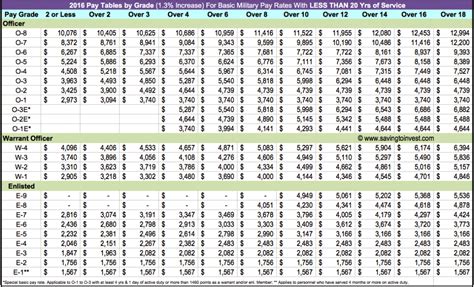

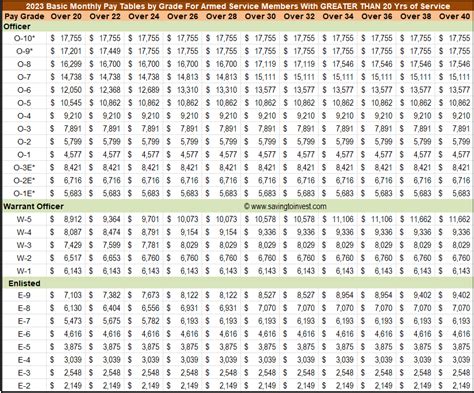

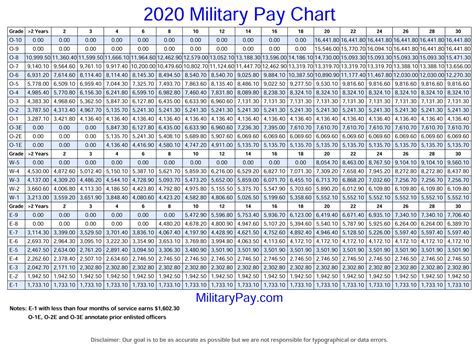

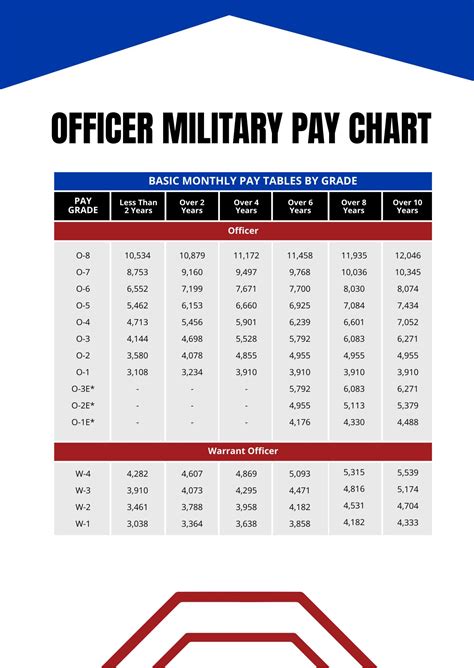

Method 1: Basic Pay Calculation

The most straightforward way to calculate military pay is by using the basic pay chart. This chart, updated annually, outlines the monthly salary for each rank and time-in-service combination. To calculate basic pay, follow these steps: * Determine your rank and time in service * Visit the official military website or a reputable online resource to access the current basic pay chart * Locate your rank and time-in-service category on the chart to find your corresponding monthly basic pay * Multiply this amount by the number of months you will serve in the upcoming year to estimate your annual basic pay

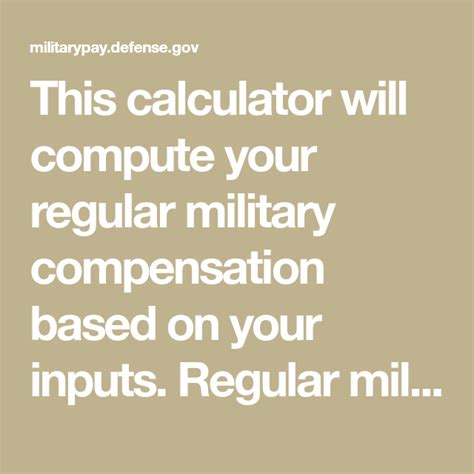

Method 2: Using Online Military Pay Calculators

Several online tools and calculators can simplify the military pay calculation process. These calculators typically require input of personal details such as rank, branch of service, time in service, and family size. They then provide an estimate of your total military compensation, including basic pay, allowances, and special pays. Some popular online military pay calculators include: * The official military pay calculator on the Department of Defense website * Military pay calculators on veteran and military-focused websites * Pay estimation tools provided by military banks and financial institutions

Method 3: Considering Allowances and Special Pays

In addition to basic pay, military personnel may be eligible for various allowances and special pays. These can significantly impact total compensation. Common allowances include: * Basic Allowance for Housing (BAH) * Basic Allowance for Subsistence (BAS) * Cost of Living Allowance (COLA) Special pays, on the other hand, may include: * Hazardous duty pay * Flight pay * Diving pay To accurately calculate total military pay, it’s essential to factor in these additional forms of compensation.

Method 4: Accounting for Taxes and Deductions

Military pay is subject to federal and state taxes, as well as various deductions. To get a clear picture of take-home pay, consider the following: * Federal income tax: Military pay is taxable, but some benefits, like BAH, are tax-free * State income tax: Some states do not tax military pay, while others do * Deductions: These may include things like health insurance premiums, retirement contributions, and allotments for savings or other financial obligations Using tax estimation tools or consulting with a financial advisor can help navigate these complexities.

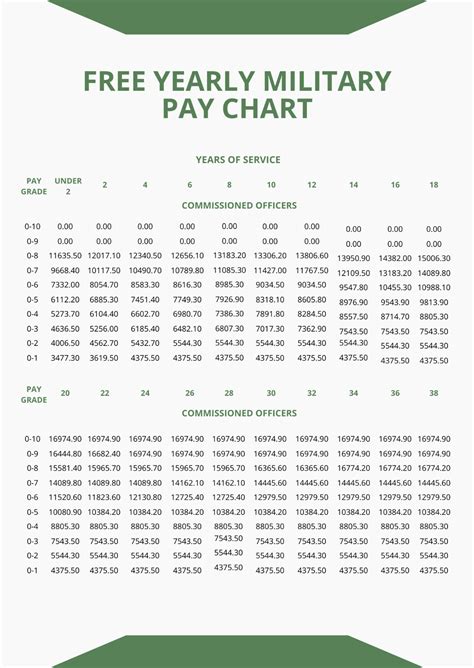

Method 5: Utilizing Military Pay Charts and Tables

For those who prefer a more visual approach, military pay charts and tables can be invaluable resources. These tools organize pay data in a clear, easy-to-understand format. By referencing these charts, servicemembers can quickly identify their basic pay, as well as any applicable allowances or special pays. Some key tables to consult include:

| Rank | Time in Service | Basic Pay |

|---|---|---|

| Private (E-1) | 2 years | 1,733.40/month</td> </tr> <tr> <td>Private First Class (E-3)</td> <td>4 years</td> <td>2,105.70/month |

| Staff Sergeant (E-6) | 10 years | $3,704.50/month |

📝 Note: The values in this table are examples and may not reflect current military pay rates.

Additional Considerations

When calculating military pay, it’s essential to consider individual circumstances that may affect compensation. These can include: * Deployment status: Servicemembers deployed to hazardous areas may receive additional pay * Family size: Larger families may qualify for increased allowances * Education level: Higher levels of education may lead to higher pay grades or special pays * Special duties: Certain roles or specialties may come with additional compensation

In summary, calculating military pay involves considering basic pay, allowances, special pays, taxes, and deductions. By utilizing online resources, pay charts, and calculators, servicemembers can gain a better understanding of their total compensation and make informed financial decisions.

The information provided here should give servicemembers a comprehensive view of how their pay is calculated, helping them to plan their finances more effectively. Understanding these aspects of military pay can make a significant difference in managing one’s financial obligations and opportunities.

What is the difference between basic pay and total military compensation?

+

Basic pay refers to the monthly salary received by servicemembers based on their rank and time in service. Total military compensation, on the other hand, includes basic pay plus allowances, special pays, and other benefits.

How do I calculate my military pay if I am deployed?

+

To calculate your military pay while deployed, consider any additional pays you may be eligible for, such as hazardous duty pay or combat pay. You can use online military pay calculators or consult with a financial advisor to get an accurate estimate.

Are there any online resources that can help me calculate my military pay?

+

Yes, there are several online resources available to help you calculate your military pay. These include the official military pay calculator on the Department of Defense website, as well as pay estimation tools provided by military banks and financial institutions.

Related Terms:

- militarypay defense gov calculator

- air force pay calculator 2024

- 2025 air force pay calculator

- army pay calculator 2025

- usmc pay calculator 2024

- military paycheck calculator with taxes